Recommendation: Strong Buy (No Change)

£--

$20m

£--

£6.4bn

~91%

SGE LN

Investment Thesis

- High margin business exposed to a structurally growing and underpenetrated market with a sticky customer base.

- New management and a better company culture is moving Sage away from the arguable mismanagement of the past, which stunted the SaaS transition.

- Product deficiencies are narrowing with roll-out of cloud native Intacct and Sage accounting, bank feeds, and developing network of third-party developers.

- Our £12 target leaves ~91% upside potential from the current price.

We had a call with IR at Xero (No Current Recommendation – NCR) as part of our ongoing research on Sage. In this note, we discuss a few insights from the call and why we maintain conviction in the investment case in Sage at the current levels.

Backed by a refreshed brand, a sticky customer base and a more focused strategy in terms of target geographies, we expect Sage’s expansion of cloud-based solutions to continue to drive positive transformation in the business.

We maintain our Strong Buy recommendation on Sage with a price target of £12.00, which leaves ~91% upside potential from the current price.

Differentiation Is Less of a Factor

Based on conversations with the company, Xero sees competitive advantages in mainly three factors – cloud, simplicity, and accountant network. We think all of these are not meaningful differentiators of the value proposition at this stage.

Sage’s Expansion of Cloud Solutions Narrows the Gap

Xero was created as a cloud native solution out of the need to improve the timeliness of accounting data on a software. IR explained that founder Rod Drury was frustrated that he had to download data from a pen drive that was always out of date by the time it was downloaded. A cloud-native solution would help fix that.

While arguably slow at first in adopting cloud solutions, we think the cloud aspect is becoming less of a differentiator:

- Sage expects to reach ~58% cloud adoption in FY’23 and, we believe, is on track to achieve that result. Growth in recurring cloud native revenue increased to 44% YoY, with total cloud native revenue growing 39% YoY in H1’22.

- Moreover, Sage expanded cloud native ARR from UK small business solutions (including Sage Accounting and Sage HR) by more than 50% over the last year.

- The business believes that products generating £516m of annualised revenue and £450m of annualised recurring revenue can potentially be migrated to cloud in the future.

We think these are all indications that the business’ transition to a cloud-based product portfolio is progressing well.

Sage’s Product Improvements Help Compete in the Small Businesses Space

The simplicity of accounting software such as Xero means that users do not need to be accountants to understand it. This topic has been recurring and was confirmed in our conversation with experts and customers that have used Xero, and could compare it to other accounting software. However, we think this is not a meaningful differentiating factor anymore. While some older products arguably looked outdated, we think the current offerings’ interface is more comparable to Xero. We have also seen Sage compared to Xero in terms of simplicity in some online reviews. In other instances, simplicity is highlighted as one of the biggest benefits of Sage Business Cloud versus competitors such as QuickBooks. However, we think a lower grip on the lone entrepreneur/micro business segment remains.

Sage Can Leverage Professional Networks Too

By relying on a network of accountants and bookkeepers, which account for 70% of Xero’s revenues, Xero arguably benefitted from the accountants and bookkeepers’ client networks to expand sales, and offer discounts for the top partners. This is arguably a competitive lever that can be used in the microbusiness space, but arguably not effective with small and medium enterprises, and we do not see it as a source of competitive advantage versus Sage as a standalone factor.

We believe Xero’s historical outperformance came from the attractiveness and simplicity of the solution rather than the ability to leverage the network itself. Sage’s primary customer target consist of accountants and bookkeepers as well and we believe that an improved product can help create a similar flywheel of growth in its network too.

Sage for Accountants, launched in November and, complemented by the recent acquisitions of GoProposal and Futrli, has already added 1,000 accountancy practices so far. According to Sage, it is serving as a key advocacy tool. Sage is now internationalising the UK approach in other markets, starting from Canada and South Africa.

