Recommendation: No Current Recommendation

631p

$23.9m

P/E

N/A

£6.8bn

£6.8bn

N/A

SGE LN

Investment Thesis

- Sage, the UK-based SME financial software provider, continues to struggle with its transition to a SaaS business. Excluding FY’17 acquisitions, we estimate the business grew organic revenue by 5.6%, compared to 6.6% the previous year. Most of this growth derives from upselling its existing customers, a revenue source that only gets more difficult with time.

- After years of R&D spending under half that of peer Intuit, the outdated product suite risks being outflanked by nimbler players at the bottom end and global powerhouses at the top.

- To combat falling revenue growth, the business will need to invest considerably in R&D and to remove the cultural damage left by previous CEO Stephen Kelly. This will likely see margins permanently fall from 27% to 22%, generating an estimated £335m adjusted net income by FY’20 (FY’18: £352m), placing Sage on 20x FY’20 P/E.

- However, strong cash generation (>95% cash conversion), continued product roll outs and underlying market growth of 8% combined with low expectations by the market make the short difficult to initiate today.

Having conducted a detailed review on its future prospects, we maintain our ‘no recommendation’ stance on Sage. In 2015, we closed our previous Short recommendation on the stock, noting a more resilient business than we had anticipated and uncertainty over timing of increased R&D spending. Following a ~25% fall in the share price since January 2018 due to slowing revenue growth and concerns over the transition to cloud products, we wanted to assess if there is further downside from here.

This note highlights the main points of the bear case:

- Customers are migrating to cloud products and Sage’s offering lags peers and requires further investment.

- As Sage executes on its existing customer upsell opportunities, product deficiencies will hamper the company’s ability to acquire new customers and maintain revenue growth.

- In addition to higher R&D spending, sales and distribution costs are likely to need to rise to improve take-up.

However, we think that the business has several levers to pull to maintain overall revenue growth, including further monetising sticky desktop customers and additional acquisitions. Whilst the 19x FY’20e adjusted earnings valuation is high, we do not believe it is excessive for a highly cash-generative business model in a growing underlying market. Hence, we keep Sage on our watchlist and would seek a better entry point to consider initiating a short.

Background and the Market

- Sage is a financial management software roll-up, currently operating in 23 countries. It predominately sells to small and medium businesses with an estimated:

- 20% (£370m) of revenue from businesses with 0-20 employees;

- 55% (£1bn) of revenue from businesses between 20-200 employees; and

- 25% (£460m) of revenue from larger enterprises and payment services.

- Whilst there are over 200 products, 50% of revenue is from the Sage 50 and Sage 200 families. These products provide accounting and resource management software for small and medium-sized business. Annual subscription prices range from ~£300 (basic Sage 50) to £10k+ (Sage 200 premium).

- Sage’s underlying market is expected to grow ~8% CAGR globally over the next five years, driven by cloud product adoption, demand for more efficient financial administration, and greater business intelligence.

- The appealing market has encouraged competition and the market remains highly fragmented, with market shares >15% rare in a single geography. For smaller businesses, Sage faces competition from nimbler players such as Intuit (QuickBooks) and cloud native Xero. At the upper end, it competes with global powerhouses such as Microsoft (Dynamics) and Oracle (NetSuite). Whilst Sage now attempts to focus on medium-sized businesses — what it calls ‘scale-up’ — this is a particularly difficult market to cater for. These businesses have the option of using premium versions of small business products or basic versions of ERP systems.

Exhibit 1: Sage’s Key Products and Target Businesses

Source: Sage FY’17 Annual Report

Sage’s Cloud Problem: More R&D Needed

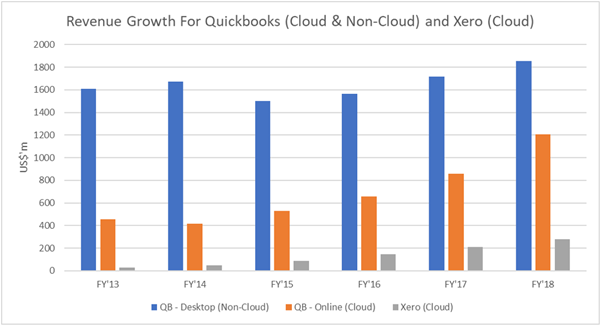

- Cloud products are driving this underlying market growth, compensating for a stagnant desktop market. 67% of accountants surveyed across Sage’s global markets noted a preference for cloud over desktop products and these products have been driving growth for competitors (Exhibit 2). This preference exists because:

- Data can be accessed from any internet-connected device, facilitating remote working.

