Recommendation: Strong Buy (No Change)

NOK --

$10m

NOK --

NOK 70bn

100%

SCHA NO

Investment Thesis

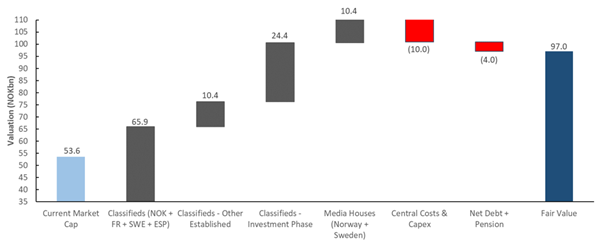

We expect intrinsic value of marketplace assets will far exceed current market capitalisation. We argue the stock can at least double given value in Leboncoin (France), 50% share of OLX (Brazil), Lendo, and other winning classifieds.

Classified marketplaces are natural monopolies with high margins and pricing power when they mature. Many of Schibsted’s assets are still immature with significant growth ahead, which is not captured in short-term earnings.

Stock trades at 3x sales, but 60% of revenue and 90% of the value lies in marketplace assets where peers trade at much higher multiples due to maturity, simplicity, and focus; for example, Rightmove (20x sales), Auto Trader (12x sales), Scout24 (10x sales), and Avito (17x sales).

Complex and multi-layered story with limited disclosure, controlled for the very long-term by largest shareholder. Difficult for analysts and investors to understand, which explains much of the valuation discount.

Free cash flow growth, increased disclosure, and corporate activity such as in-market consolidation, disposal of non-core assets, third-party investment, or asset swaps can be the catalyst to revealing underlying value, whilst management compensation has also been realigned with minority shareholder interests recently.

Mapping the Market

Half of Schibsted’s revenues come from Marketplaces. In our previous note, we argued that the division contains several valuable assets, such as the €6bn ‘developed winner’ Leboncoin in France, along with a number of growth prospects, including a 50/50 JV with Naspers’s OLX in Brazil. We suggest that the complexity of Schibsted’s portfolio of websites and apps across different continents and levels of profitability is one of the reasons the stock has been overlooked. In this note, we break down Schibsted’s positioning in each market and, as a result, we feel even more confident in the multi-billion euro opportunity that is hidden inside a much smaller equity wrapper.

Our main conclusion is that Schibsted is a true global leader in online classified ads websites. It holds a No. 1 place in terms of traffic in almost all countries in which it is present. Furthermore, through acquisitions of close competitors — both horizontal and in the professional verticals (jobs, cars, real estate) — the company strengthens its position and diversifies its offering to professional clients. This, we believe, will be crucial in monetising the brands, which are already well-established. In markets where the reach of the websites is at a very high penetration, we see higher monetisation coming from the professional verticals. Examples of that are already in place, such as entering professional job adverts and new-build properties in France, covering new real estate regions, and switching to mobile apps in Spain.

N.B. In the following charts we have prepared, ‘traffic’ refers to average unique monthly visitors on a website (both on mobile and desktop) in the last six months (darker colour), and average monthly active users on the app in the past year (lighter colour), unless otherwise stated. In our charts we will be comparing traffic on the main domain versus both generalist and single-vertical websites and apps, unless data allows for more specific breakdown of visits.

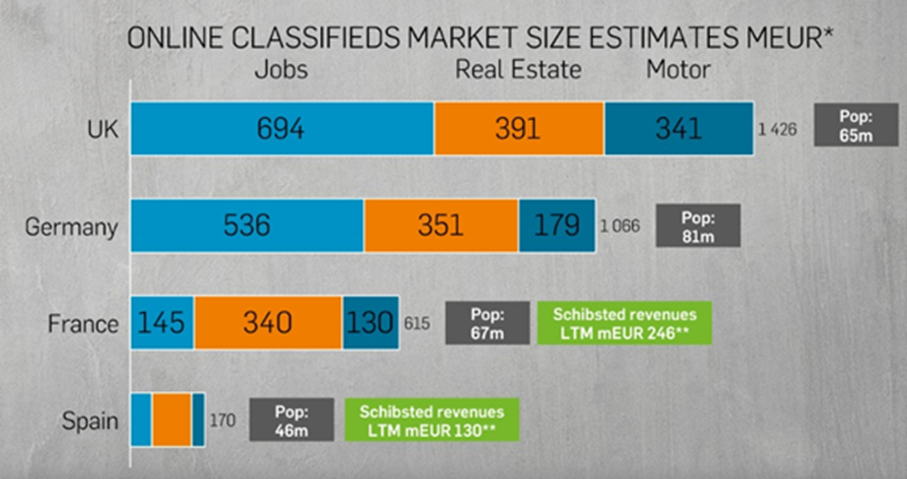

Exhibit 1: High Potential for Growth in France and Spain

Source: Schibsted SEB Nordic Seminar 2018, Accessed August 2018

In some countries, we see consolidated competition with Schibsted sharing the leadership in several verticals with a single operator (France, Austria, and Portugal), while in others the landscape is more diverse, creating opportunities for acquisitions.

Schibsted’s operations in different countries fall into two categories: investment phase and ‘developed’/‘established’ phase. Operations in the investment phase are in a growth stage where revenues and optimal monetisation have not yet been achieved. There is increased marketing spend to bring awareness and traffic. After four consecutive quarters of profitability, the classified business can move into a developed phase.

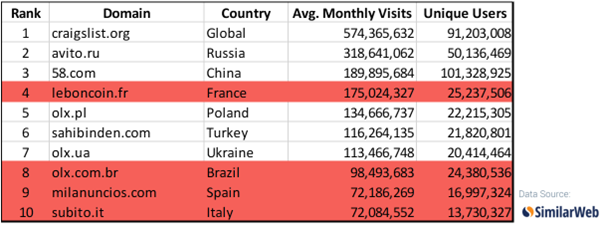

Finally, it is worth noting that Schibsted owns (fully or partially) four out of the 10 leading classifieds websites in the world. According to data from SimilarWeb, Schibsted’s domains receive ~14% of the global traffic aimed at online classifieds marketplaces.

Exhibit 2: Global Classifieds Websites Ranking by Share of Traffic

Source: Insights by SimilarWeb, Accessed August 2018

France

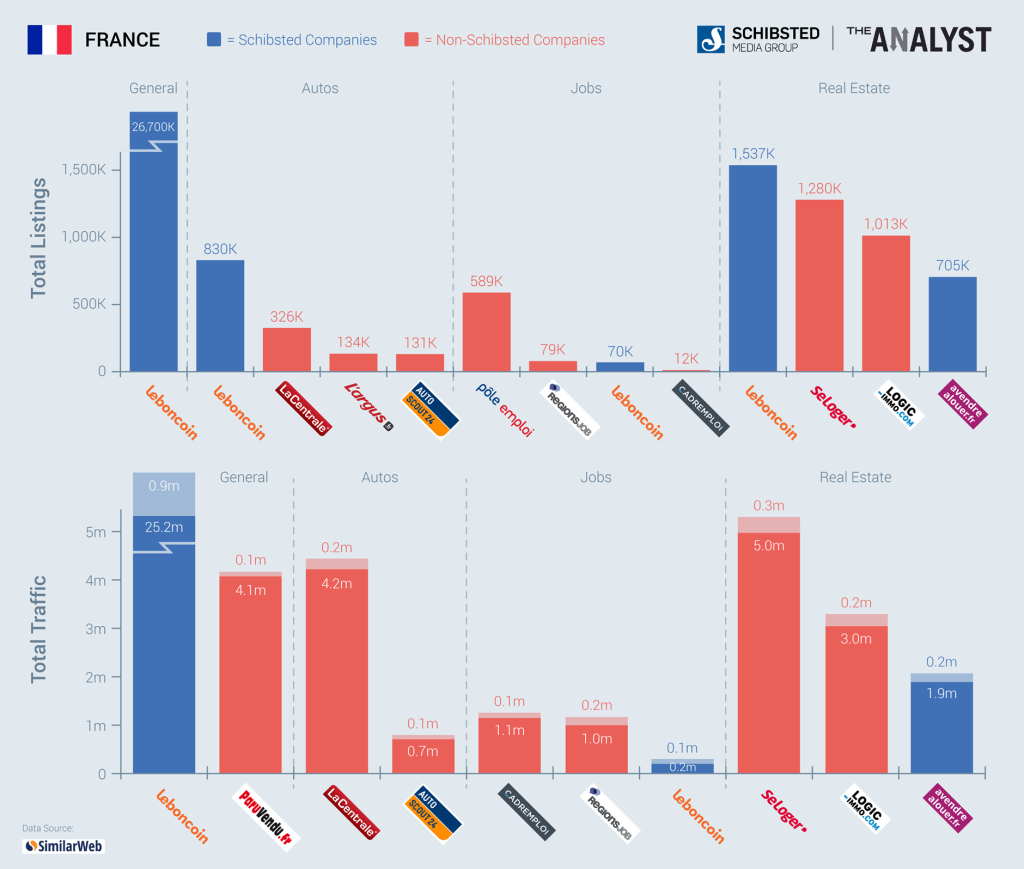

Exhibit 3: Schibsted’s Positioning in France

*Leboncoin’s traffic in Jobs refers to Leboncoin Emploi Cadres only

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

Leboncoin.fr is the fifth most visited website in France after Google (local and international domains), Facebook, and YouTube, and is the No. 1 most visited French website. It has a dominant position in all verticals, mainly because it has become the go-to website for any classified ads in France. Schibsted reports it achieves a monetisation of €4.60 per internet capita.

Schibsted notes that professional verticals (jobs, autos, real estate) are the growth drivers behind its strategy. Consequently, the company does not compete with other general classifieds websites but rather with different competitors on the professional verticals.

Auto

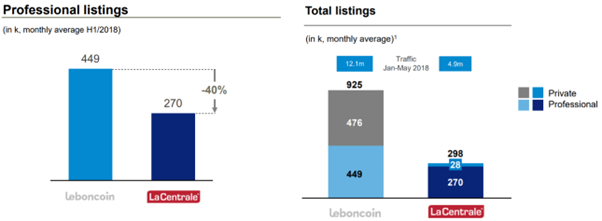

- Leboncoin is a leader in the auto vertical with 2.5x more ads than the closest competitor Lacentrale.fr, owned by Axel Springer, and 5.7x more than the third largest rival Largus.fr.

