Recommendation: No Current Recommendation

£7.60

$18m

N/A

£3.5bn

N/A

RS1 LN

Summary

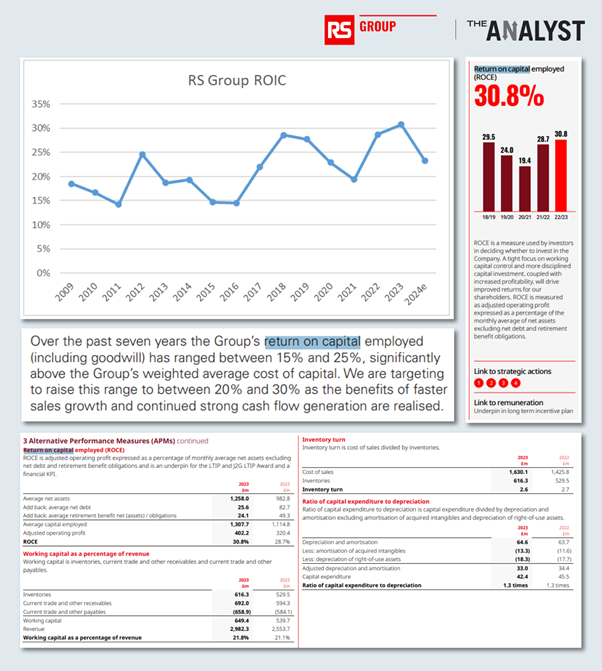

- High, consistent, and sustainable >25% ROIC through 2.6x inventory turn of >750,000 stocked products from 2,500 suppliers to 1.2m customers at 45% gross margins, in value-added distribution model.

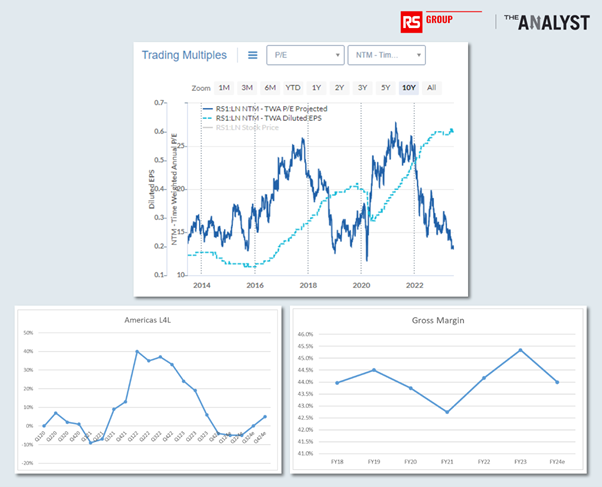

- Entry point may be approaching soon as 12x PE begins to undervalue the long-term franchise, and starts to reflect cyclical concerns and margin normalisation risk.

- Good free cash flow and balance sheet (pro-forma ND/EBITDA 1x) with new CEO may provide opportunity to accelerate M&A growth.

- Vulnerable, in our opinion, to opportunistic bid.

We have updated on RS Group as a new CEO arrived, the share price declined, and we view it as an excellent business approaching a reasonable valuation.

With some cyclical risks and especially Americas/Electronics division against tough comps for the next two quarters, investors may get a chance to buy a business with exceptional & sustainably high-returns, at a low price.

New CEO marks a new strategic phase, and his last two businesses were eventually sold (Ultra Electronics and BBA Aviation).

- Stock is down >30% from highs, but RS Group fundamentals, on a long-term basis, seem unchanged; high ROIC, structural growth in a large market, high free cash conversion, good balance sheet, added value offer to customers.

- RS Group could more aggressively utilise cash flows to accelerate M&A, expanding geographic and product coverage. M&A should be very accretive, also benefitting from structural trends as suppliers consolidate distributors, and distributors increasingly need broadest product range and regional coverage to be a one-stop shop.

- We think investors could potentially enjoy a cross-cycle compounding TSR growth of 13% p.a. based on +4% organic growth (+2% market growth, +1% distributor share growth, and +1% RS Group outperformance) which would drive +8% net income growth through operational leverage. An additional 2-3% p.a. M&A (£150m annual spend at 12x) and 2-3% dividend yield (£100m p.a.) is possible.

- At the same time, low balance sheet leverage, high and stable returns, lower entry point, and a potentially higher exit multiple make RS Group an attractive PE candidate (see exhibit 3).

Why Not a Buy?