- Multiple user access: accountants can directly work on live information, without relying on data transfers from business owners/staff.

- There is a single live database, so there are no concerns over version control or conflicting entries.

- Remote data storage reduces individual business risk from data loss and breaches.

- There are no incremental software updates. The version accessed is the most recent version.

- Third parties can create apps to more add functionality and tailor experiences to a particular business type.

Exhibit 2: Growth of Cloud Revenues for Intuit (QuickBooks Online) and Xero

Source: Xero and Intuit Annual Reports and Intuit Factsheet, Accessed January 2019

Sage’s Cloud Offering Still Has Some Way to Go

- 23% of Sage’s £1.8bn of FY’18 revenue relates to cloud products, compared to 40% for Intuit’s comparable segment.

- The company has maintained reasonable overall growth by selling ‘cloud connected’ versions of its high quality and popular desktop products (e.g. Sage 50c, 200c). However, these are not truly cloud products, but rather software which allow synchronisation between different installed versions, still requiring the user to download software onto the relevant device. This removes some of the key benefits of cloud, notably around having a single live dataset, incremental software updates, and the third-party app ecosystem.

- Confusingly for its customers, these cloud connected products target similar businesses to Sage’s cloud native products, such as Sage Accounting and Sage Financials, which account for just 8% of group revenue. Customers often fail to understand the differences, and this muddies Sage’s cloud offering.

- Management argues that offering cloud connected products allows it to capture customers that prefer the familiarity of Sage’s high-quality and popular desktop products. However, we spoke to a number of accounting firms targeting small businesses who stated they would prefer a cloud native solution but noted there was significantly lower functionality between Sage’s desktop/cloud connected offerings compared to its cloud native ones. Whilst they did also highlight there is lag between cloud native and desktop product functionality across the market, particularly around reporting, they noted the gap for Sage was the greatest in their experience.

- When scanning product reviews, we noted that comparisons for small business solutions compared Sage’s cloud-connected versions alongside Xero and Inuit’s cloud native, suggesting Sage’s cloud native products are poor competition.

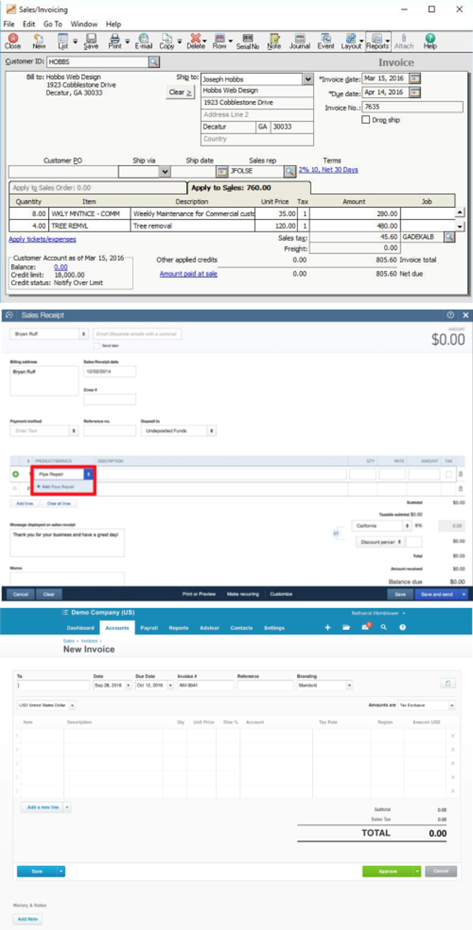

- Per Exhibit 4, the user interface for these cloud-connected products follows the desktop and is outdated compared to Xero or QuickBooks’ cloud native products.