- At time of writing, Leboncoin achieves the highest monetisation in the Auto vertical (€1.80 per capita), with assumed potential for it to grow to €5.00 based on product enhancement and further penetration. To compare, Auto Trader in the UK achieves €4.50 revenue per capita, which we consider a benchmark for optimal profitability.

- Leboncoin charges a basic fee of €13.36 for an ad along with additional popularisation options for up to €100 per month. Lacentrale charges an insertion fee based on the selling price of the vehicle: free for prices below €15k (44% of all ads), €29.90 for prices between €15k and €20k (20% of ads), and €39.90 for prices above €20k (36% of ads).

Exhibit 4: Listings Comparison with Lacentrale

Source: Axel Springer Company Presentation August 2018, Accessed August 2018

Real Estate

- In the property market, Schibsted has a duopoly position with Axel Springer’s Seloger.com. Leboncoin is a leader both in volumes and traffic on this vertical, while the company reports it ranks second in revenues. Leboncoin achieves €1.20 of revenue per capita versus €2.10 for Seloger. For comparison, Rightmove in the UK achieves the equivalent of €4.15 per capita, which we consider the optimal level of profitability in this vertical.

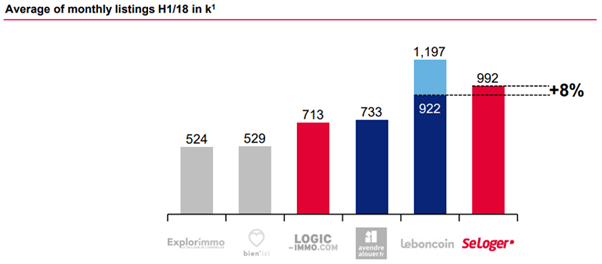

Exhibit 5: Professional Listings in France

Source: Axel Springer Company Presentation August 2018, Accessed August 2018

- Consolidation in the real estate classifieds sector is in full effect. In November 2017, Schibsted acquired the real estate website Avendrealouer.fr to add an offering of new-build properties to its portfolio. The new addition is said to complement Leboncoin, now covering the entire portfolio of both new and second-hand properties on the market. Packages are being offered to professional agents for one or both websites. Furthermore, Axel Springer also targets the leading position in French real estate through the acquisition of Logic-immo.com – the third largest property classifieds website in France – from Spir Communications. The transaction was approved by the competition authorities at the purchase price of €105m (2015 revenue: €69m).

- According to Arctic Securities, an independent Nordic investment bank, Logic-immo has a market share among French real estate agents of ~48%, against Seloger’s 66% and Leboncoin’s 72%.

Jobs

- In jobs, Leboncoin is third in terms of volume of ads after the government-backed Pole-emploi.fr and Regionsjob.com, owned by Telegram and Le Monde.

- Leboncoin started monetising jobs just two years ago, so this is a vertical that is still developing in terms of revenue contribution. Leboncoin charges €210 for a basic insertion. For comparison, Regionsjob charges €795 for a single ad or €895 for one ad with three-month recruitment guarantee.

- The natural progression of employment-related classified ads is to move from advertising blue collar to white collar positions. The latter are more lucrative for the company, as they bring more revenue per ad and are charged a higher price for insertion. To capture this trend, at the end of 2017 Leboncoin acquired a start-up called Kudoz, known as the ‘Tinder for jobs’. Kudoz has developed an application based on candidates ‘swiping’ through jobs, an approach targeting more specifically young executives. After the acquisition, Leboncoin launched a new platform (website and app) called Emploi Cadres, aimed at white collar positions. The biggest competitor in this space is Figaro’s Cadremploi.fr with 1.5m unique monthly visitors, with has a starting price of €870 for insertion.

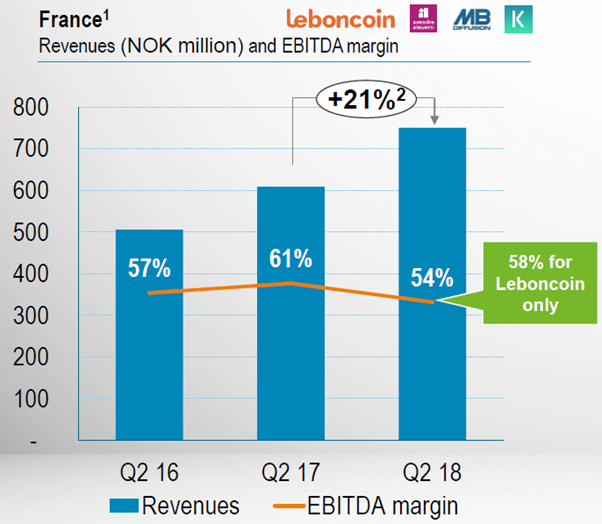

Overall, we believe the French operations are one of the most important assets in Schibsted’s portfolio. With current internet penetration at 90% and given the size of Leboncoin’s audience as it is today, we see opportunity for revenue growth through a higher value of content across all professional verticals. Taking the Real Estate vertical, for example, Seloger has less average monthly listings overall but more are with professional clients than on Leboncoin. Thus, Seloger achieves almost double the monetisation per capita with less listings. We believe in the opportunity of Leboncoin to attract more professional clients in the future given the reach it has in France, all while not sacrificing private sellers. Hence, we assume French operations can double revenues to €650m (2018e: €307m) and at a multiple of EV/sales of 20x, consistent with Rightmove in the UK, they alone could achieve a valuation of close to €6bn.

Exhibit 6: France Revenue Growth and EBITDA Margin

Source: Schibsted Q2’18 Results Presentation, Accessed August 2018

Norway

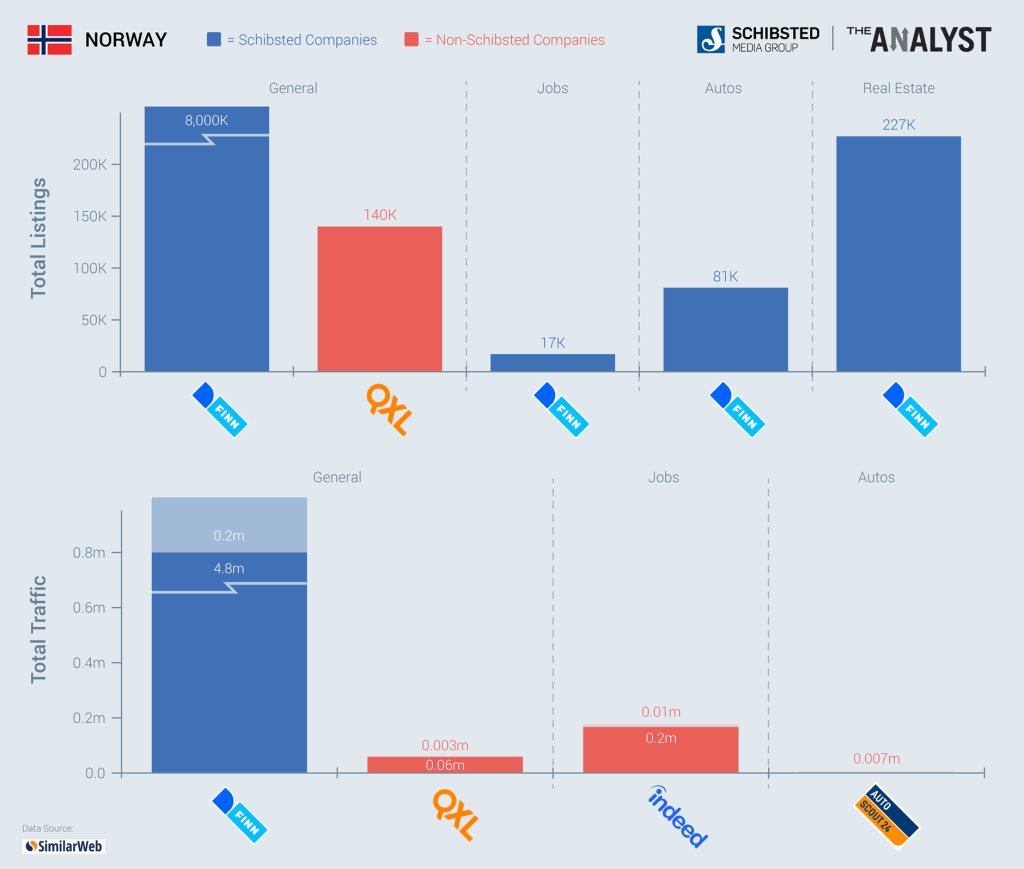

Exhibit 7: Schibsted’s Positioning in Norway

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

Finn.no is a general classifieds website amongst the most established in the world in terms of monetisation per user, currently at €37.80 per internet capita. The high monetisation is a result of pricing power and Norway’s GDP per capita being one of the highest in Europe. Finn already has close to 100% market share in all categories (cars, jobs, real estate) both in revenue and traffic.

To illustrate the reach of Finn in Norway, Rune Skou, CEO of a Wunitech, a company that is developing an app for renting, selling, and leasing items intended for the Nordic region, explained why his firm moved the app launch from Norway to Sweden: ‘In Norway, Finn.no has become so big and if you are buying or selling or something, [you] go there instead of Google. Google is not so relevant for trade in Norway anymore, and we are struggling to become visible.’

The Norwegian operations also include the website Mittanbud.no. With 217,000 unique monthly visitors, it allows people to post a tender for a particular service on the website (cleaning, moving, house renovation, etc.) and choose a contractor using submitted bids and the reviews collected by Mittanbud.

In Norway, Schibsted continuously innovates in order to attract more professional clients. For example, Finn now offers Blink technology, which tracks users’ intent during their browse on classifieds websites and displays targeted ads while the user is on a different website, such as Facebook.

Overall, regardless of the high level of monetisation already achieved, we believe there is potential to grow revenue through more professional listings, thus improving EBITDA margin to 60% (2018e: 46%). Assigning a multiple of 8.2x EV/sales 2018e (established domestic leader in Germany Scout24 is valued at 10x), we value Finn at €1.5bn.