- Increased value-add services, RS Pro (private-label) and web sales should be structural margin drivers. However, over the last five years, digital sales have been flat at 63%, and RS Pro sales (19% of Europe) may not have enough traction yet in the US. Is management really delivering sufficient change?

- Gross margins may need to normalise after beneficial pricing with supply-chain shortages and inflation last year. The last statement also indicated some operational challenges in Americas.

- Americas (-4%), APAC (-15%), and Electronics (-14%) showed negative like for like trends in recent quarter (Q4’23 Jan-Mar’23). There may be another 2/3 quarters to work through an industrial slowdown and inventory correction.

- These concerns have already pushed the stock down >30% from its highs, and the forward PE multiple has dropped to a decade-low ~12x consensus (Source: Sentieo). In the near-term, earnings are supported by accretion from M&A, rather than organic improvements.

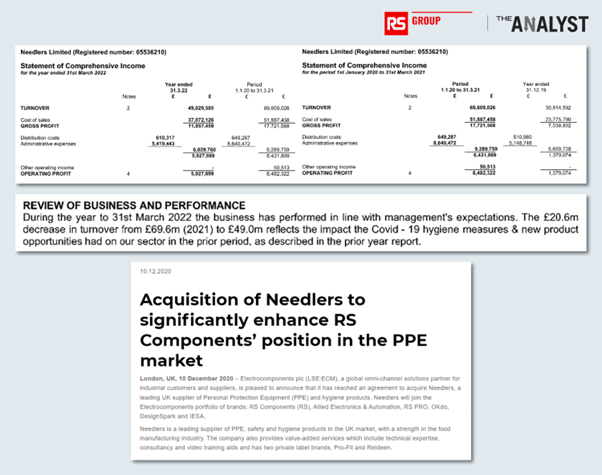

- Acquisition track record is short, but safety product companies acquired in 2020 may have been bought near cycle highs, bringing further normalisation risks on earnings. M&A track record needs developing.

Exhibit 1: Decade Low Earnings Multiple Reflects Cyclical Concerns

Source: Sentieo

Returns Grind Higher with Scale

Return on capital has been a critical KPI for management in recent years, and appears to have structurally improved. When former CEO, Lindsley Ruth, arrived in 2015, Electrocomponents’ (prior name of RS) UK profits still represented 60% of the group, despite having been in structural decline for two decades. The UK was the highest gross margin business for the company, with a dominant position but a shrinking end market. The last material deal had been Allied, in the US, in 1999.

Back in 2016, a further focus on international growth was therefore needed, and improvements in customer service, productivity, processes, and culture were brought. Revenue doubled and margins moved up from 6% (FY’16) to 13% (FY’22). The stock went up 5x and received a further bump last year with exceptional earnings after COVID as like for likes accelerated and gross margins made new highs on improved pricing, against slow-turning balance sheet inventory.

Exhibit 2: Great Business with High and Consistent ROIC

Source: RS Group Annual Reports

Scale and Offer Drive Returns and Growth

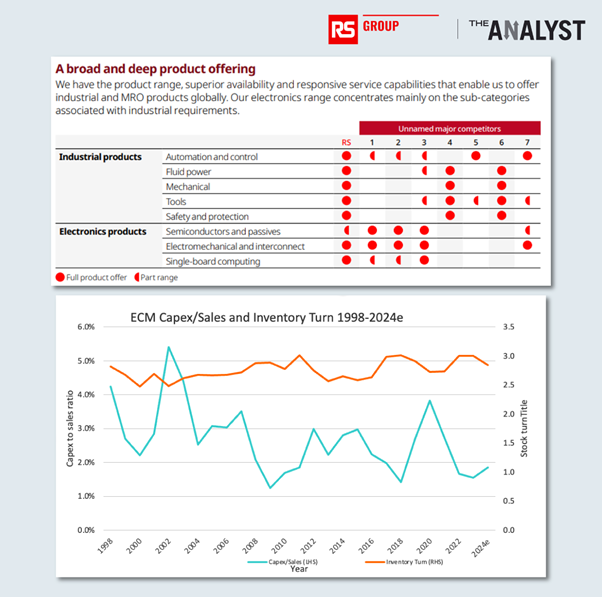

- RS Group’s business model is based on having the broadest range in the industry and delivering products on time, usually same, or next, day. This means inventory of £616m (FY’23) turns 2.6x per year, slowly because the long tail must be available, and RS need to offer products globally with service support capability. >750,000 products are stocked from >2,500 suppliers, for 1.2m customers. Range has been expanding.