- A poor third-party app ecosystem is Sage’s biggest deficit in its cloud products. As of January 2019, Sage’s app marketplace had 133 apps available for download, compared to 288 for QuickBooks and 431 for Xero. Apps are increasingly important to users, as new functions are often developed by third-party developers. For instance, the app Hubdocs pulls invoices from ~1,000 common suppliers across the US, extracts key information, and automatically records this in the accounting system and matches to bank statements, removing these once manual processes.

- As the app ecosystem expands, features that were previously unique to cloud connected/desktop products narrows, along with Sage’s competitive advantage. For example, whilst Xero is not sold as an ERP system, there are several apps available which provide fixed asset tracking, CRM, and inventory management. Sage largely provides these through own-developed modules and this is why the platform is popular with medium-sized businesses. As awareness of these specialist apps increases, Sage’s appeal to this market is likely to come under threat.

- We spoke to eight popular independent software vendors that have produced apps for multiple accounting platforms to understand their experiences and noted:

- Integration with Sage was least common, with three vendors choosing not to develop a Sage-compatible version of their apps, citing insufficient demand, less developer support, and a more difficult platform to work with. All integrated with Xero and QuickBooks Online and noted Xero had the greatest support for developers.

- Of those that did integrate with Sage, they often noted that it was behind QuickBooks and Xero in app marketplace development and highlighted the company was only recently making attempts to remedy this. This has resulted in a lag of six months to two years between developing QuickBooks/Xero app versions and Sage-compatible ones.

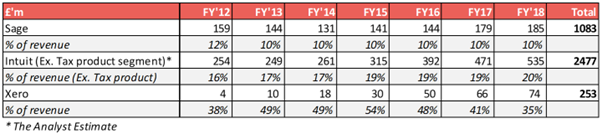

- We believe this is due to years of underinvestment, which will need to be corrected. Per Exhibit 3, Sage has spent ~10% of its revenue on R&D, meaning a cumulative total of £1.1bn over the last seven years.

- Whilst this is over 4x Xero’s investment, it is spread across >12 product families, catering to a variety of business sizes. Most of this expenditure was also likely used to maintain legacy desktop products and develop cloud connected rather than cloud native. This compares to Xero’s single product family which is entirely cloud native and aimed at 0-20 employee businesses. As Xero expands, its ability to fund greater R&D increases; in FY’18, Sage’s spend narrowed to 2.5x Xero’s, intensifying the R&D arms race.

- Intuit is a better comparator. It too has a legacy desktop user base to maintain and is of a comparable size, with its relevant segment (Small Business & Self-Employed) generating £2.3bn ($3bn) in revenue compared to Sage’s total £1.8bn. Per Exhibit 3, from FY’12-’18, Sage’s cumulative R&D spend lags Intuit’s by £1.4bn. This is despite Intuit’s smaller product portfolio across six countries, compared to Sage’s 23.

- At the FY’18 results in November 2018, Sage conceded its level of investment has been insufficient, guiding to an additional £40m for FY’19. This means a total of ~£235m, or 12% of FY’19e revenue. Given the trail of legacy code that still requires maintenance, and that both Inuit and Xero’s R&D budget are also set to rise, we think this is still insufficient and estimate this will trend towards a recurring annual 15% of revenue by FY’20.

Exhibit 3: R&D Spend for Sage, Intuit (Small Business Segment), Xero

Source: Sage Annual Reports, Intuit 10-Ks, The Analyst Estimates Completed January 2019

Exhibit 4: Sage’s Cloud-Connected User Interface; QuickBooks Online (Cloud Native); Xero (Cloud Native)

Three images showing sales invoice screenshots on Sage 50c (top), QuickBooks Online (Mmddle), Xero (bottom)

Source: PC Mag UK, Intuit.com, GetApp, (Accessed 15 January 2019)

Slowing Revenue Growth

- With customer churn at an estimated 14%, yet value retention at 101%, we believe Sage has maintained its high single-digit organic revenue growth by unsustainably upselling and raising pricing for its existing customers.