Significant Growth Potential on Increasing Penetration

Small Penetration Offers Room to Grow

Xero estimates that only ~30% of SME in the UK use accounting software (Source: IR). This is consistent with Sage’s estimate of ~33% penetration (2m SMEs out of a total of 6m in the country). Conversely, penetration in Australia and New Zealand is estimated at ~60-70%. Xero estimates US penetration at levels close to the UK (Source: IR). If we assume the Australia and New Zealand levels to be reasonable targets for penetration in the UK and the US, we can estimate Sage’s markets to have the potential to effectively double on penetration alone. If we assume that it will take ~10 years to get to Australia-like levels of penetration, we can estimate a ~7.2% yearly growth tailwind from growing penetration, which grows to ~8-9% assuming 1-2% yearly growth in the number of SMEs. Avoiding market share losses could translate into 8-9%+ growth for Sage’s top-line.

Regulatory Push Can Help

We think that in some markets, such as the UK, regulation and government actions can act as catalysts to boost growth in accounting software. One example of this is the Help to Grow: Digital scheme launched in January via which the UK Government supports small businesses with discounted software and free advice. More specifically, eligible businesses can receive discounts of up to £5,000 off the retail price of approved Digital Accounting and CRM software from leading technology suppliers. In the accounting space, these include Sage, Intuit (NCR) and Crunch.

Other regulatory-driven sources of potential boost include Making Tax Digital, which makes it mandatory to use software to submit VAT returns for all VAT-registered businesses.

Organic Growth Trends Are Improving

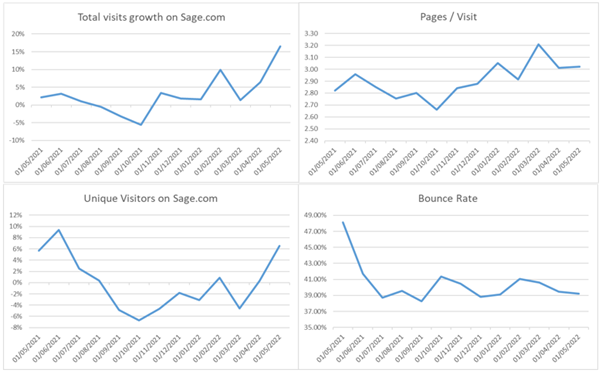

While the growth picture is slightly blurred by other revenue shrinking and small M&A and divestments, we think organic trends are indicating positive developments for the top line. Recurring revenue started to pick up again with 3% growth in H1’22 after a flat FY’21, and annualised recurring revenue grew by 10% to £1,784 in H1’22. Growth trends appear to be backed by alternative data metrics such as an increase in growth for total visits and unique visitors on sage.com (Exhibit 1), which reached ~17% and ~7%, respectively, in May.

Similarweb data also shows that pages/visits are trending up and bounce rates are well below last year’s levels, which we see as signs of increased customer engagement/interest that potentially suggest higher effectiveness of marketing efforts.

Exhibit 1: Similarweb Web Traffic Data for sage.com

Source: The Analyst, Similarweb.com

Positioned Well in the Macro Context

The macroeconomic picture remains highly uncertain, with micro and small businesses potentially receiving an impact from a potential recession. However, with subscription software focused on overhead functions like accounting, Sage is arguably positioned in a highly defensive segment of the economy and of the software space, which is exemplified by the high renewal rate. By value, renewal rate has improved to ~100% from ~97% last year. Together with the strong cash flow generation and the relatively low leverage at 1.5x net debt to EBITDA, we think Sage has a less-than average vulnerability to the business cycle fluctuations and increases in interest rates.

Conclusion

We had a call with Xero IR and took the opportunity to comment on a few topics discussed and update on our recommendation on Sage. While a better grip on lone entrepreneurs and microbusinesses for Xero arguably remains, we believe the main sources of competitive advantages that used to help Xero outperform are not that relevant anymore.

We think a focus on cloud with a refreshed brand and product portfolio has put Sage on track to take advantage of structural growth in the accounting software space. We also think recent trends in terms of organic growth show improvements for the business and are helped by regulatory push on SME digitalisation. Moreover, positive web traffic data in more recent months seems to confirm improving trends.

With an arguably highly defensive positioning, a sticky customer base, and good free cash flow generation, we believe the business has a better-than-average position in this macroeconomic context and is potentially cheap on ~16x our FY’24 adjusted EPS estimate of £0.38.

We maintain our Strong Buy recommendation on Sage with a price target of £12.00, which leaves ~91% upside potential from the current price.