Furthermore, the Norwegian operations include Lendo, the consumer loans website that has been taking off recently (already in Norway in Sweden). We think Lendo will pass €100m revenue in FY’18 while growing at 40%, thus easily doubling revenues once it reaches maturity. The business has 47% EBITDA margins (2018e). Given the similarity with Moneysupermarket in the UK, we think 60% EBITDA margin is achievable for this type of business due to scalability. Assigning a multiple of 20x EV/EBITDA, we value Lendo alone at €1bn.

Exhibit 8: Norway Operations (Finn, Mittanbud.no, Lendo) Revenue and EBITDA Margin

Source: Schibsted Morgan Stanley TMT Conference 2018, Accessed August 2018

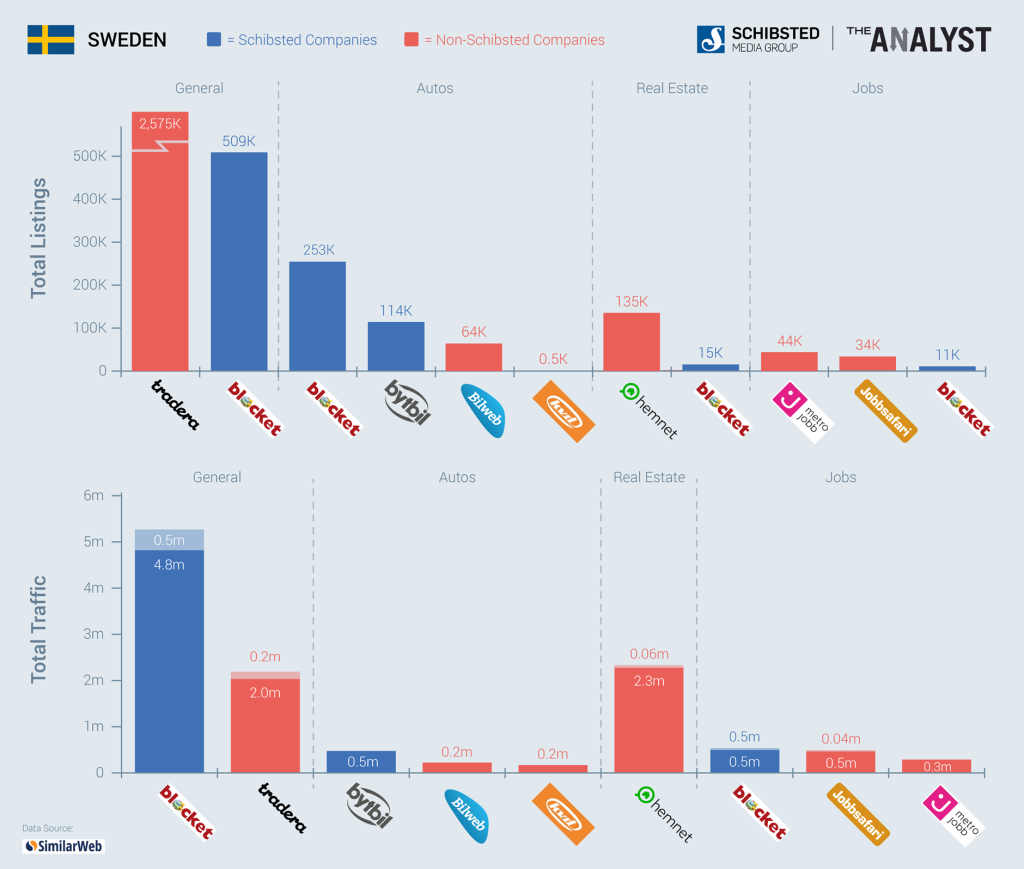

Sweden

Exhibit 9: Schibsted’s Positioning in Sweden

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

Blocket.se is the general classifieds website of choice in Sweden for cars, jobs, and properties. It is the fifth most visited website with 4.8m unique visitors per month (for comparison, Sweden has a population of ~10m). Blocket has a leading position in automotive. Rival website Tradera.com leads in second-hand items (~5x more listings) but it does not compete on jobs, cars, or real estate.

The Swedish operations also include Servicefinder.se, a service classifieds website similar to Mittanbud in Norway. Servicefinder is visited by ~22,000 unique monthly users.

Auto

In autos, in addition to Blocket, Schibsted also owns and operates the automotive classifieds website Bytbil.com. It dominates its closest competitors in that vertical by both traffic and volume of advertisements. Nos. 3 and 4 are KVD.se, owned by the private equity firm Ratos, and Bilweb.se, which the press suggests was acquired in 2014 by the company Netify, in turn owned by Ratos. Thus, the automotive vertical in Sweden is divided between Schibsted and Ratos.

Real Estate

- In Real Estate, Blocket competes with Hemnet.se. Hemnet is the leading website in Sweden in terms of property listings, with 9x more listings than Blocket. In 2016, Schibsted made an attempt to acquire it (at valuation of €144m), but the transaction was not approved by the Swedish Competition Authority. Consequently, the private equity firm General Atlantic bought a majority stake in the business at the end of 2017.

- Hemnet charges between SEK 600 and SEK 2,100 (€58-204) depending on the price of the property. Blocket charges private persons SEK 125 (€12) and institutional clients SEK 240 (€23) for a basic insertion.

Jobs

- In the jobs vertical, Blocket is less dominant. It competes with Jobbsafari.se (which has 3.7x more listings) and Metrojobb.se (4.6x more listings).

- In early 2014, Schibsted acquired StepStone Sweden through Blocket Jobb with the goal to tap into executive jobs.

- Blocket Jobb offers recruiters different packages depending on the exposure of the ad in partner websites. The prices range from SEK 3,500 to SEK 14,900 (€340-1,450). The closest competitor by traffic, Jobbsafari, charges SEK 6,995 (€680) for a basic insertion of an ad and a CV-matching service.

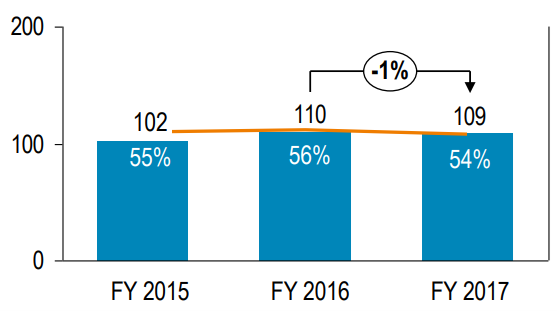

Exhibit 10: Sweden Operations (Blocket, Bytbil, Servicefinder) Revenue and EBITDA Margin

Source: Schibsted Morgan Stanley TMT Conference 2018, Accessed August 2018

We see Swedish operations as stable and we project 5% revenue growth with margins a little above 50%. We see automotive as the most lucrative vertical, especially given the duopoly state, and we believe Schibsted can achieve €11 per capita (2017: €9). Meanwhile, we estimate that jobs is the least-monetised vertical and see opportunities for higher profitability from the transition to professional and executive listings. Assigning a multiple of 15x EV/EBITDA 2018e, we value the Swedish operations at €700m.

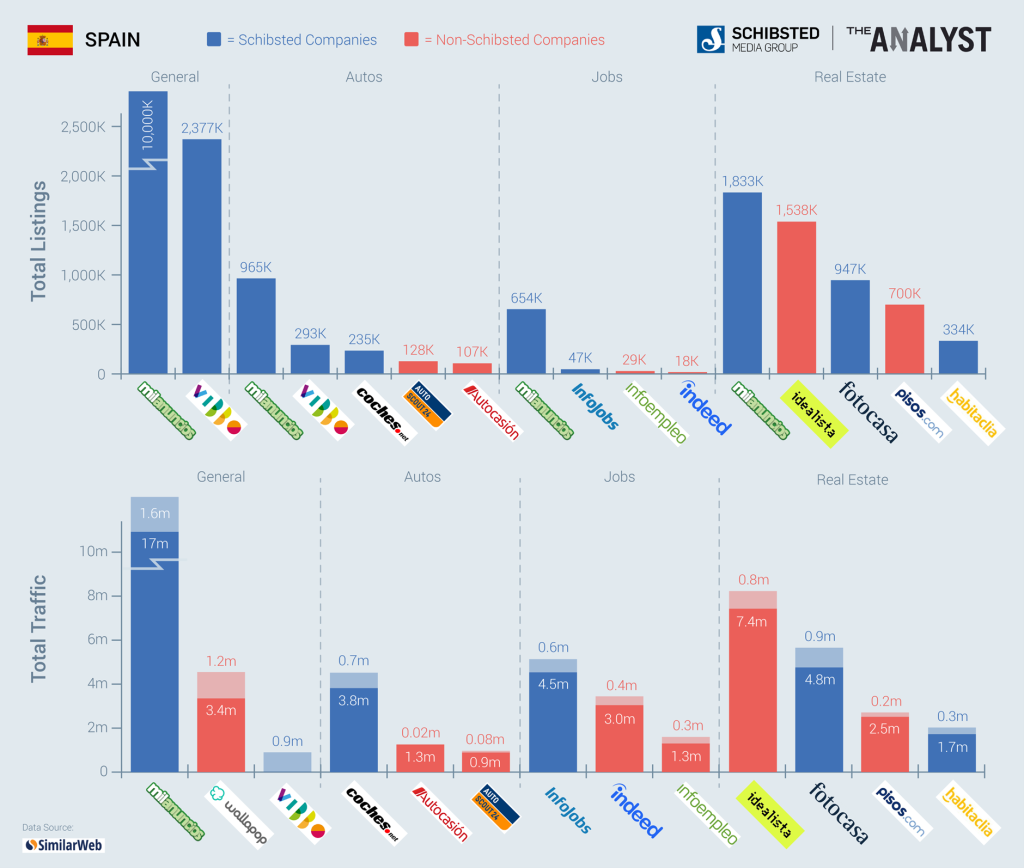

Spain

The Spanish operations include two generalist websites, Milanuncios.com and Vibbo.es, and a presence in all the professional verticals through Infojobs.net (jobs), Fotocasa.es and Habitaclia.com (real estate), and Coches.net (Auto). Vibbo, previously called Segundamano, was the No. 2 classifieds website in Spain, before Schibsted acquired its then competitor Milanuncios in February 2014 for €50m. At the time, Milanuncios had 2x more monthly visitors than Segundamano.