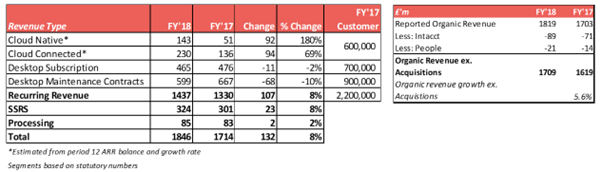

- Per Exhibit 5, cloud connected growth of £94m was the largest driver of FY’18’s £132m total revenue growth. Whilst Sage no longer discloses customer numbers, we believe this is largely driven by upselling subscription desktop users and customers with a perpetual license and maintenance contract. We estimate that Desktop Subscription and Desktop Maintenance Contracts sales fell by £79m and pricing tends to increase by ~20% as clients are moved to cloud connected solutions, providing up to £95m in cloud connected tailwind.

- Each incremental rung of customers becomes more difficult to upgrade, meaning the rate of conversion and hence Sage’s largest revenue growth driver is likely to slow. ~33% of Sage 50 customers have already migrated onto cloud connected.

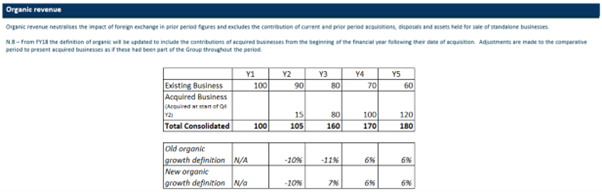

- Sage has also used acquisitions to attempt to plug product quality gaps, most notably acquiring the US-based firm Intacct for $850m in July 2017. We estimate that, excluding the impact of Intacct and FY’17’s smaller £110m Fairsail acquisition (Sage People), organic revenue grew 5.6%. This compares to 6.6% for FY’17. Per Exhibit 6, a change in the company’s definition of organic growth in FY’18 allowed it to capture these fast-growing acquisitions one year earlier and helped the company report 6.8% organic growth.

- We estimate this revenue growth decrease will be partially offset by the roll out of the high-quality Sage Intacct product and Sage 200c into the UK and the International segment, combined with a renewed focus on subscription sales implemented by new CEO Steve Hare. This means an estimated 8% rise in recurring revenue for FY’19, slowing to 6% by FY’20 as new markets to roll out these products dwindles.

- To achieve this relatively high recurring revenue growth, software and software related services (SSRS) revenue growth, which includes perpetual licence and training sales, will likely see a sizeable decline. Management noted that they ‘don’t expect to maintain’ FY’18’s 8% growth, guiding to a 0-5% decline in FY’19. We estimate an average of 1% decline (FY’18: +8%) until FY’20, as some the decline in perpetual licences is offset by training and services related to upselling customers.

- Overall, we expect group revenue growth in the medium term will fall from 8% to 4.5%, generating £1.9bn in revenue by FY’20.

Exhibit 5: The Analyst’s Estimated FY’18 Revenue Breakdown

Source: FY’18 & FY’17 Results Presentations, FY’18 Annual Report, January 2018 CMD, The Analyst Estimates Completed January 2019

Exhibit 6: Example of The Impact of Changing Definition of Organic Revenue Growth

Source: Sage FY’17 Investor Presentation, The Analyst Estimates Completed January 2019

The sections below break down this revenue estimate by Sage’s two largest markets (UK&I and North America), which represent 53% of group underlying operating profit.

UK & Ireland

- UK & Ireland accounts for 21% of group revenue and has the highest underlying operating margin at 37%, generating 28% of group operating profit.

- This has proven a particularly difficult market for Sage since the arrival of Xero in December 2007. Xero now has an estimated 35% market share with 355k subscriptions in the smaller business space. This is followed by QuickBooks with ~25% and Sage with an estimated 15%, which was the incumbent.

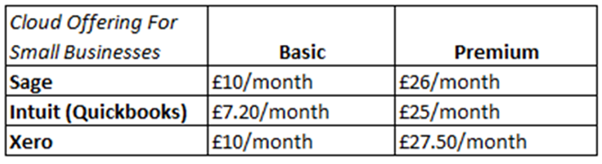

- Despite comparable price points (Exhibit 7), we believe that Sage continues to lose market share to Xero, which grew UK revenues by 60% compared to Sage’s 3% in FY’18 and highlight that:

- Sage cancelled its national conference of accountant partners in 2018, instead hosting several smaller events, whereas Xero’s national conference equivalent saw a 50% increase in attendance to over 3,000 attendees (Exhibit 8).

