Recommendation: Strong Buy (No Change)

NOK --

$25m

Mid-Cycle PE

NOK --

$12bn

7x

~50%

YAR NO

10x

- Risk/reward is asymmetric and positive to the upside with 50% higher price target in $12bn industrial. Higher conviction given internal changes, activist interest, and potential for value creation with focus on downstream assets.

- We value Sales & Marketing at $8bn, which is the large hidden value in the asset. The downstream division is a stable-margin, high-return logistics & distribution business that should trade on a much higher multiple than Yara does today.

- Large, quality portfolio weighted towards specialty products, with attractive market positions. Largest producer of nitrogen fertiliser globally.

- Non-gas positions outside Europe are overlooked due to historic European cost exposure.

- Cyclical low margins with tightening of supply/demand likely between 2019-22 which will boost earnings to mid-cycle levels of NOK 50-60/share, compared with NOK 10-15 in the last two years.

In our previous two notes on Yara, we examined its UK and French businesses. Although these two geographies only account for 12% of group revenue (~$700m revenue in each country), they were good examples of a value-added downstream business (UK) and a loss-making upstream/production business.

Whereas Yara runs a string of supply chain networks and high asset turn facilities in the UK, making strong returns, it also runs sub-scale, gas-based, loss-making production in France. If investors focus more on the downstream assets, Yara can be revalued and the management can create value by repositioning the company to value-add solutions for farmers, rather than relying on volatile production margins.

We said we would investigate Yara Brazil, and we include our thoughts within this note. This is desk work only, and the note represents a solid primer for investors. We suggest Yara could do a capital markets day in Brazil as part of its strategy to reposition to crop nutrition and pivot investor attention away from the legacy gas-based European production base.

In the near term, lower European gas prices and stable urea prices should lead to margin expansion, although a stronger cyclical rebound is still not underway (to be addressed in our next note).

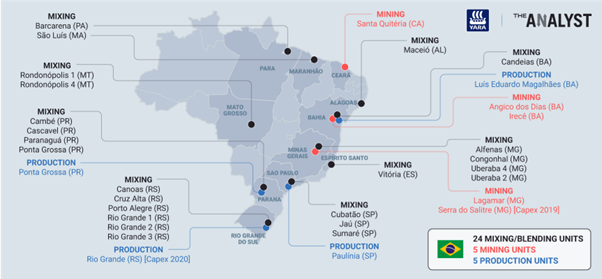

Exhibit 1: Map of Yara’s Positions in Brazil

Source: The Analyst, Yara Company Information

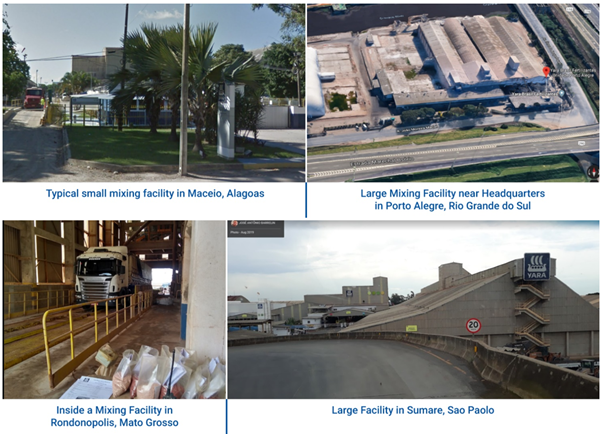

Exhibit 2: Examples of Yara Assets in Brazil

Source: Google Maps (Accessed September 2019)

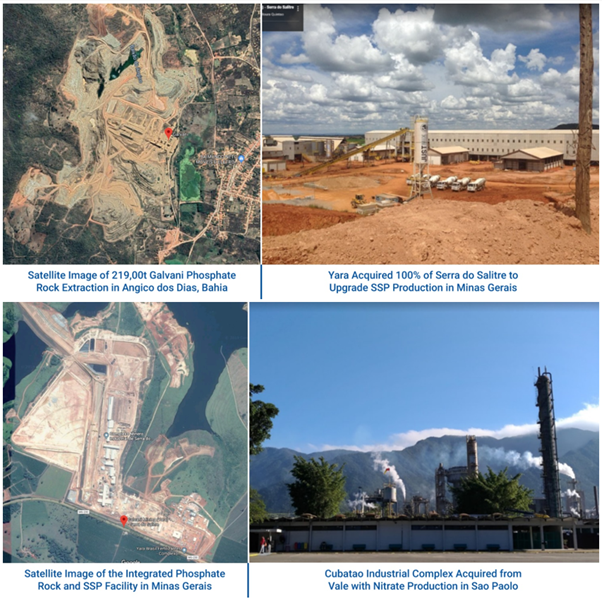

Exhibit 3: Examples of Yara Assets in Brazil (cont’d)

Source: Google Maps (Accessed September 2019)

Key Points

- Brazil is ~33% of Yara’s staff and operations (6,164 employees), selling 9.2mt of product to 25,000 farmers. This is ~33% of volume and 25% of revenue ($3.5bn).

- This is Yara’s most important business, although the market focuses more on the European gas-based production as a reason not to own the stock and a headwind. Yara has spent ~$1.8bn of capital in Brazil in recent years (M&A and capacity expansion) that is yet to deliver good returns. The unit is not contributing value today but is well-positioned with significant upside. The company has a strategic issue as it is well-positioned in specialty products but has a lot of commodity mixing/blending business. The Brazilian market has consolidated but is competitive in a low-price environment for agricultural products. Yara could offer third parties access to its distribution.