At the end of 2015, Schibsted rebranded Segundamano into the Vibbo platform (app and website), targeting younger audiences. After the rebranding, the traffic on the website suffered, and the website moved the second most visited general classifieds website to being outside of the top 10. However, the Vibbo app, which is a focus for management, ranks 20th in Shopping and accommodates close to 1m monthly active users.

Exhibit 11: Schibsted’s Positioning in Spain

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

General

- The main competitor in Spain’s general classifieds is Naspers-backed Wallapop. Users can visit the website, but purchases can only be made through the app. For this reason, we do not have data for all the listings on Wallapop, but we can see that in traffic it only accommodates ~25% of Milanuncios’ visitors.

- Posting an ad on Milanuncios is free, with users able to pay a small fee (€0.20) for promotion. Wallapop has administration fees starting from €2.50 (for purchases up to €25) to 5-10% of the price of purchases between €25 and €1,000.

Auto

- In the auto classifieds segment, Schibsted operates the Coches website. It is the leader in its category both in terms of volumes of ads and traffic compared to closest competitors Autocasion.com (owned by the media group Vocento) and Autoscout24.es (Scout24).

- Milanuncios, Vibbo, and Coches all have auto-related ads; thus, together they have no real rivals. Coches has 2x times more ads and 3x more monthly unique visitors than Autocasion. The Coches Android app is ranked 10th in the Shopping category in Spain, with 2m downloads and 634,000 monthly active users (MAUs) versus 60,000 downloads and 14,000 MAUs for Autocasion.

- Posting an ad is free for private sellers on both platforms.

Real Estate

- In real estate, Schibsted’s main website Fotocasa is in second place after Idealista, owned by the PE firm Apax. Idealista has ~2x more inventory listed. In the app space, the Fotocasa app ranks similarly to Idealista, both being downloaded ~2.2m times since August 2017.

- In January 2017, Schibsted acquired the real estate portal Habitaclia.com, specializing in the Mediterranean region. At the time, Habitaclia had revenues of €6.8m (Q3’16) and EBITDA margin in the main regions of 30%. On a call with The Analyst, the company expressed plans to keep the brands Fotocasa and Habitaclia separate while sharing some of the functionality between the two.

- Habitaclia is much smaller than market leaders Fotocasa and Idealista and competes more closely with the smaller Pisos.com, owned by Vocento.

- Fotocasa allows up to six free ads and charges between €7 and €60 for additional promotional options. The website also offers separate bundles covering Fotocasa, Vibbo, and Milanuncios for professional clients, which currently amount to 11,000 real estate agencies. Idealista is also free for up to two ads and offers promotional options costing between €10 and €300.

Jobs

- Milanuncios and Infojobs lead in volume of listings and traffic in this vertical. Third is Indeed.es and Vocento-owned Infoempleo.com.

- Infojobs has close to 3x the volume of ads of Indeed and 1.5x the number of unique monthly visitors. 40,000 companies post adverts on Infojobs.

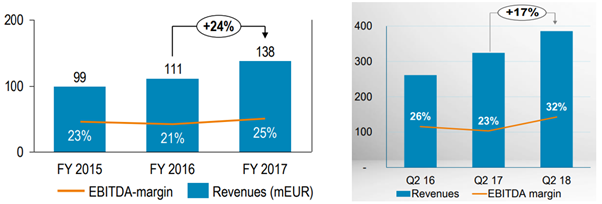

The Spanish operations are all in a developed stage, with Schibsted comfortably present in all professional verticals. We see the opportunity here both in terms of monetisation and further internet penetration. As it is visible in real estate, there is potential for revenue growth through different pricing strategies, especially now with the addition of Habitaclia. We are confident that above 30% EBITDA margin is achievable with a long-term opportunity to get to 55% (similar to more penetrated and monetised Schibsted markets). We value the Spanish operations together at €1.5bn (9x EV/revenue 2018e).

Exhibit 12: Spain Operations Revenue and EBITDA Margin

Source: Schibsted Morgan Stanley TMT Conference 2018, Q2’18 Results, Accessed August 2018

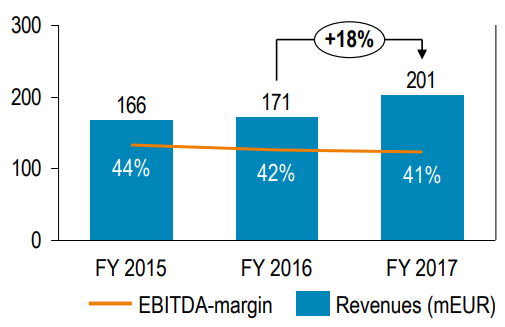

Others

The following operations are classified under ‘Other Established’ and ‘Investment phase’ in Schibsted’s accounts; thus, we can only make assumptions for specific monetisation and profitability.

‘Other Established’ includes Subito in Italy (100% ownership), Willhaben in Austria (50%), three Irish websites (50%), an automotive classifieds website in Hungary, and a real estate portal in Colombia.

In their respective countries, we have also included two of the investment phase assets. These include Infojobs in Italy and the general classifieds website Jofogas in Hungary. From their classification, we gather that the two websites have not yet achieved four consecutive quarters of profitability.

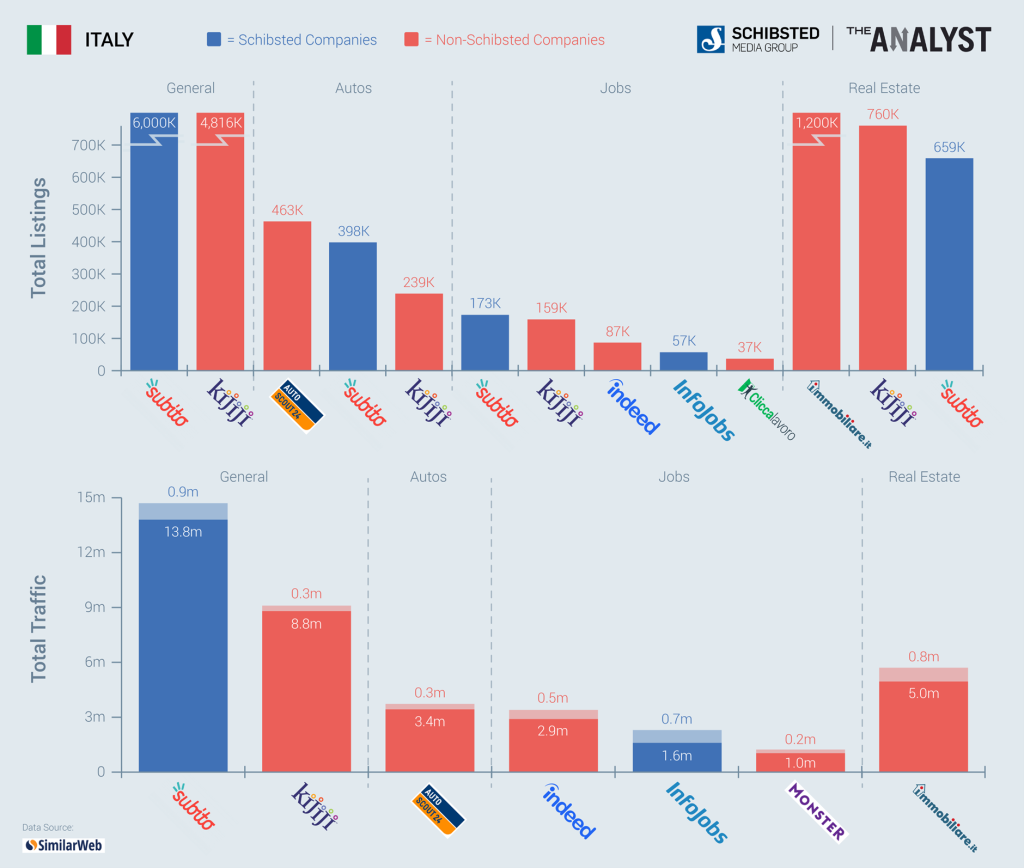

Italy

In Italy, Schibsted owns Subito.it, a general classifieds business and the fifth most visited website in the country. Subito launched in 2007 and is based on the same technology as Blocket in Sweden. In Italy, it is closely followed by eBay’s generalist Kijiji.it. While Subito leads in volume of Jobs and Autos (1.1x and 1.7x more ads respectively), it lacks in Real Estate, where Kijiji has 1.2x the volume.

The Italian operations also include Infojobs.it, a leading local jobs classifieds website in Italy.

Auto

- In automotive, Subito competes with generalist Kijiji and the specialist Autoscout24.it, which has 1.2x more listings.

Real Estate

- In the Italian operations, Real Estate is not a significant vertical. Subito has less listings than Kijiji.

- The leader in the Real Estate vertical in Italy is Immobiliare.it with 1.2m ads and affiliation with 19,000 real estate agents. It is the fifth most popular app in the Lifestyle category (Subito is No. 2).

Jobs

- Together, Subito and Infojobs form a leader in this vertical. They have ~3x more listings that Indeed in Italy.

- In the app space, Infojobs is ahead with ~2m downloads since August 2017 versus close competitor Indeed (1.3m). Monster’s app has been active for only a year, yet it has already been downloaded more than 0.5m times.

- It is important to note that Infojobs in Italy is still in an investment phase, meaning that this is not its optimal positioning, and we expect higher monetisation with the operations turning profitable in the future.

We estimate that the Italian operations achieve some of the lowest overall monetisation. However, future developments will likely strongly benefit from the position Subito has already established in terms of reach.