- We spoke to an independent data transfer provider which had undertaken 30,000 accounting platform conversions in the last seven years. This company noted that ‘Sage 50c to Xero is the single biggest move’ it sees and it is almost exclusively one-way traffic. Reasons behind clients’ transfers included a desire for a fully cloud native products and fatigue from Sage’s price rises. This company also noted that whilst Sage does have a large and loyal customer base, this also means people are well aware of the products’ flaws and are interested to try something new, given that data transfers are free to the customer and free trials are readily available.

- Sage itself is expecting lower growth in the UK. The average medium-term growth rate used in the company’s goodwill impairment assessment in FY’18 was reduced from 6.8% to 4.5%.

- Sage has recently emphasised that its expertise lies away from small business and towards medium and larger ones. Per Exhibit 8, this is in contrast to previous statements made by the company and we question whether this amounts to conceding defeat in the smaller end of the market, dominated by Xero and QuickBooks.

- Nonetheless, the underlying market is still growing, with only 62% of UK SMEs currently utilising any type of software as part of their accounting process. Combined with the UK roll out of Sage Intacct and 200c in FY’19 means that, despite a reducing market share, we estimate Sage will continue to grow at an average of 4% in the medium term (FY’18: 6%), generating £412m in revenue by FY’20.

Exhibit 7: UK Pricing Comparison for Basic and Premium Cloud Native Versions

Source: Company Websites, Accessed November 2018

Exhibit 8: 50% Increase in Attendees at Xero’s UK Conference for Partners; Sage Cancelled Its UK Conference

Source: The Analyst Lens, 14 November 2018

Exhibit 9: Has Sage Given Up on Small Businesses? 2014 versus 2018 Annual Reports

Source: (LHS) Sage Annual Report 2014, (RHS) Sage Annual Report 2018

North America

- This segment is largely comprised of the US market, which represents 26% of group revenue with 26% underlying operating margin, generating 25% of group operating profit.

- In the smaller business market, Inuit has ~80% market share. This is due to the popularity of Inuit’s personal tax products, which provides a strong marketing and distribution channel for its business software. Sage admits ‘it does not try to go head to head’ with Intuit and whilst we see little market share growth, only 30% of business currently utilise any software, suggesting a significant amount of white space for growth.

- The market for medium-sized businesses is more attractive for Sage, where it competes with Epicor and Oracle’s Netsuite. The cloud native Sage Intacct is a high-quality product aimed at this market segment, which grew ~30% in FY’18 (~£130m) and will likely drive growth going forward. This is likely to offset by increasing difficulty converting customers to cloud connected products, as 50% have already made the transition.

- Despite a planned disposal of Sage payroll solutions that generated ~£38m revenue annually, as the penetration of Sage Intacct expands and the underlying market grows, we see average revenue growth of 10% in North America (FY’18: +17%), generating £650m by FY’20.

R&D Is Not the Only Cost Set to Rise

Staff Costs

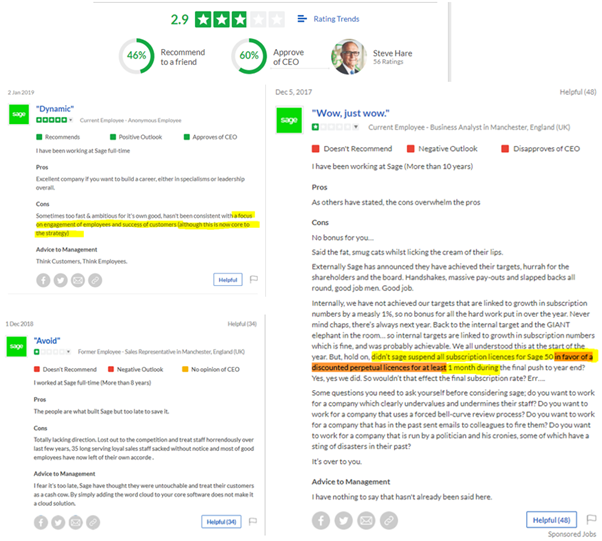

- Headquartered in Newcastle, outside the south east and Manchester UK technology hubs, we would expect Sage to offer a strong working environment to attract and retain its software talent. Glassdoor would suggest this is not the case, with one reviewer describing it as ‘the fastest revolving door in tech, most people want to leave within 3-6 months of joining’.