- Yara has built a strong position in Brazil, which is a growth market, and the positioning (20-25% market share) should be a highly valuable fertiliser asset by any measure. The strong market shares and growth should deliver high returns for Yara shareholders in the medium term. Like much of Yara’s business, they aren’t generating the returns they need.

- Yara has 24 mixing/blending units serving as market access points to farmers. In addition, it has production assets in five mining units (phosphate rock production from the Galvani acquisition) and five production units (SSP and NPK production including the Vale Cubatao acquisition) (Exhibit 1). Large capex projects are underway at Rio Grande (conversion to premium NPK) and Serra do Salitre (expanded phosphate rock production). These projects are consuming capex, but not generating returns. There is an inflection point next year and Yara guided for $170m EBITDA improvement (on 2015 prices) on the $575m capex spending.

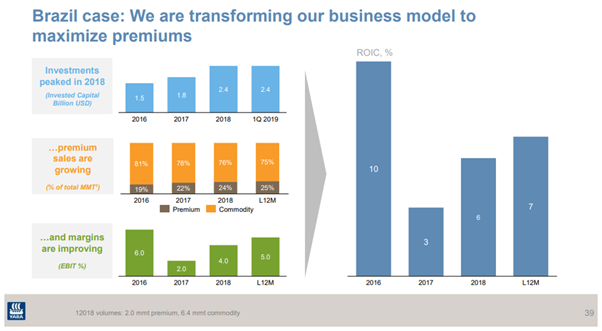

- Yara makes a low 4% margin in Brazil and has $2.4bn of capital invested (Exhibit 4).

- The Brazil business was built through the acquisitions of Fertibras (2006), Bunge Fertilisers ($750m in 2012), Vale Cubatao ($255m in 2018), and Galvani (60% for $318m in 2014, 40% for $70m in 2018). Yara has spent ~$1.4bn on M&A and is rightly criticised by shareholders for not creating sufficient value and acquiring at the wrong point in the cycle. Capital discipline was a key pillar of the 2019 capital markets day presentations in the summer.

- The company argues it did not overpay for the assets and subsequent M&A transactions in Brazil occurred at much higher multiples.

- Yara has also committed capex on capacity additions and capital injections into the acquired operations, including: $170m on the expansion of the Salitre phosphate production complex to 1.5mt, $80m towards upgrading investments in the Cubatao complex, expansion Ponta Grossa (Sumare), and the Rio Grande upgrade to a premium NPK facility.

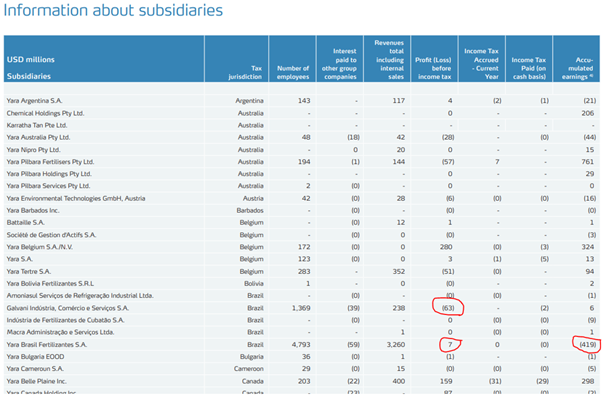

- 80% of revenue is downstream, which suggests a strong marketing business with market access. Yara claims a 20-25% market share in Brazil; however, the business unit has accumulated an earnings loss of $420m and reported negative PBT of $56 last year. We have no accounting transparency on intra-company cost allocations, which may overstate the losses on transfer pricing. We do know Galvani (Yara’s phosphate mining activities acquired from Vale) lost ~$40m (revenue of $248m, operating costs of $277m), whilst the main subsidiary is close to break-even ($7m PBT). As in Europe, Yara’s operations in Brazil are a combination of loss-making production and profitable downstream (Exhibit 5). As shown in the capital markets day presentation, Yara shows a 4% margin and 7% ROIC for the whole Brazil operation, which likely adjusts for inter-company sales through the Yara South America Investments BV subsidiary, which is domiciled in the Netherlands.

- Yara carries the Brazil subsidiary CGU (downstream) at $926m in the balance sheet, noting an additional 76% value higher for the asset-in-use, whilst the Galvani Production CGU (upstream) is held at $690m, noting an additional 40% value higher for in-use. Yara guides for $170m of incremental EBITDA for the Saltire investments (at 2015 prices) and, on $2.4bn of invested capital employed at the company’s target ROIC of 10% (mid-cycle conditions), it should be making $240m or more in EBIT considering Brazilian discount rates. Compared to the 7% LTM ROIC, Yara needs to show a strong improvement of >$100m EBIT in performance in Brazil to justify the investments. Better performance in Brazil could drive 10-20% upside to estimates for the group.

- Yara is adding 20% to production capacities from 2015 levels, and this new capacity should come on-stream into better market pricing. With the step down in capex at the group level, we forecast a strong expansion of Yara’s free cash flow in the coming years. Brazil is a major contributor to this inflection point.

Exhibit 4: Yara’s Presentation of Brazil Operations

Source: Capital Markets Day Presentation 2018

Exhibit 5: Yara’s Subsidiary Reporting on Brazil

Source: Yara Country Report 2018

Conclusion

Yara remains on our Strong Buy list with 50% upside and attractive risk/reward in a large, cyclical investment idea.