Introduction

This note covers international growth, unit economics, and production cycles to suggest how Shein has gone from obscurity to ubiquity at break-neck speed, overtaking Amazon to become the most downloaded shopping app in the US and a strong fast fashion contender in the EU.

Is history repeating itself? Shein’s rapid growth echoes Boohoo’s rise when, several years ago, Boohoo impacted ASOS’s gross margins and growth. We think Shein now poses an even greater threat to Boohoo and, to a lesser degree, ASOS.

In its Q1 trading update, Boohoo reported disappointing European growth at -12% (constant fx), -10% RoW, and a continued slowdown in US growth; although still respectable at 40%. This weakness in growth in some regions in Q1 was not matched by Boohoo’s peers (e.g. Zalando/ASOS), suggesting that Shein could already be impacting Boohoo sales.

Short History of Shein

Shein was founded in China in 2008, by Xu Yangtian (Chris Xu) originally as the wedding dress manufacturer, She Inside. Very little is known about Chris Xu but before founding Shein, his early years were spent in Search Engine Optimization (SEO). In 2012 Shein switched from manufacturing wedding dresses to women’s clothes. In January 2019, Shein raised $500 million from several high-profile venture capital firms (Sequoia China and Tiger Global) at a $5 billion company valuation.

Shein is now reported to be considering a ~$47bn US listing, having secured nearly $10bn of sales in 2020; almost all of those sales outside of China.

Shein’s Impressive International Growth

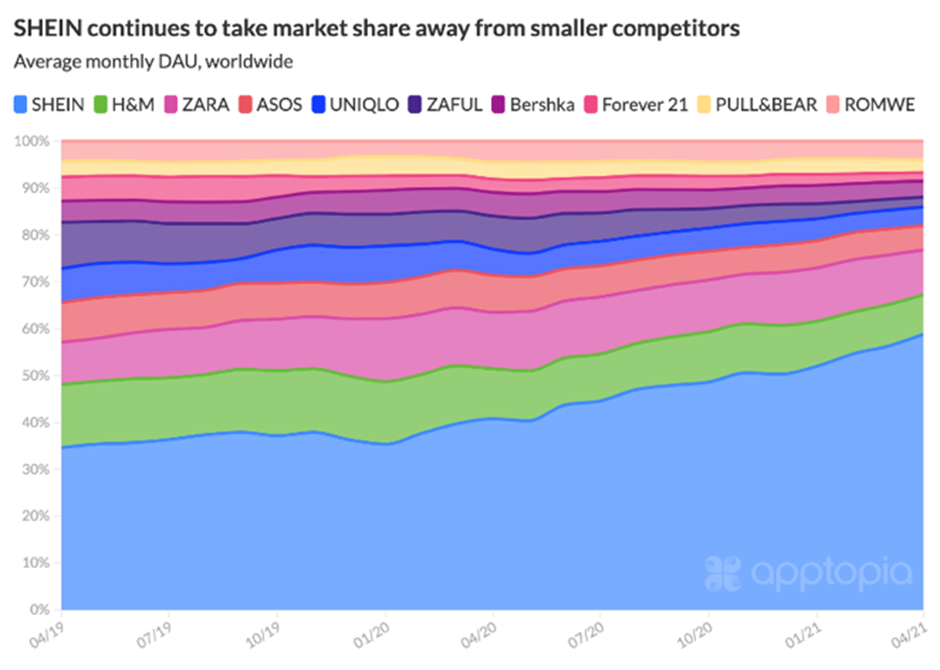

We have limited data on Shein’s sales, besides the $10bn of sales referred to in press articles, and the fact that the company has allegedly more than doubled annual sales for eight consecutive years. It is clear from reviewing multiple data sources (Similar Web, Google Trends, App data) that Shein is continuing to experience phenomenal growth in both the US and Europe.