Exhibit 13: Schibsted’s Positioning in Italy

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

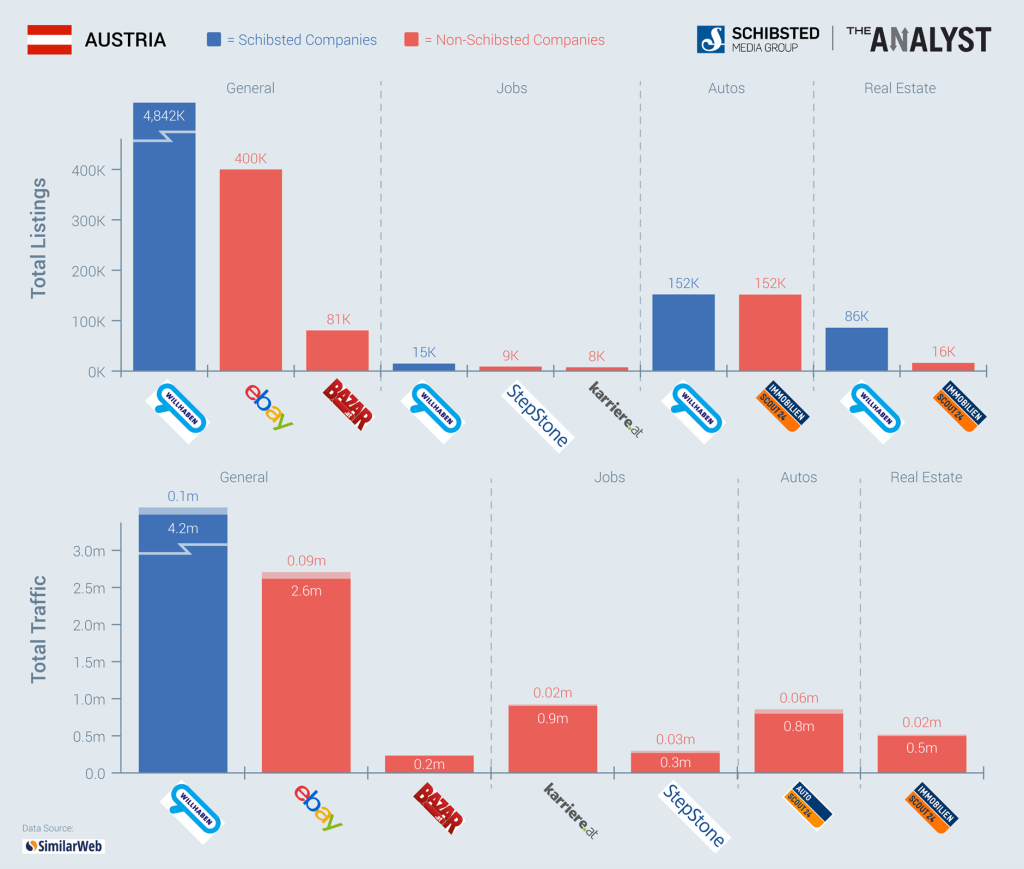

Austria

Exhibit 14: Schibsted’s positioning in Austria

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

Wilhaben.at is the seventh most visited website in Austria. It has twice the unique monthly visitors of eBay and has registered close to 5m ads. It is a clear leader in all verticals. It has 4.2m unique visitors every month in a country with a population of 8.7m.

- In general classifieds, it competes with Bauer’s Bazar.at and eBay, which lack on traffic and volume of ads respectively.

- In jobs, Willhaben has twice the number of ads as closest competitor Karriere.at. It is interesting to note that in 2015, Karriere had the dominant position with 2x more ads. Willhaben charges €300 for a single standard insertion versus €680 on Karriere.

- In Real Estate and Auto verticals, Willhaben competes with Scout24-owned Autoscout24.at and Immobilienscout24.at. While in Real Estate, Whillhaben has 5x more ads, the two rivals are very close in automotive.

Ireland

Schibsted’s assets in Ireland include the general classifieds Donedeal.ie and Adverts.ie, along with the real estate portal Daft.ie. They are all in a developed stage.

In 2015, Distilled Media Group, which operated Donedeal’s main competitor in the general category Adverts, along with the property portal Daft, merged its two assets with Schibsted’s Irish operations into Distilled SCH. Both companies have 50% ownership in the three websites.

Exhibit 15: Schibsted’s Positioning in Ireland

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

General

- Donedeal.ie is the eighth most visited website and the leader in general classifieds in Ireland. The website is visited by 1.6m users every month who spend an average of 10 min on the site.

- Adverts does not charge private sellers for most insertions and offers bumps for prices ranging between €2 to €4. Listing fees for businesses are €0.25 for items below €25 and €0.75 for items above €25. Additionally, a commission fee of 3.5% is charged on the total sale price. In May 2017, Adverts stopped charging success fees (a fee paid on successful closing of a sale) for transactions above €30 in some categories.

- Donedeal’s fees policy is different. Listing is free for general items, costs €10-22 for an automotive ad, €10 for a property ad, and €3-4 for services.

Auto

Donedeal is the leader in the automotive vertical with 126,000 adverts. Listing fees for vehicles depend on the selling price but generally are between €2 and €4 for basic and €5 and €7 for premium ads.

Real Estate

Daft is the 12th most visited website in Ireland with 1.5m monthly unique visitors. It has 3.3x more listings than the Irish-Times-owned Myhome.ie and has ~4x the traffic.

Jobs

In the Employment vertical, Adverts has a very modest presence compared to leaders such as Indeed, Monster, and Jobs.ie (Axel Springer).

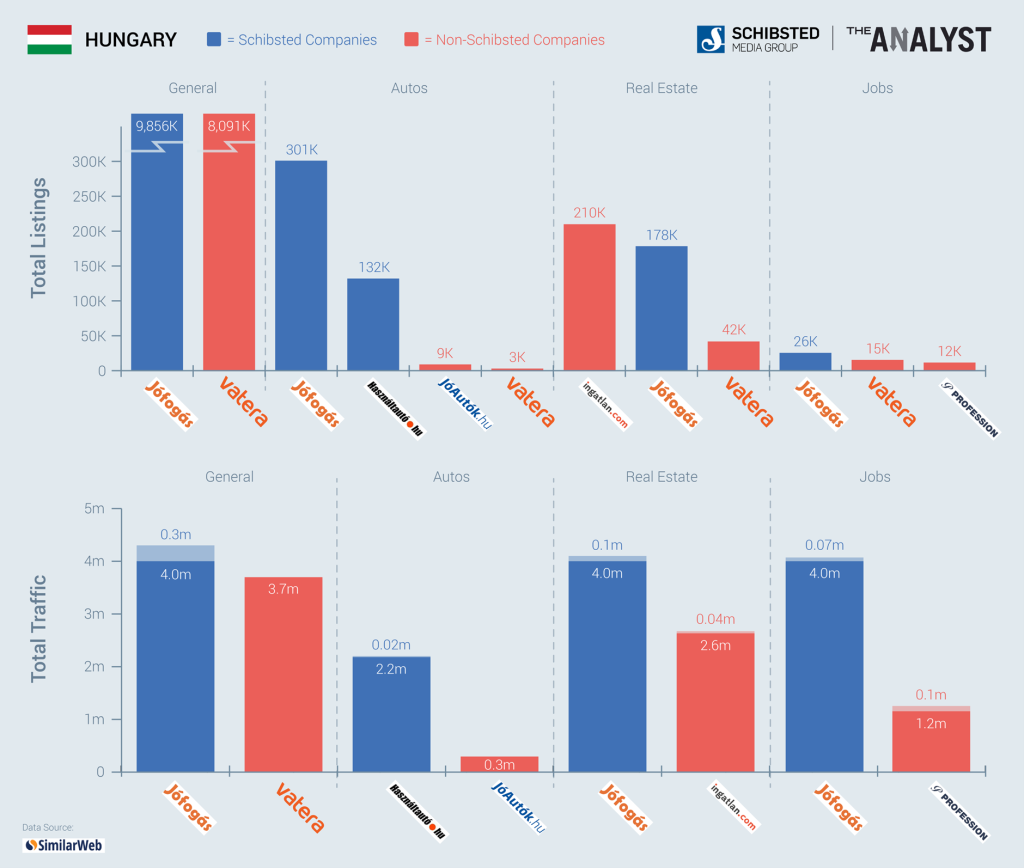

Hungary

Marketplaces in Hungary consist of the developed Hasznaltauto.hu in the Automotive vertical and the generalist Jofogas.hu, which is still in an investment phase. They were merged in November 2016.

Exhibit 16: Schibsted’s Positioning in Hungary

Note: Traffic numbers for Jofogas consist of traffic on main domain plus app traffic on general, real estate and jobs-specific apps

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

General

- Jofogas is the ninth most visited website in Hungary with close to 9m listed ads in all categories.

- In the general category, the closest competitor is Vatera.hu. Vatera is owned by Mail.ru, a Naspers-backed media company, and connects buyers and sellers through auctions.

Auto

- Hasznaltauto is the leading classifieds website for automotive adverts and the 13th most visited website in Hungary. The closest competitor, Joautok.hu, has 14x less listed inventory. Scout24 is also present in Hungary with Autoscout24.hu, which lacks on website traffic.

- The Hasznaltauto app was launched in May 2017 and has already been downloaded 140,000 times. It is the leading app in Auto and Vehicles in Hungary.

Real Estate

- In September 2016, Jofogas launched a separate portal for Real Estate. The biggest competitor in this vertical is Ingatlan.com, which has been the establish leader with most listings (1.2x more than Jofogas).

- The Jofogas real estate app was launched in May 2016, while Ingatlan did not enter the space until end of 2017.

Jobs

- In this vertical, the jobs-focused leader is Profession.hu with 11,600 jobs published, 2.2x less than Jofogas. However, as management has pointed out in the past, positions posted on a general classified website are mostly aimed towards temporary, manual, and student jobs. Jofogas intends to capitalise on this when targeting younger audiences coming from all other categories.