- If a customer needs a widget (e.g. semiconductor, power pack, PCB board) to build a design in the lab tomorrow, they order from RS expecting immediate availability and on-time delivery, with price consideration an afterthought.

- If a production line breaks down and a new component is needed to get things restarted, the maintenance manager expects RS to have that component at hand (e.g. a Schneider or Siemens motor), whilst cost of downtime starts climbing if there is a delay, or no availability.

- The market is large and fragmented. RS estimate a >£470bn total distributor TAM, in which they have <1% share. Being a one-stop shop with a service support and broad range is essential as orders can be consolidated into single deliveries, products can be accessed via one channel (often customers cannot deal directly with the original supplier), the distributor can offer technical advice, key account management, and a long-term business relationship is built. These fixed costs can effectively be outsourced into the distribution channel by suppliers, RS promote the suppliers products, and get those products into every customer worldwide through fragmented channels.

- Whilst RS does have exposure to volume electronics (e.g. semiconductors, passives, and interconnectors) for production (23% of revenue), most products are not sensitive to end market production and inventory, rather being used in a maintenance, repair, or design environment. This means pricing is not transparent and a 45% gross margin on ‘commodity’ products is possible due to time-sensitive and critical nature of RS offer.

- RS Pro products are 13% of group and outgrowing at 19% like for like last year – this should become accretive to gross margins. Digital and service solutions revenue also outgrows group, and this is something we will explore in follow-up research.

The above means that returns should keep moving upwards across industrial cycles, and that scale benefits feed back into better returns.

Exhibit 3: Range Drives Slow Inventory Turn in Low Capex/Sales Model

Source: RS Group Annual Report 2023 (LHS), financials published (RHS)

Further M&A Likely

We are attracted to a prospective M&A strategy at RS but review of recent acquisitions raises some initial concerns that RS acquired peak earnings at the wrong time. Needlers, for example, acquired in Dec’20, saw revenue and profits decline post acquisition as sales of PPE and safety products dropped (see exhibit 4), although the company said on our call that excess earnings were carved out of the multiple.

The company also appears underweight North America with a tiny market share, that is unlikely yet to make them critical to suppliers, for market access. Synovos, acquired for £101m in Jan’21 was an integrated supply solutions platform, managing client spend and should provide an opportunity for cross-selling and expanding RS PRO participation. We would like to follow-up on how Synovos has performed since acquisition because private-label and own solutions are still a negligible part of RS’s Americas business. We understand RS sells to further wholesalers, and lots of small clients, and the market position may need further investment.

Deals made in recent months (Distrelec and Risoul) appear to be very complementary, accretive, and expanding RS group product and geographical reach. Again, we would initially be concerned these were bought near the peak of an industrial cycle as RS Group recent reports show the slowdown in growth as supply-chains ease.

Exhibit 4: Needlers Acquisition During PPE Covid Boom

Source: Needlers Limited Companies House

Trends described above point to consolidation in the fragmented market and this is also why private-equity can show interest in the space.

Suppliers want fewer partners, customers want one-stop shop. RS now enters this new phase under fresh CEO Simon Pryce. Earnings may be normalising after the post-COVID boom but M&A has commenced. In 2020, the company opportunistically raised £176m equity for M&A, buying Synovos and Needlers.

RS was effectively debt-free again by Mar’22 and >£500m has subsequently been spent this year on two large deals; RIsoul, and Distrelec. We believe earnings accretion from these deals will push EPS higher, but pull down ROIC slightly. We are initially concerned that these deals may have some backlog to unwind and they were acquired towards the end of a strong cycle with product shortages. However, the multiples are low and deals easily funded from cash flows.

In the last three years RS has announced £680m deals (compared to £520m free cash flow generated), as follows:

- Distrelec (Apr’23): Biggest deal so far at £320m (€365m) consideration, 1.4x sales and 11x EBIT pre-synergies. Assuming half synergy capture and some working capital consolidation, final multiple should be <10x. earnings accretive, margin netural, and adding MRO and industrial products to European presence (DACH revenue +40%, Scandinavia +80%).

- Risoul (Jan’23): £233m deal for the largest Rockwell distributor in Mexico with Rockwell Automation products representing 70% of revenue. High revenue multiple of 1.7x paid and 12x EBIT pre-synergies but the company flagged <10x multiple with synergies within 3-years. Earnings accretive, complementary geography and strong strategic supply partnership.