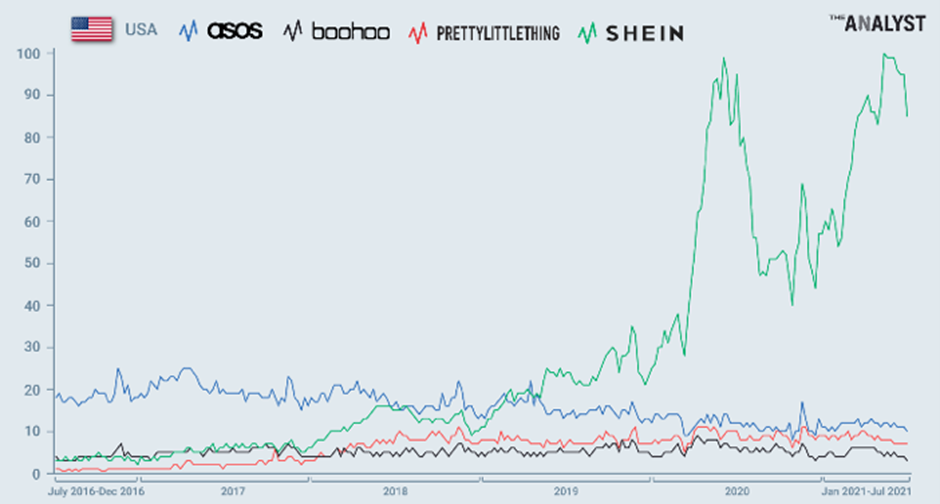

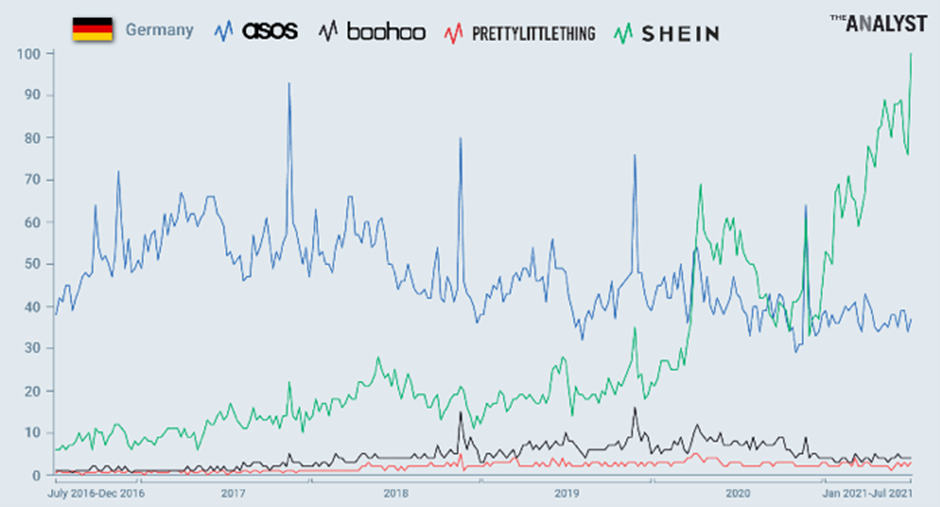

What are the key takeaways from the Google Trends data below (Exhibit 1)?

- US: Shein has eclipsed both ASOS and Boohoo in terms of search interest:

- ~8x of ASOS ;

- ~12x of PLT;

- ~25x of Boohoo.

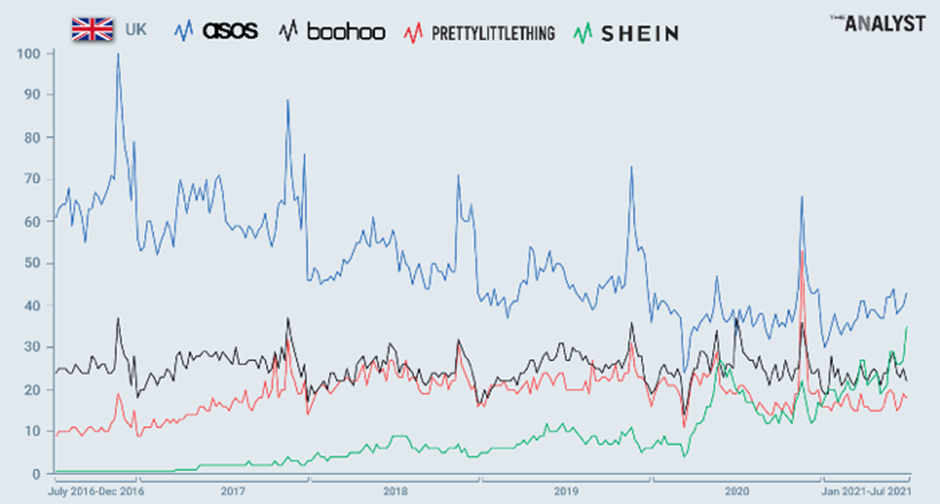

- UK: Shein’s progress in the UK market has been slower than with other markets, with ASOS still ahead on search interest. However, as Shein becomes more ubiquitous, this is changing. Anecdotally, we have spotted an increased level of offline advertising (Billboards, Buses etc.) by Shein, as it invests in the UK market.