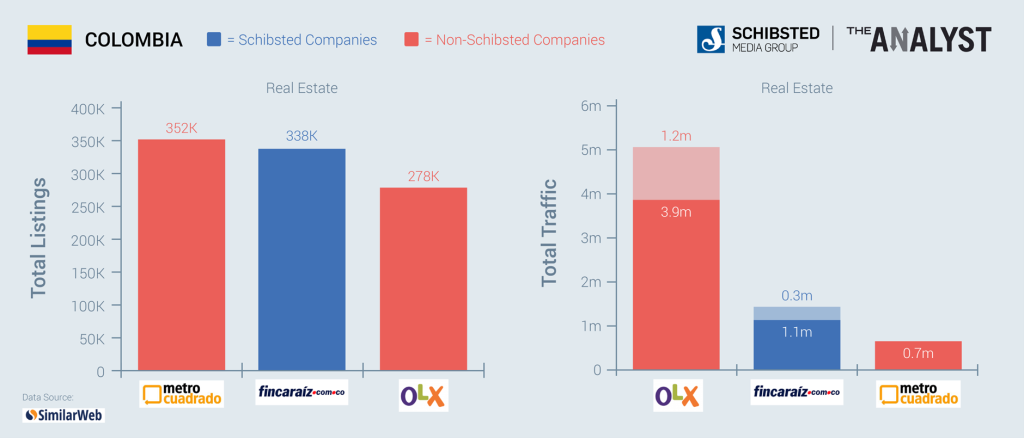

Colombia

Exhibit 17: Schibsted’s Positioning in Colombia

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

- In Colombia, Schibsted operates the real estate portal Fincaraiz.com.co. It is the leading property website in Colombia. Closest competitor Metrocuadrado.com has 1.04x more listed inventory but is visited by half the users of Fincaraiz.

- In the general classified ads space, OLX is the leader with 11m page views in July 2018. The OLX app was downloaded 3m times since August 2017 and has more than 1m active users every month.

Italy, Austria, Ireland, Hungary, and Colombia constitute the ‘Other’ business with variable profitability and monetisation. We value these assets at €1.5bn based on an EV/sales 2018e multiple of 19x and revenue 2018e of €79m.

Investment Phase

We now discuss the operations still in the investment phase. These are businesses currently operating at losses and with minimal revenue; however, we see short-term numbers as having little relevance to the long-term value of classifieds as they first need to build traffic and brand recognition before ramping up listing fees and ad revenue. Here we excluded Infojobs in Italy, Jofogas in Hungary, and Lendo in Norway, which are included in the breakdown of their respective geographies.

Brazil

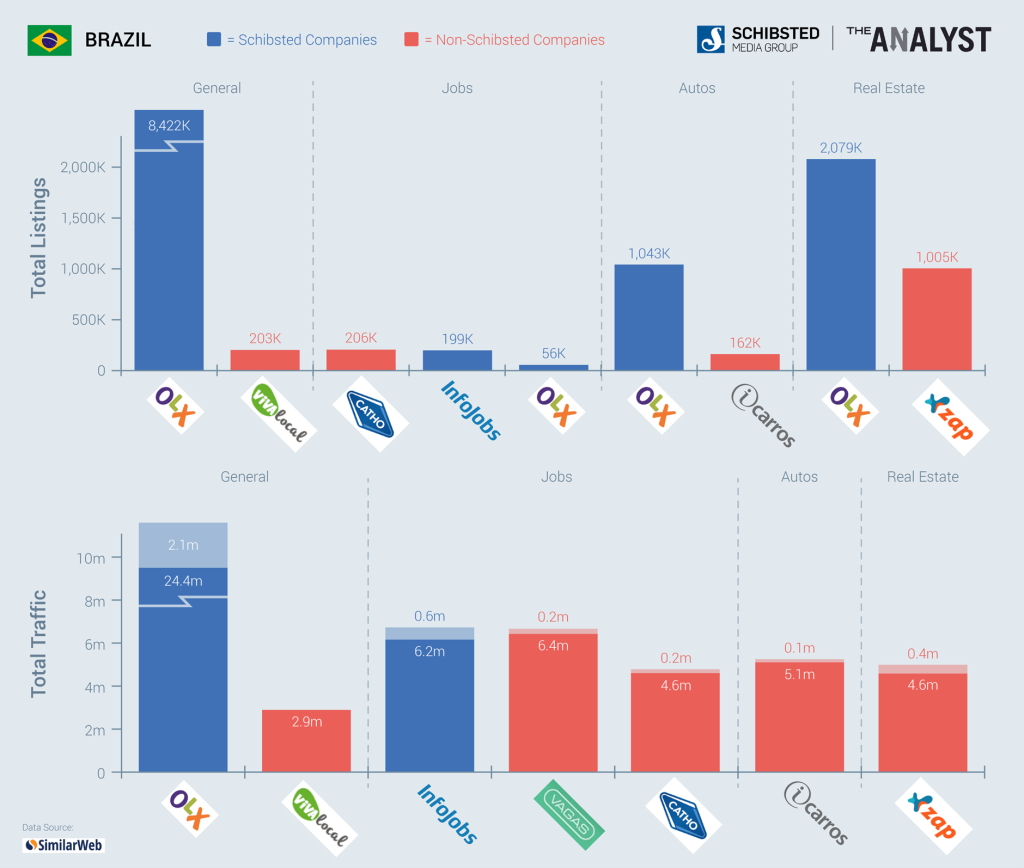

Exhibit 18: Schibsted’s Positioning in Brazil

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

The Brazilian operations include Olx.com.br, the No. 1 in general classifieds, and the jobs portal Infojobs.com.br.

- Infojobs.com.br is one of the leaders in the Job vertical in Brazil. It is the second most visited website after Vagas.com.br, which accommodates ~2x the unique monthly visitors. Third is Catho.com.br, which has more listing but receives 1.5x less traffic.

- The success of Infojobs in Brazil is said to have come from the fact that its main competitors were originally not online businesses. Both Catho and Vagas started as human resources companies/tools and were charging high fees for listings, which made them profitable but vulnerable to competition. In apps, Vagas and Catho are not very strong on traffic, with Infojobs being the most downloaded Jobs app in the last 12 months (since August 2017), followed by Indeed.

- As we mentioned in our previous note, the OLX operations in Brazil are part of a JV with Naspers in which Schibsted increased ownership from 25% to 50% in 2017.

- OLX is the clear leader in the generalist category, with closest competitor Vivalocal.com having 8x less traffic.

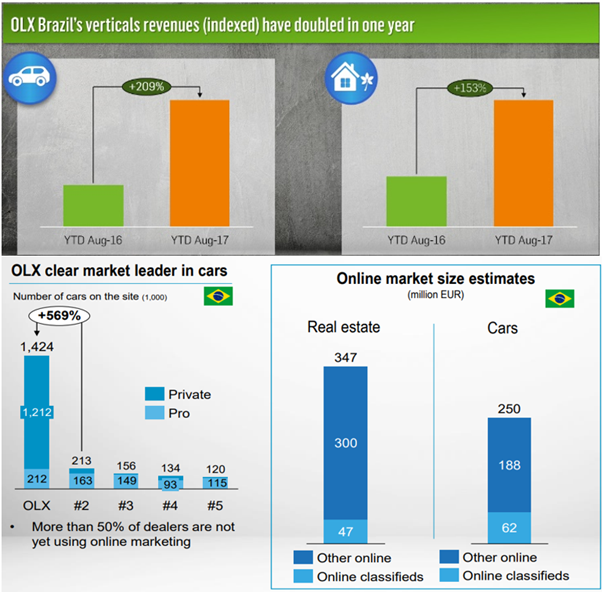

We see OLX as the most important JV with potential we value at €4bn today. Given the opportunity of accessing and monetising the Brazilian classifieds market, we project revenues growing at 40% (2017: 97%, 2018e: 64%), passing the €100m mark in 2020e.

Exhibit 19: OLX Clear Leader in Cars with High-Value Opportunity in Cars and Real Estate in Motion

Source: Schibsted SEB Nordic Seminar 2018, DNB Nordic TMT Conference 2017, Accessed August 2018

Shpock App

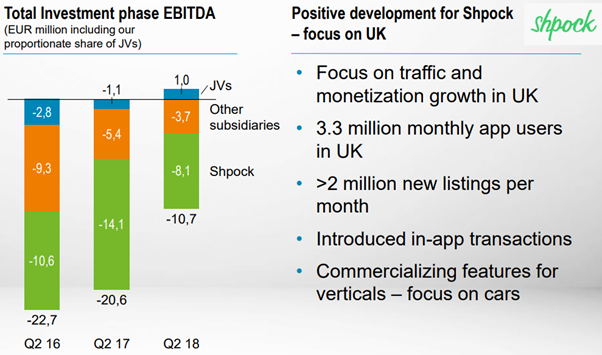

- Shpock is a mobile app for classified ads tailored to a younger audience. It was originally launched in Austria by local entrepreneurs and was bought by Schibsted in 2015. As per Schibsted’s 2017 Annual Report, Shpock operates in the following markets: Austria, Germany, the UK, Norway, Sweden, and Italy.

- The app provides a simple platform for exchanging second-hand items. Buyer and seller can agree on a time and a place to meet and exchange; thus, no payments are made through the app. Buyers may look for items locally or by category. Insertions are free and there are several promotion fee options.

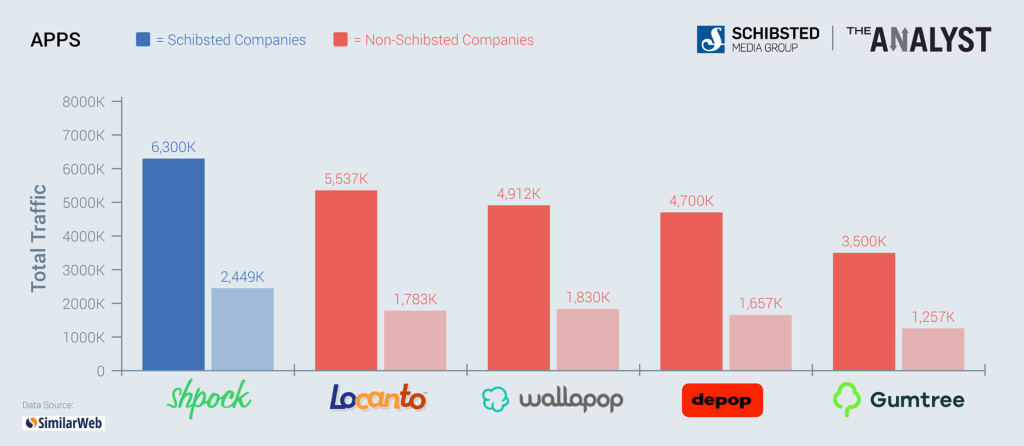

- In the app space, Shpock is competing with a number of established and new players. Amongst them are eBay (global), Naspers-backed Letgo (mainly in the US), Wallapop, the UK incumbent Gumtree, and the Latin America-focused Locanto. Depop is considered a much smaller competitor than the rest, but it has a strong presence in Shpock’s markets.