- It is not just software staff that do not like what they experience. Per Exhibit 10, several employees note a poor working culture, with one sales rep noting that perpetual license sales were favoured over subscriptions sales in order to meet targets.

Exhibit 10: Employee Morale at a Low and Suffering from High Turnover

Source: Glassdoor, Accessed 15 January 2019

- CEO Steve Hare has made resolving this situation one of three key priorities and we are seeing improvements in internal promotion metrics. However, nearly four years of a poor tone from the top under ex-CEO Stephen Kelly’s aggressive leadership style is not easily nor quickly fixed. As the scope to upsell existing customers fades, focus will turn to new customer acquisition. Sage has already guided to an extra ~£20m (~1% of revenue) investment in staff for FY’19, which we believe is likely to recur in FY’20 to undo the damage left by Kelly.

- Hare himself seems to lack conviction in the business. Despite joining Sage as CFO in 2014, he had no holdings until a 200% of salary stake was mandated by the 2016 AGM. By December 2017 he held 227% of salary (approximately £860k), which we do not consider a sizeable stake given Hare’s career history as finance chief at a number of large, listed companies and as operating partner at the private equity firm APAX Partners. Hare has never made an open market share purchase.

Overall Margin Impact

- We estimate a 5% underlying operating margin decline from increased recurring R&D and 1% from selling and distribution (other staff costs), partially offset by overhead savings planned by management. This suggests a 22% expected underlying operating margin by FY’20. This is down from 27% in FY’18. We model an adjusted net income of £335m and EPS of 31p in FY’20. Our numbers are ~8% below consensus for FY’20, largely driven by our lower margin expectations, as one-off costs guided for FY’19 are likely to remain at least until FY’20.

Why Not Initiate?

Although this could provide a compelling short case, there are several factors which we believe makes Sage difficult to initiate on today. Sage has several levers to pull and concerns are arguably priced in. Given this, we would seek a higher entry price to justify Sage as a Short recommendation.

Positive Steps from New Management & Low Expectations

- Whilst we expect a notable margin fall, we believe the market expects poor performance in the medium term. The FY’18 results in November 2018 were a significant profit warning, with management announcing:

- An extra £60m investment in the business for FY’19 causing underlying operating margins to fall from 27% to 23-25%;

- Slower revenue growth in future as the business focuses on recurring revenue and expects to see a fall in SSRS of 0-5%.

This led to a ~14% reduction in consensus FY’20e EPS — yet, since then, the share price has risen 11%. Arguably, this suggests investor relief that management is now tackling the issues that have long plagued the business and they acknowledge the shorter-term risks but still find the business model attractive for the long run. It also means the bar is set low for future results.

Cash Generation Gives Sage Options

- With cash conversion over 95% and stable annual FCF generation of ~£250m representing a 4% yield, it is easy to see why the underlying business model is attractive. Continued strong cash generation means the business:

- Can maintain an attractive dividend policy yielding ~3%.

- Can use M&A to sustain revenue growth. Despite the acquisition of Intacct for $850m in FY’17, Sage has a relatively modest net debt balance of £628m, representing just over 1x EBITDA. As this continues to fall towards £190m by FY’20, management has the option of continuing Sage’s roll up strategy and has commented it is open to further M&A.

- Is an attractive target for Private Equity cf. KKR’s $1.4bn acquisition of Australian accounting software firm MYOB.

Desktop Users Remain Sticky and Cloud Connected Is Not Yet Rolled Out Globally

- As time goes on, remaining committed desktop users obviously become more difficult to convert into cloud subscribers. Nonetheless, this is a large pool of customers to be targeted.

- We estimate 1.4m customers remain on either desktop subscription or maintenance contracts, representing customers already engaged with Sage and an upsell opportunity worth up to ~£200m of additional annual revenue.

- Further behind in the customer engagement hierarchy are perpetual licence holders with no current contact with Sage. Whilst management estimate this represents ~800k customers — which we estimate could be worth an £100m in annual revenue, given a 40% premium from perpetual licenses to cloud subscriptions — this is uncertain. Management has had difficulty identifying this number in the past as it is unclear how many perpetual licence holders still use the product. We believe this is the largest contributor to the estimated number of total customers which management has revised from 6m in FY’12 to 3m in FY’17.