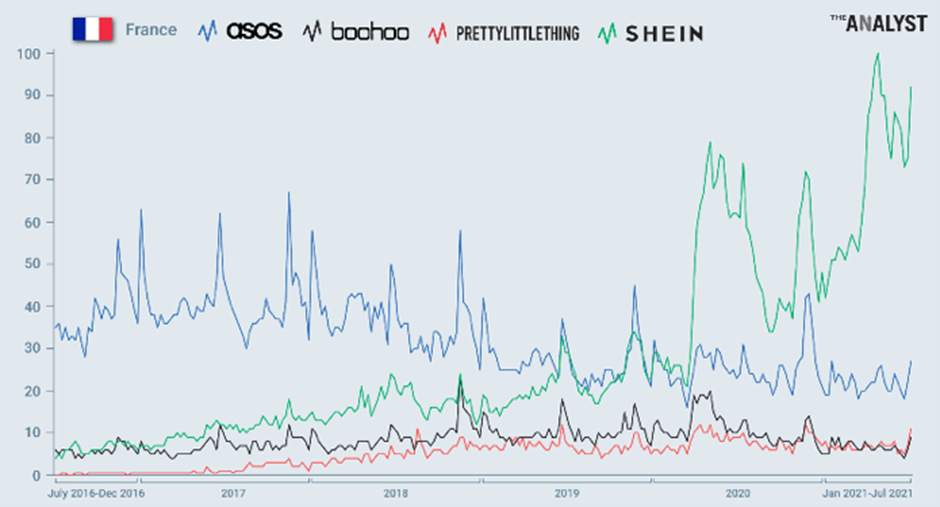

- France and Germany: Have both seen Shein dominate search share at ASOS’s expense.

Exhibit 1: Growing Interest in Shein on Google Across Multiple Geographies

Source: Google Trends Accessed July 2021

Unit Economics Potentially Compelling

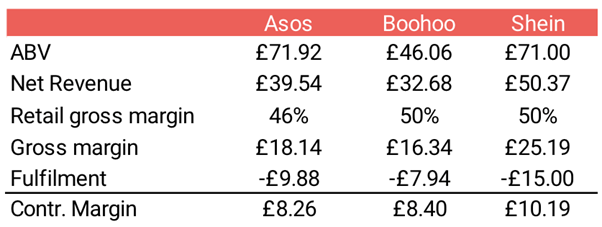

Exhibit 3: Shien’s Estimated Unit Economics

Source: The Analyst Estimates, ASOS FY’20 Annual Report & Boohoo FY’21 Annual Report

We assume Shein is generating at least Boohoo gross margins, as although Shein’s pricing looks to be 10-20% lower, it also benefits from much lower labour cost (~50% of COGS). We believe, because Shein has a large average basket value (ABV), the increased cost of shipping from China is more than covered by the higher gross profit per order.

We estimate Shien may make a higher contribution margin than both ASOS and Boohoo; leaving significant money to invest in growth i.e. customer acquisition.

A Sustainable Moat?

- Lower labour costs combined with real-time retail. Labour represents a substantial cost to clothing manufacture (~50% based on our prior work). Based in China, Shein benefits from lower labour costs, relative to its Western suppliers manufacturing in Europe or the USA.

- However, historically, manufacturing in China has come at the cost of long lead times, and large order sizes, but Shein has overcome this through its supply chain management (SCM) software. To manage order flow, Shein has built a software system that connects with its suppliers in real time. This system enables the suppliers to quickly produce inventory that is selling well, and ensures that high-demand items do not sell out. It also helps reduce discounting at the end of season.

- Optimisation of the recommendation algorithm that could potentially increase the conversion rate of customers relative to peers and make customers stickier to the app. Ultimately increasing the lifetime value of customers.

Real-Time Retail

- All suppliers are connected to Shein’s supplier software.

- Proprietary technology harvests customers’ search data from the app and shares it with suppliers.

- Based on Shein’s own, and third-party, data, Shein can predict based-on consumer behaviour (e.g. searches, clicks, sales) what designs will sell out, and quickly adjust its current production.

- This allows Shein to place very small orders with manufacturers (about 100 items or smaller), which are much smaller than Zara and even Boohoo’s 300–500 units. If a specific item goes viral, Shein can instantaneously ramp up production on the garment. (Sources: Not Boring and Vox).

Optimising Clothes Discovery

- Clothing consumers vary between those with intent (e.g., I want the black Jigsaw dress that X celebrity was wearing) to discovery consumers (e.g. those that browse shopping apps and websites).

- Companies that can personalise the shopping experience effectively for the discovery consumer can convert more customers to sales.

- Shein has, allegedly, a superior recommendation algorithm, increasing the conversion rate of customers relative to peers. (Sources: Not Boring and Bloomberg).

Shortening Production Cycles: Shein < Boohoo < Inditex

Inditex was at the forefront of fast fashion when it shortened the standard design-to-retail cycle from 5–6 months to 5 weeks. This has been a key driver behind Inditex’s success; enabling it to respond quickly to what sells, produce more of it, and also reduce gross margin leakage from having excess (discount) stock at the end of the season. Boohoo, as a pure-play online retailer, shortened production even further (to two weeks), and Shein has allegedly shortened production to less than a week.

However, the faster production cycle does not necessarily mean the consumer gets the end product any quicker, as the clothes are sent from China. On average it takes 12-14 days for standard delivery from China. This is a clear downside for consumers.

Conclusion

We currently have a short recommendation on both Boohoo and ASOS, and believe Shein will continue to dampen sales growth for both. Boohoo is most likely to be impacted here, given its clothes and customer demographics are, in our opinion, very similar to Shein’s.

The speed with which Shein has gone from obscurity to ubiquity, and $10bn of worldwide sales, is remarkable and highlights the lack of brand loyalty of consumers in the low-priced fast-fashion segment of the market. We will closely watch Shein’s evolution over the coming months.