Exhibit 20: Shpock versus Peers, App Downloads (darker red) and Monthly Active Users (lighter red)

Source: Rankings calculated by The Analyst based on Apptopia’s Insights (Downloads and Active Users for Last Six Months since August 2018)

- Italy is currently Shpock’s biggest market by monthly active users (MAUs), with close to 1m MAUs. Spock is second to eBay (1.3m MAUs) and comfortably ahead of No. 3, the second-hand fashion app Depop with 275k MAUs.

- In Norway, Schibsted hopes it will capture a young audience and small transactions on a local level, whereas Finn.no would remain the go-to place for all price points and across the whole country. In the company’s latest presentation, Schibsted mentions that the UK has been a recent focus.

- In the UK, Shpock competes mainly with Gumtree, which has been the leader in general classifieds. Since August 2017, Shpock has been downloaded 1.1m times and had on average 408k MAUs versus Gumtree’s almost 2m downloads and 392k MAUs.

As Shpock is still in a loss-making phase, we do not assign value to it yet. However, given recent developments in the space, we are inclined to understand management’s conviction in Shpock and we are keen to follow the development of the app into profitability.

Exhibit 21: Shpock Spending and UK Developments

Source: Schibsted Q2’18 Results Presentation, Accessed August 2018

Finland

Exhibit 22: Schibsted’s Positioning in Finland

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

- In Finland, Schibsted-owned Tori.fi competes with the generalist auction website Huuto.net, owned by Sanoma. At the time of this report, Huuto has 1.5x the inventory of Tori but Tori has 3.2x more traffic. From online discussions, we gathered that users appreciate the function to review sellers in Huuto, which is missing on Tori. However, it appears that the liquidity (the speed in which a seller finds a buyer) is higher on Tori, along with the prices being fixed from the start.

- Another competitor in General is the horizontal vertical Oikotie.fi, again owned by Sanoma. It is a platform for apartments, vehicles, and jobs with access to Huuto. It has less listings in the Auto vertical but more in Real Estate, where Oikotie has pursued a leading position.

- None of the generalist websites have more inventory than the leading specialists. Nettiauto.com has 1.5x and 2.2x more inventory listed than Tori and Oikotie respectively and is the 22nd most visited website in Finland (Oikotie 33rd). Etuovi is the leading real estate website with 4.2x and 1.2x more listings. A basic insertion costs €149.

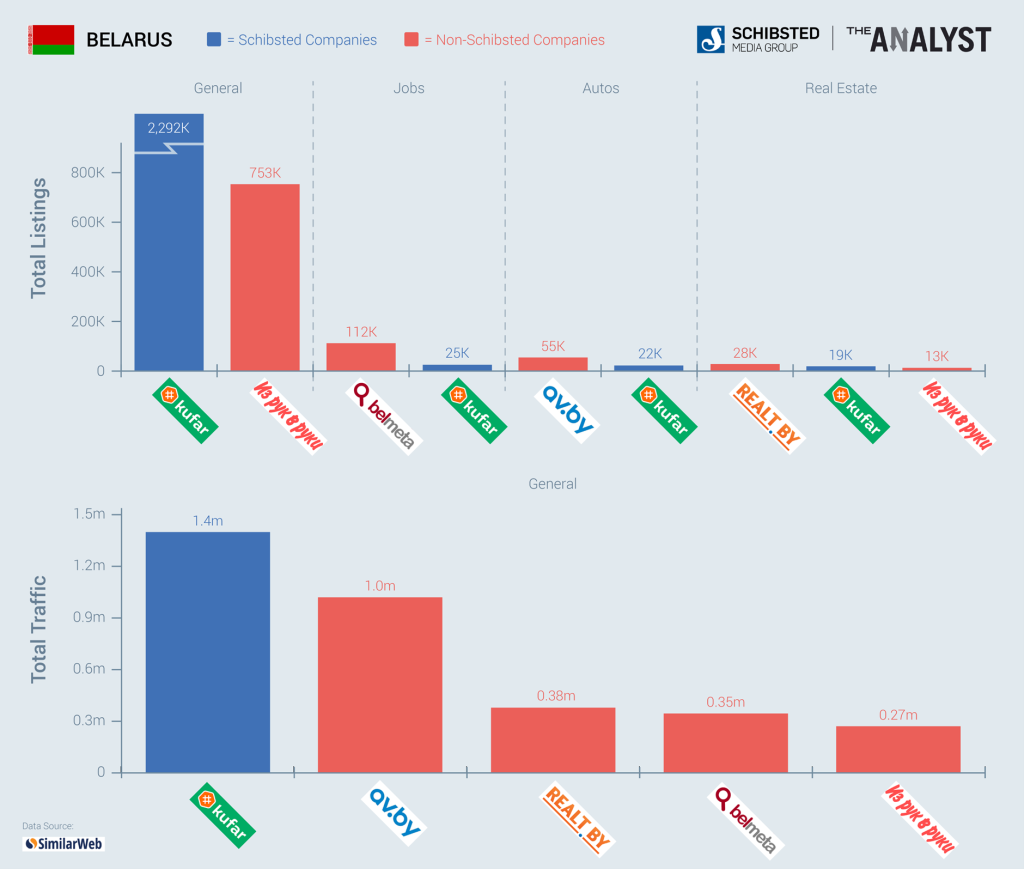

Belarus

Exhibit 23: Positioning in Belarus

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

- Kufar.by is the 12th most visited website in Belarus.

- In the past, Kufar faced strong competition from Second.by, which was much stronger in generalist classified ads but weaker in the professional verticals. In June 2016, Kufar acquired Second’s operation and consolidated it under its own brand, thus becoming an undisputed leader.

- In second place is Irr.by, the Belarus version of a popular Russian website Irr.ru. Although it is strong in the Real Estate vertical, Kufar has 3x more listings and the traffic is very weak at 270k unique visitors (1.4m for Kufar).

- In the Auto vertical, Av.by is leading with 2.5x more listings and 1.2m visitors monthly. In Real Estate (led by Realt.by) and Jobs (Belmeta.com), Kufar is also lagging.

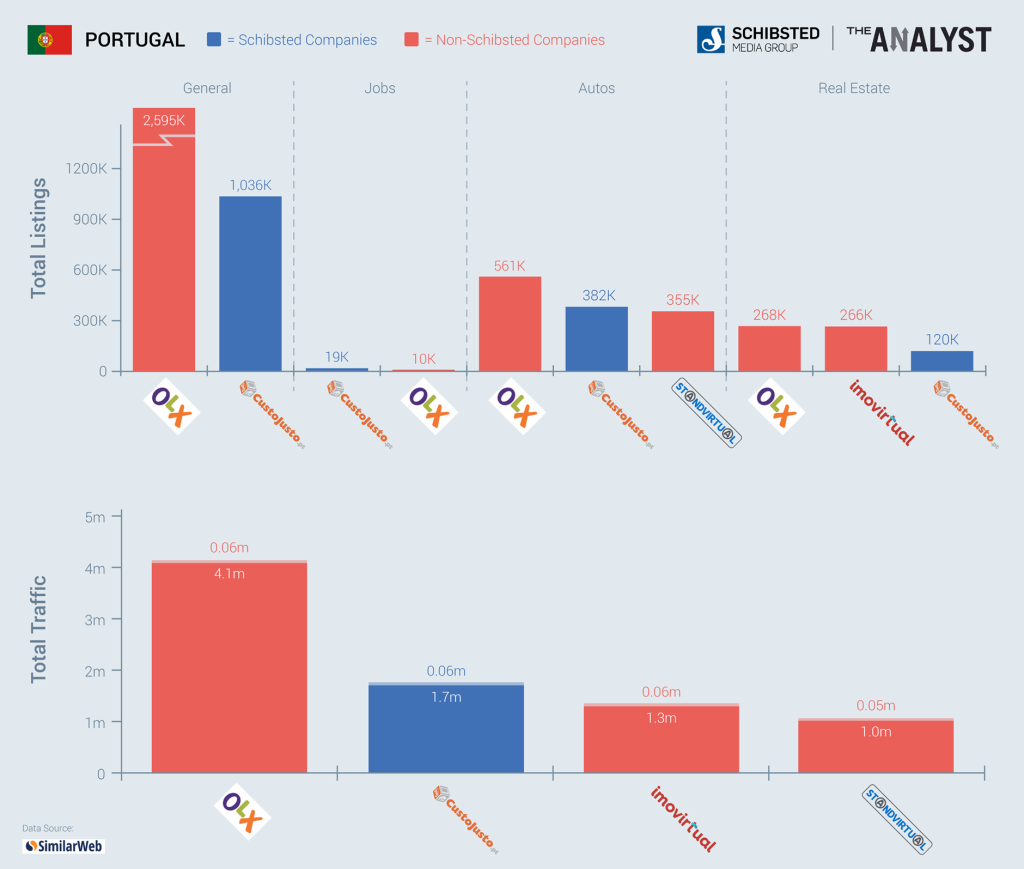

Portugal

Exhibit 24: Schibsted’s Positioning in Portugal

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

Portugal is one of the few markets where Schibsted’s position is strongly challenged.

- OLX is the absolute leader in general classifieds, with 2.3x more traffic and 2x more listings than Schibsted-owned Custojusto.pt. Custojusto is only leading in listings on the Jobs vertical, where it has 2x more. In both Real Estate and Automotive, OLX is twice the size.

- Naspers also owns the leading website in the Automotive vertical (standvirtual.com) with 1m monthly visitors (1.7m for Custojusto), but which has less listings than both OLX and Custojusto.