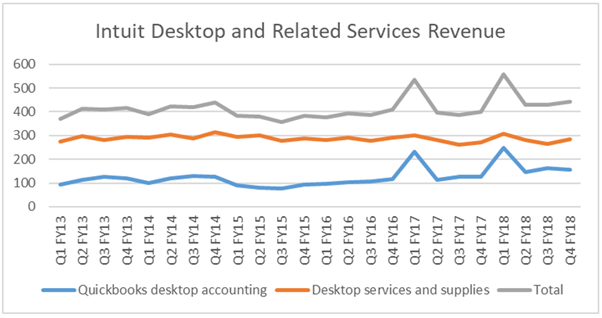

- Even without upselling desktop customers onto the cloud, these customers will likely provide a stable source of revenue given their stickiness. Per Exhibit 11, Intuit, despite a strong cloud native product, has even seen a modest increase in desktop and related sales since FY’13, driven by sales to larger businesses which Sage is attempting to now focus on.

Exhibit 11: Intuit’s Revenue (USD) from Desktop and Related Services

Source: Inuit Factsheets FY’14-‘18

- Sage Intacct and 200c are yet to be rolled out globally. Whilst the market size in volumes for larger businesses is ~7% that of small ones, typical annual contract values of £5-15k are 10x. Hence, this will arguably provide the next wave of customer upsell opportunity.

- A further catalyst for greater customer upsell are tax authorities moving to digital business administration. For instance, from April 2019, the UK’s HMRC expect all VAT registered businesses to keep digital records and submit returns through direct integration of these records. HMRC only expects 30k of the 1.1m relevant businesses to be ready by April, and this could provide a significant catalyst for sales growth over the long run as businesses convert to software compliant with the new regime, known as Making Tax Digital.

Opaque Revenue Streams

- Sage no longer provides customer numbers and does not break down revenue by product, given that 50% of revenue is spread over 200 products. Combined with few metrics to indicate growth from new versus existing customers, this makes it difficult to assess how effective its transition to cloud product is and provides the company opportunity for obfuscation.

Valuation

- We estimate 4.5% average revenue growth for the medium term, generating revenue of £1.9bn by FY’20.

- With underlying operating margins falling from 27% to 22%, we expect FY’20 underlying operating profit of £458m.

- This places Sage on 20x FY’20 adjusted earnings of £335m, which is 7% below consensus of £359m.

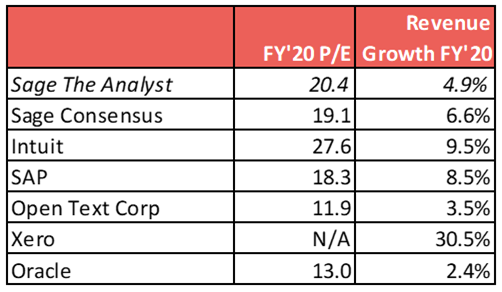

- Whilst 20x is still a relatively high multiple for a business with slowing revenue growth and declining margins, we do not believe it is excessive, considering the valuation of peers and that these declines are unlikely to continue longer-term given the underlying market growth of ~8%. The cash generation of the business also allows the possibility of further acquisitions to maintain revenue growth and explains the company’s attractiveness for income investors.

Exhibit 12: Relative Valuation, Sage versus Peers

Source: Bloomberg, The Analyst Estimates Completed January 2019

Conclusion

Sage continues to struggle with its transition to a SaaS business. We believe the next two years will see revenue growth slow to 4.5% and underlying operating margins fall from 27% to 22% by FY’20, as the space to upsell existing customers narrows, forcing up R&D and staff costs. However, given the market’s positive reaction to the profit warning at the FY’18 results, we believe investors had anticipated this quantum of margin decline. At 20x our below-consensus FY’20e adjusted earnings, the stock is not excessively priced for a solid underlying cash-generative business model and we do not see sufficient downside to initiate here. We will continue to monitor the stock to identify more attractive entry points for a potential short position.; we currently do not initiate and have no recommendation on Sage.