Recommendation: No Current Recommendation (from Short)

€--

€--

€--

€400m

~~

WDI GY

Moving On

Our business is driven by an alignment with the long-term interests of all our clients. We see our job in short recommendations as — in equal measure — to generate alpha by both protecting shareholders (with our short ideas) and to activate short ideas at long/short funds. We do our research with integrity and independence.

Now, as we move on from Wirecard, we come back to our research process and continue generating ideas in Europe that are commercial for our clients — longs that could double and shorts that could halve. We hope all clients continue to deepen their engagement with our output and we expect there will be more frauds in Europe in the coming years. There are immediately some derivative trades for our pipeline: German corporates with accounting issues and stretched balance sheets, and overhyped technology companies.

The recent market volatility due to the COVID-19 pandemic has been an extremely challenging period for clients. Initially, when the stock market collapsed in March 2020, there was an unbelievable amount of uncertainty. As the market recovered, it has also been painful for clients due to positioning. The market is now in a news flow driven phase, with extreme volatility. We want to thank clients for the support over the last few months.

Ultimately, we believe we are in a fantastic period for alpha generation.

Lemons

At The Analyst, we define a lemon as a stock that has fallen >90% in its share value during the period that The Analyst had an active short recommendation.

Exhibit 1: The Analyst Lemon Tree

Source: The Analyst Lens

Exhibit 2: Lemons at The Analyst

Source: The Analyst

We add Wirecard to our list of lemons, alongside some other examples such as Steinhoff, Let’s Gowex , Asian Bamboo, Globo, Cupid, and Bio-On. Carillion, Debenhams , NMC Health , and Intu also approached the ‘lemon’ category but we dropped our recommendations before they went to zero.

Wirecard is insolvent. There will be little, if anything, for liquidators to salvage from the business. We are dropping our recommendation and coverage of Wirecard.

The Wirecard auditors accused it of committing an ‘elaborate and sophisticated fraud’ and the full scope of the impact is now visible on Twitter, with hundreds of customers of the real Wirecard business (that did exist) seeing accounts and money frozen. The story is likely to run as possibly the biggest alleged corporate fraud in Europe and as the dust settles, we expect more bad news to become apparent.

As the Wirecard scandal unfolds, we offer a checklist for clients who may have concerns about any of their current holdings and briefly give 10 key learnings for spotting a potential fraud.

Key Red Flag Learnings

- First question in equity research: does the business exist? If you ask this over and over again, you could come across a business that does not exist. Wirecard did exist, and most effective and possible frauds need a real business to hide inside.

- If it’s too good to be true, it probably isn’t true. Promotional rhetoric from management, incredible share price performance, and phenomenal financials should all be treated with scepticism.

- Misdeeds get hidden in complexity. Alleged frauds often use opaque accounting to misdirect investors and auditors.

- Corporate governance and culture matter and cannot be fixed easily or overnight. When there are corporate governance concerns in listed companies, investors should be very worried as the risk profile is disproportionately higher when something goes wrong.

- Beware accelerating growth at greater scale. As a business scales, higher percentage growth becomes harder and harder to achieve, creating incentives for possible accounting fraud.

- Fake profits do not generate cash, and this creates a problem in the accounts. Look for balancing items in the cash flow statement such as inflated M&A, growth in unpaid receivables, related-party transactions, or capitalised development projects.

- Geographic distance is a major red flag. NMC Health was a London-listed Middle Eastern hospital operator. Steinhoff was a South African retailer listed in Germany. Wirecard was acquiring businesses a long way from HQ in Munich, and its major subsidiaries were in Dubai transacting with an opaque partner network in the Middle East and Asia.

- Management tend to find a way to get money out. Be very sceptical of share pledges (taking a loan at an inflated share price) and director selling. Sometimes management sell without telling anyone. Sometimes they buy businesses off themselves.

