Recommendation: Strong Buy (from Buy)

NOK --

$25m

Mid-Cycle Earnings

NOK --

$12bn

7x

45%

YAR NO

10x

Investment Thesis

- Risk/reward is asymmetric and positive: 50% upside in $12bn industrial. Higher conviction given internal changes, activist interest, and potential for value creation with focus on downstream assets.

- Raise valuation of Sales & Marketing to $8bn: Hidden value in the asset base. Downstream division is a stable-margin, high-return, logistics and distribution business, that should trade on a much higher multiple than Yara, as a group, does today.

- Large, quality portfolio: Weighted towards specialty products, with attractive market positions and largest producer of Nitrogen-fertiliser globally.

- Cyclical low margins: Tightening of supply/demand between 2019-22 should boost earnings towards mid-cycle levels of NOK 50-60/share, compared to NOK 10-15 in the last two years.

This note provides a deeper dive into Yara UK, as an initial case study on ‘hidden’ value in Yara. Separately, we have published on Yara France. (We will follow up on Brazil, India, and other operations.)

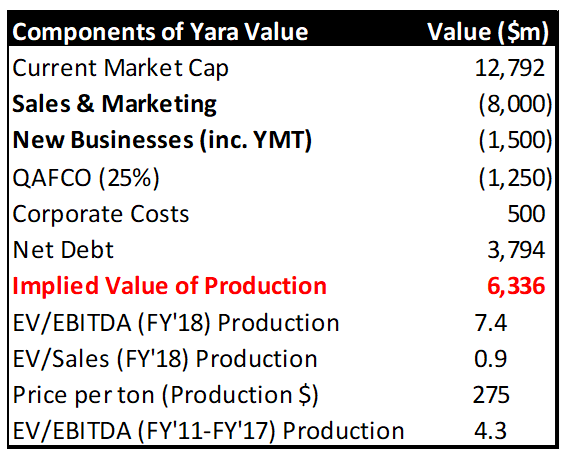

In our most recent note on Yara, we discussed the activist case centred on the hidden value in the downstream Sales & Marketing division, which has high and stable returns, both in an absolute sense and relative to the upstream production. At the capital markets day on 26 June 2019, we expect Yara to increase the profile of this business. To get ahead of the curve, we provide our own independent insight in this note. We now believe this division could be valued up to $8bn (compared to $6bn in our last note). This would leave production valued below $300/ton and 4x EV/EBITDA (average cross-cycle earnings FY’11-’17). Adding $2bn to our previous analysis shows the implied value of production at $6.3bn.

Strategic improvements would likely become available to Yara with a full separation. For example, the demands of downstream for volumes from upstream may create a conflict in the business whereby profitability is analysed on the entire supply chain, but loss-making European production is essentially cross-subsidised by downstream logistics profits, and downstream would benefit from volume growth with access to more third-party product.

Exhibit 1: Yara Implied Value of Product on $8bn Downstream Value

Source: Company Filings, The Analyst Estimates Completed June 2019

We are in the process of reviewing Yara’s entire group structure to build a picture of the hidden assets and value intrinsic to the group. This due diligence will improve clients’ understanding of the activist case and contribute to an improved perception of the group, less as a commoditised producer of heavy fertiliser chemicals and more as a global sales & marketing operation. Yara’s downstream business is not well understood (now named Sales & Marketing, previously named Crop Nutrition) but this is an interesting ‘soft infrastructure asset’ involved in blending, bagging, distribution, technical service, and support to the end user. This is a high asset turn business with stable earnings. The volatility in the group stems from the production (upstream) margins, which is a capital-heavy, commoditised, industrial asset.

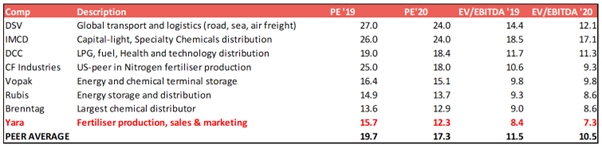

In a bull case on Yara, the Sales & Marketing business will evolve into a best-in-class logistics, distribution, and technical services operation with global market access and prized infrastructure assets. The UK operation, for example, includes strategic positions in seven ports with storage, berthing rights, handling facilities, bagging, and dispatch. This is akin to a ‘small Vopak’ whilst the in-market networks are akin to Brenntag or IMCD. Yara’s Sales & Marketing division could be rated 50% higher than the Yara group over time.

Exhibit 2: Yara Multiple versus IMCD, Brenntag

Source: Bloomberg Consensus Estimates, Accessed 24 June 2019

Review of UK Operations

When it comes to understanding Yara’s local presence, investors can get more information from the subsidiary accounts than from the top-co filings. This speaks to the improved communication required by management and the opportunity for investors who can understand the undervaluation of Yara’s Sales & Marketing segment.

This insight shows that Yara’s market reach is underestimated, and the non-production assets are more akin to chemical distribution assets or capital-light supply chains. In the UK, for example, the main subsidiary is a distribution company, running bagging & blending on imported bulk supply from either Yara or third parties, reaching farmers and merchants through a direct sales force. Yara runs four production plants, three of which produce and distribute liquid fertilisers and one (Pocklington) which produces specialty nutrients (YaraVita) for the export market.