- On the Real Estate vertical, Naspers is also present through Imovirtual.com, which has twice the listings of Custojusto.

- There are reports that in 2015 Naspers unsuccessfully attempted to buy Custojusto.

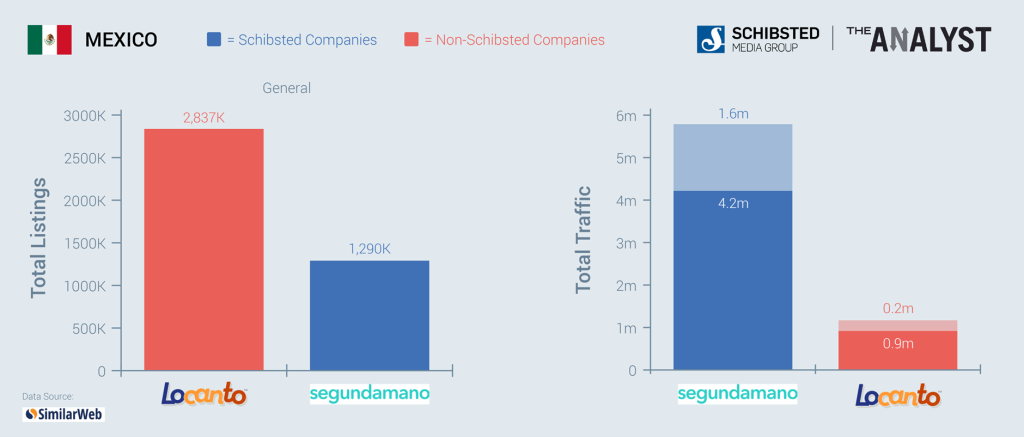

Mexico

- Schibsted acquired Naspers’s OLX in Mexico, which was subsequently consolidated under Segundamano.mx. Segundamano is the No. 1 generalist classified ads site in Mexico. In June 2015, Schibsted announced the acquisition of Anumex.com, its main competitor in Generals, which was aimed at further strengthening the leading position.

Exhibit 25: Schibsted’s Positioning in Mexico

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

- In Mexico, Segundamano’s main competitor used to be eBay’s Vivanuncios.com.mx. It is a general classified ads website but has been specifically focused on real estate since 2016. Thus, Segundamano became the leader in the Automotive vertical and in Generals. Nowadays, Segundamano competes with Locanto, which has higher volumes of listings but less traffic both on the website and on the app.

- In April 2018, Segundamano launched a platform specifically aimed at real estate agents, helping them to manage inventory and accelerate sales. We see this as a sign that the Real Estate vertical is proving to be lucrative and Segundamano is targeting leadership over Vivanuncios. Vivanuncios is visited on average by 5m unique users every month, while the app receives ~3x less traffic than Segundamano’s.

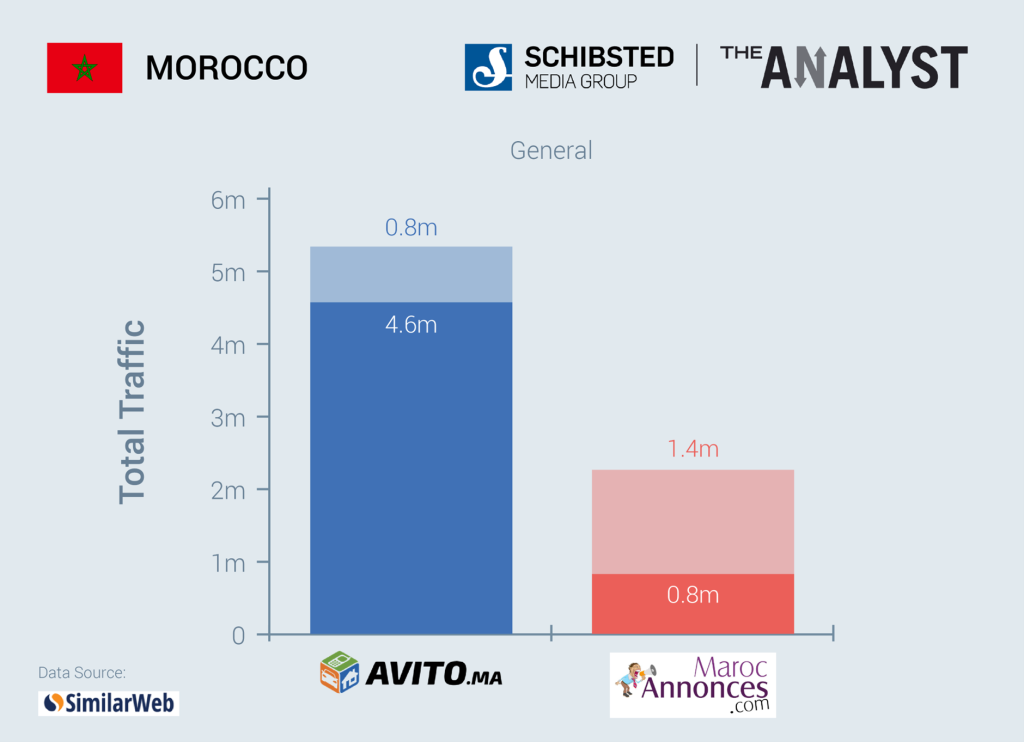

Morocco

Exhibit 26: Schibsted’s Positioning in Morocco

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

- Avito.ma is a general classifieds website, product of a merger between Schibsted’s Bikhr and Avito’s operation in Morocco.

- Its main competitor in general items is Marocannonces.com. Marocannonces has twice the number of listings but receives 5.5x less traffic, which leads us to believe that there is a large quantity of low-quality or inactive listings.

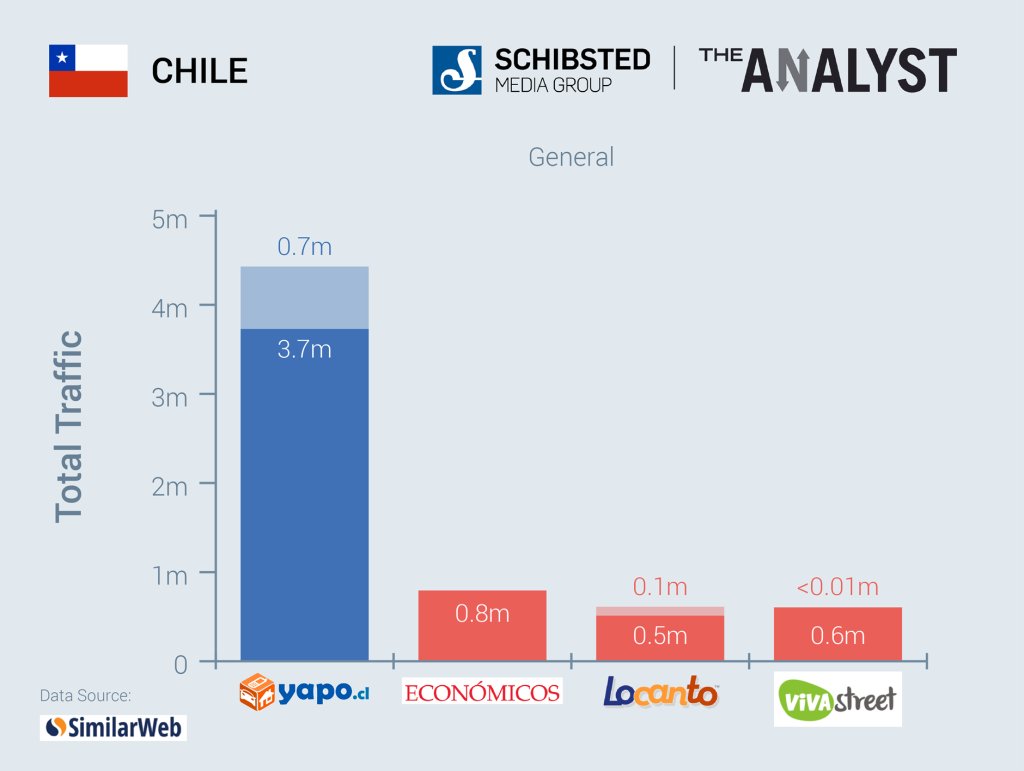

Chile

- Yapo.cl is the leading general classifieds website in Chile. In 2013, Schibsted set up a JV with Telenor which included Yapo’s operations; in May 2017, the company acquired the remaining 50% and became sole owner.

- According to Schibsted, Yapo has ‘a strong position in both cars and real estate verticals based on traffic, brand, and content and is well-positioned to take market shares and increase revenues going forward.’

Exhibit 27: Schibsted’s Positioning in Chile

Source: Rankings calculated by The Analyst based on Apptopia and SimilarWeb Insights, Information correct on 23 August 2018

Tunisia

- Tayara.tn is a general classifieds website, the 10th most visited in the country. It was launched in 2012 and by 2015 it had attained 98% brand awareness and a 15% growth in traffic per month. In July 2018, the website launched a separate real estate platform, Immo-expert.tn, to better capture professional clients and new properties.

Dominican Republic

- Schibsted operates the Crotos.com.do general classifieds website. It is the 18th most visited website in the Dominican Republic. It accommodates 1.3m unique monthly visitors versus 14k for its closest competitor in Generals, Laclave.com.do, and 220k for Supercarros.com, the leader in the Automotive vertical.

The abovementioned businesses do not have the monetisation levels of the European operations, but we believe there is value in the brands established as preferred places to sell goods in their respective geographies. Excluding the Brazilian operations, we value the investment-phase classifieds at €1.2bn given EV/sales 2018e multiple of 18x. We have assumed revenue in maturity of €200m and stable EBITDA margin in line with the other businesses at 55%.

Exhibit 28: Sum of the Parts

Source: The Analyst Estimates, August 2018

Conclusion

We believe that the data and analysis in this report supports our view of Schibsted as one of our highest-conviction Strong Buy ideas. We recognise that the complex portfolio of businesses spanning across continents and variable levels of profitability creates complexity that the market has not yet looked past. However, we reiterate that the nature of classified businesses is to slowly build on an established platform, which we see in all markets mentioned.