- Non-standard financial metrics should be treated with scepticism — for example, EBITDA, ‘company-defined’ cash flow and net cash, and ‘adjusted earnings’.

- Audits cannot necessarily be trusted or taken at face value, especially, in our opinion, those from EY. An audit statement is not always a verification of the reliability of the accounts.

At The Analyst, we consider such red flags as part of our Short Screen criteria. We encourage clients to test their portfolios against these measures and look for our red flags in the Short Screen.

Conclusion

We drop coverage of Wirecard and move on to new ideas. In the meantime, we share some cautionary pictures.

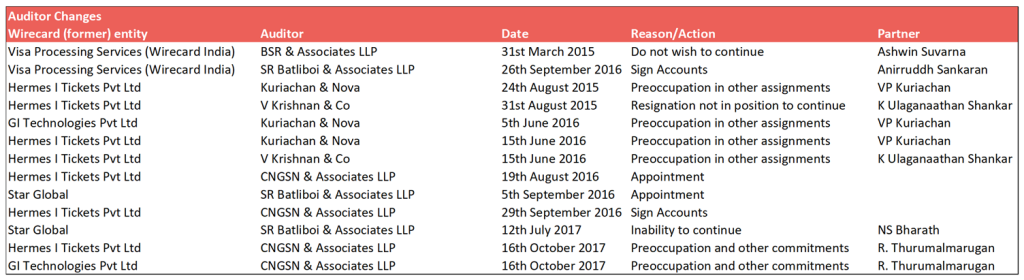

Exhibit 3: If the Auditors Won’t Play Nice, Change Them

Source: The Analyst Research (14 February 2019), Company Filings

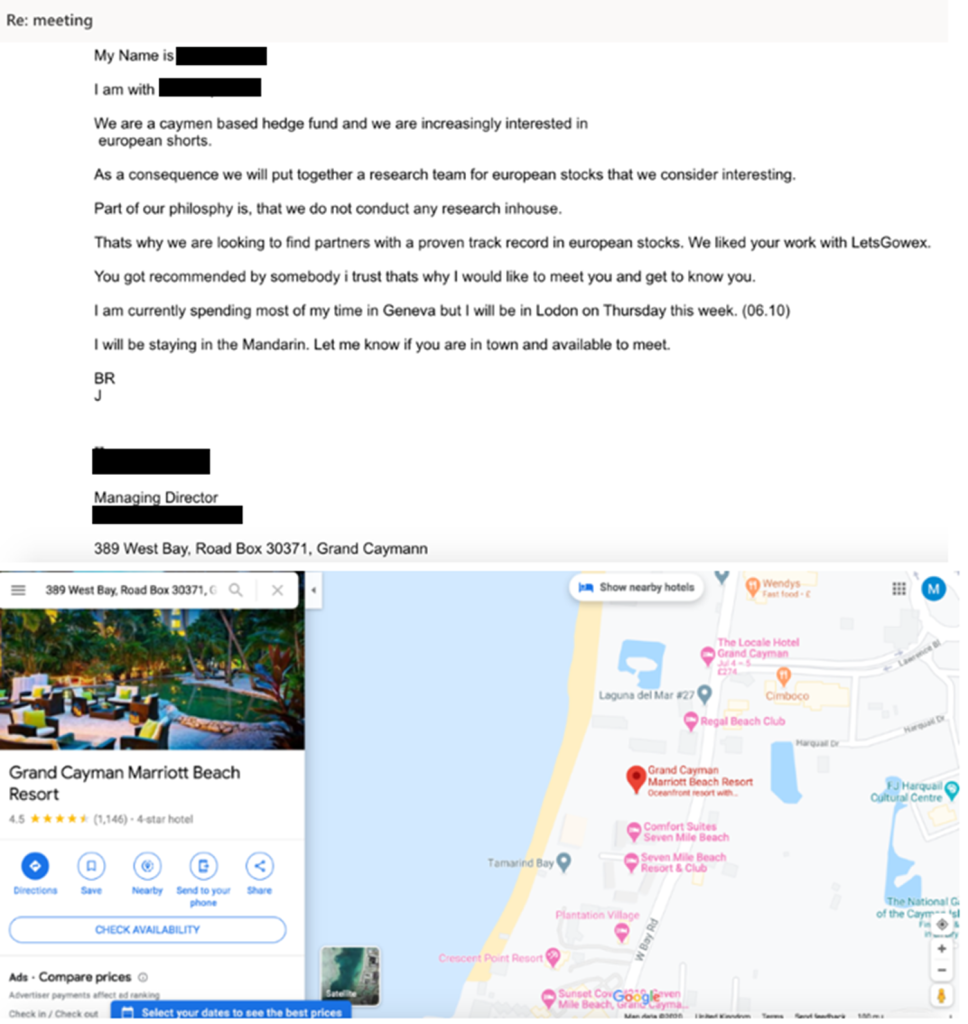

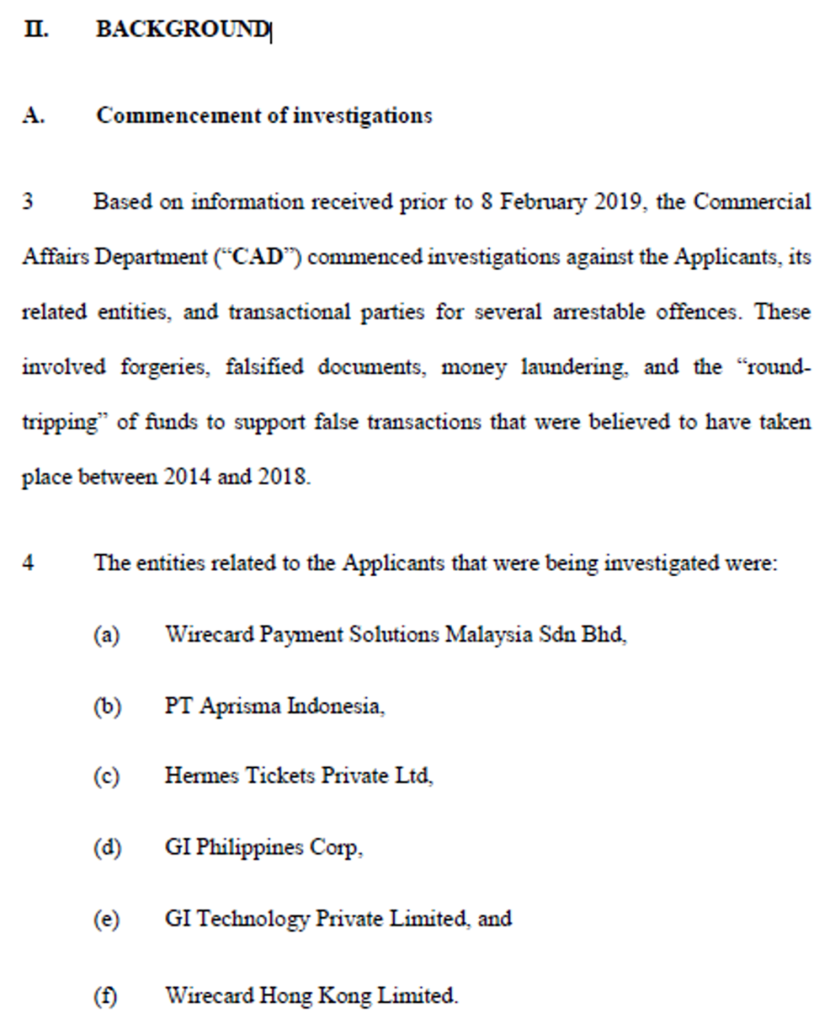

Exhibit 4: Don’t Own Companies That Have Already Been Raided by Police

Exhibit 5: Beware Fake Funds in the Cayman That Can’t Spell ‘Cayman’