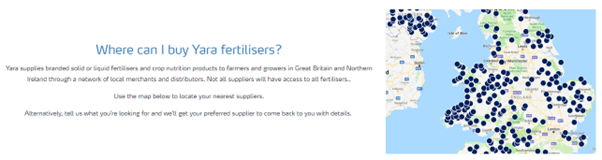

Yara sells direct to farm and distributes with advice and support through both own and third-party networks. In the UK, Yara sells Water & Septicity Control products, AdBlue (NOx reduction), Industrial Reagents, Technical Grade Urea, and analytical or consultancy services from the Pocklington laboratory in addition to the fertiliser products.

As disclosed in the Annual Report, Yara consolidates $716m revenue and $49m PBT (7% margin) from the UK.

Looking more closely, we can see that Yara UK is an asset-light business with an inventory turn of 8x, capex/sales of 1.2%, a fixed asset turn of 2x, and stable operating margins of 8-9%. This return profile is well ahead of Yara, as a group, and much higher than investors’ average perception of Yara. In fact, Yara’s UK business looks more like Brenntag, which is trading on 10x EBITDA, or IMCD which is a specialty, capital-light distributor trading on 20x EBITDA. Yara group trades on <7x consensus EBITDA. Vopak enjoys a 15x PE and 10x EV/EBITDA multiple, despite low growth, as its strategic positions in Chemical & Oil storage in Northern Europe are highly valuable.

Exhibit 3: Yara Describes the UK Operations in the Yara UK Limited Annual Filing

Source: Yara UK Limited Annual Report 2017

Exhibit 5: Yara Has Extensive Third-Party Market Access as well as Direct Sales

Source: Yara UK Website, Accessed June 2019

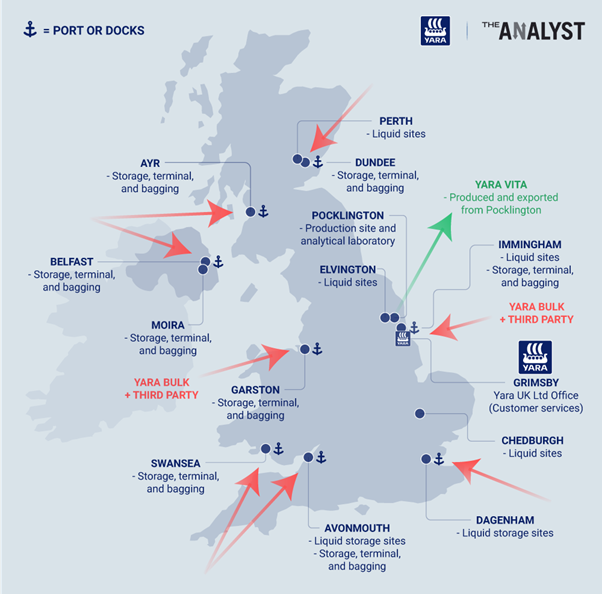

Exhibit 6: Yara ‘Soft’ Infrastructure Overview in the UK

Source: Yara Company Filings and Yara UK Website, Accessed June 2019

Ports and Terminals

One of the more interesting takeaways from this review is that Yara operates in seven UK ports. Yara UK imports bulk products from Yara and third parties and exports YaraVita, a specialised nutrient product produced in the UK. Assets are summarised as follows:

- Avonmouth: Port storage and loading. With Swansea, this position is well situated for seabound import to the South West and Midlands of the UK.

- Ayr: A port site in Scotland, close to Yara’s smaller sites at Dundee and Perth.

- Belfast: Five hectares of bagging and storage, servicing Northern Ireland and the Republic of Ireland, alongside a site in Moira.

- Dagenham: Storage and dispatch facilities inland on the Thames, servicing the South East.

- Garston: Import, storage, and bagging facilities on Merseyside, servicing the North West.

- Immingham: Privileged berthing rights, storage, and handling facilities. Location in the North East for the UK-Rotterdam trade routes.

- Swansea: Docks in Port Talbot with import, bagging, and a storage terminal.

Exhibit 7: Examples of Yara Port Operations in ABP Facilities, Strategic Access to Trade

Source: Dry Bulk Magazine (left), Google Maps (right), Accessed June 2019

Exhibit 8: Examples of Liquid, Storage, and Distribution ‘Hidden’ Assets in the UK

Source: Google Maps, Accessed June 2019

Conclusion

Yara is dominated by commodity, capital-intensive production assets — both in the economic reality of current group profitability and investors’ perception of the company. We can begin to map the evolution of Yara into a high value-added Sales & Marketing company rather than a highly volatile Nitrogen producer in the middle of the global cost curve (suffering under higher European gas costs).

This analysis paints a valuable picture for clients. We expect more clarity to be provided by the company and investors should focus on the value of Yara’s Sales & Marketing division accordingly.