Our Research Process

We give our clients confidence that they have an independent partner turning over every stone

Stock picking not just coverage

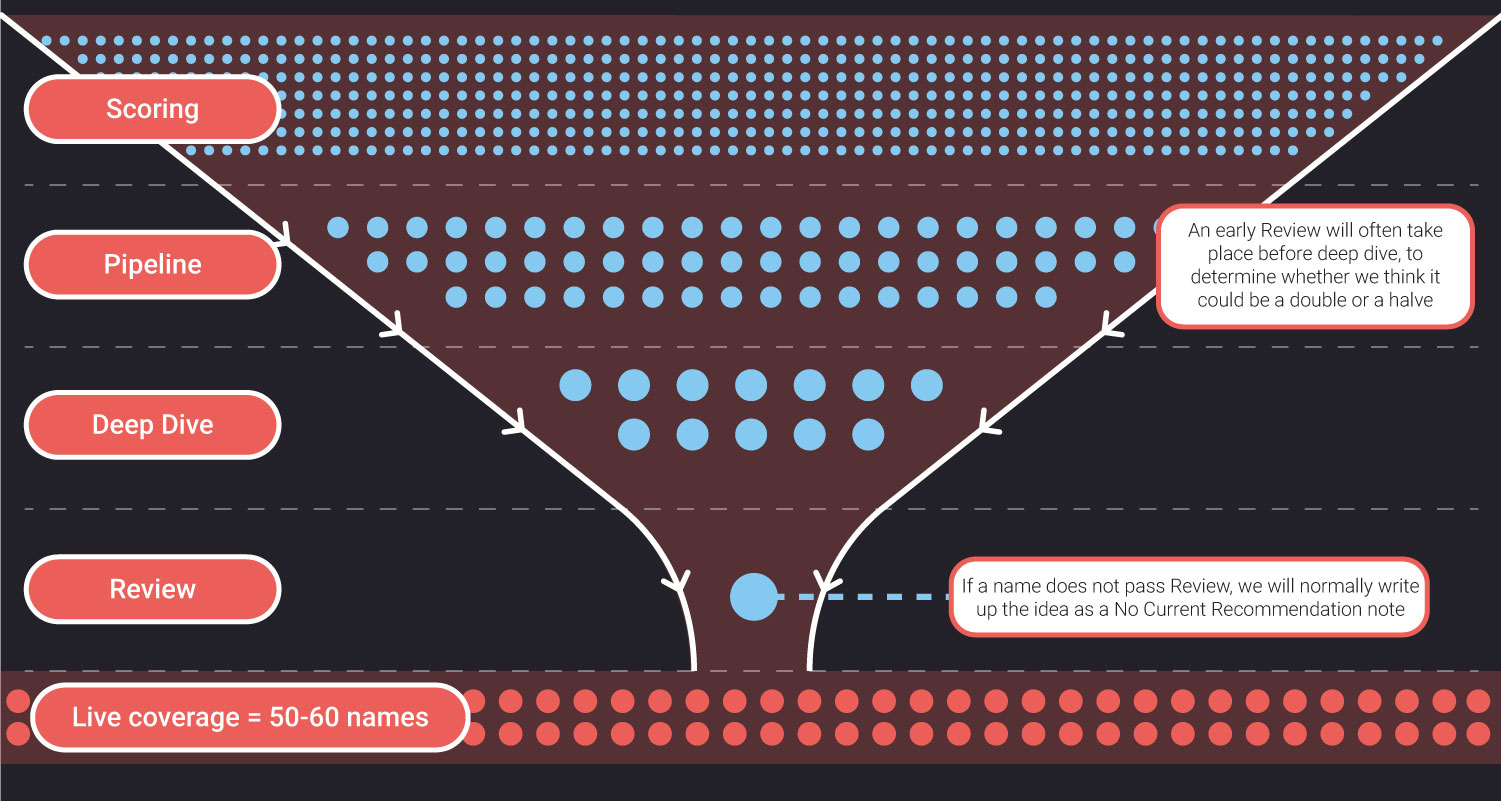

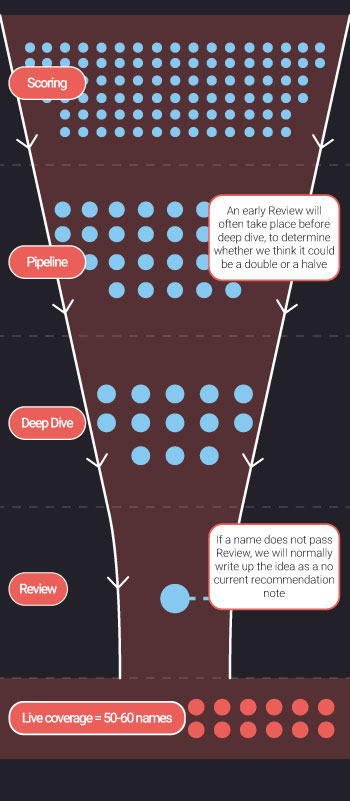

We aim to identify high-conviction, single stock ideas that could double or halve. Our analyst team follows a rigorous research process that turns over hundreds of stocks each year, aiming to find the best ideas for our clients. We utilise our experience and expertise in forensic accounting, corporate governance, fieldwork and fundamental analysis to deliver research our clients can trust that can impact their performance.

Our Aims

We seek out high-conviction single stock ideas – both long and short

We want to represent the full potential of the market in our idea spread, not just focus on buy recommendations. We believe that our expertise in both Long and Short research helps our analysts attain a more comprehensive vision of the market and sets them up with the skills needed to make brave calls with conviction.

Alpha is our guiding star – we research, initiate, cover and drop based on the opportunities for our clients

Our founders started on the buy-side and we still operate with a buy-side mentality; our ethos is focused on adding value for our clients. We don’t aim for average returns. We want to impact performance by searching for stocks with outsized return potential. A focus on alpha and performance is embedded in our culture which we believe aligns us with client interests.

We seek edge in our stock selection and go the extra mile to find it

Whether that involves digging deep into company filings or chasing down a lead on a potential fraud on the ground – we are willing to go the extra mile to produce the best research. We specialise in forensic accounting, corporate governance, fieldwork and fundamental analysis, and use these skillsets both to generate ideas and uncover insights. In an industry increasingly reliant on data technology and volume, we see room for the human element to add more value than ever before.

We are committed to adding value

We don’t want to amplify, or add, to the noise; there is already too much commoditised research in the world, we want to cut through it. We don’t cover stocks we don’t believe in and we only publish when we have something to say; buttressing our independence. Through our subscription-only website and mobile app, we communicate in a way that suits our clients’ individual investment journey.

Our Standards

Our Pipeline Process