- Synovos, Needlers & Liscombe: Synovos managed $500m of client procurement spend in the Americas with supply solution product, acquired for £101m, and Needlers/Liscombe present in protection equipment and safety products, both acquired for combined £54m in 2020/21. These three acquisitions were bought at 1.2x sales – the EBIT multiple is harder to ascertain with low disclosure in the year and earnings impacted by COVID. The three deals together were described alongside the equity raise.

- Domnick Hunter (Jun’22): A small deal in Thailand with compression, filtration and purification products. £4m, <1x revenue.

Earnings Algo

Further expansion of technical services, private-label and web channels should support stready gross margin expansion, and we estimate RS Group should keep outgrowing the market across cycles as they take share in a massive TAM. The benefits of using distribution drive outsourcing decisions.

- We believe RS Group should be able to grow 2x industrial GDP as outsourcing and market share gains compound to larger players, broader range and more customers should feed a flywheel whereby the big get bigger in distribution. The company can then benefit from operating leverage at high ROIC, and spend residual free cash flow of £150m (post dividends) to acquire to expand market reach and product offer at high levels of earnings accretion.

- With 8% compound organic earnings growth (4% top-line), 2-3% M&A growth, and a 3% dividend yield, investors can enjoy a 13% annual TSR.

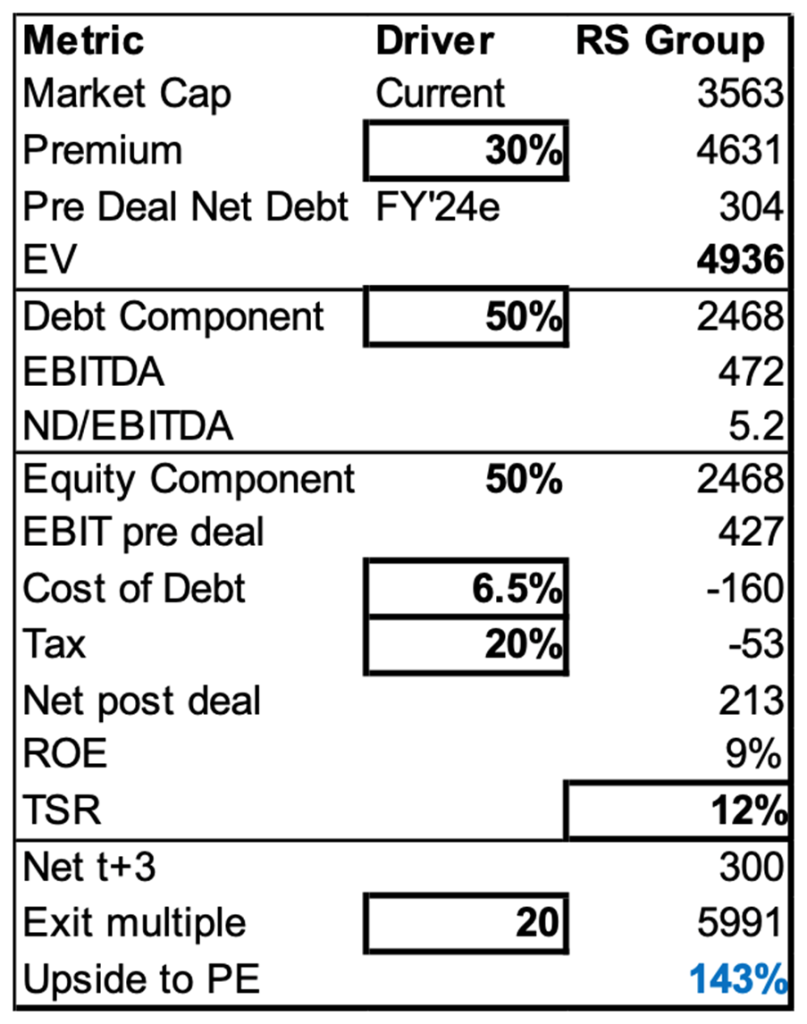

- This business profile becomes attractive for private-equity investors and larger distributors. Paying a 30% premium, a bidder could take RS out at £5bn. Assuming credit markets are conducive, the business could carry high leverage (stable ROIC and high cash conversion). At 6% debt cost and 50% debt funding, a 10% ROE could be secured on day 1.

- After three years of growth, then exit through US-listing or trade sale at 20x, we estimate a buyer could easily double their money. We see stand out examples of compounding high ROIC in distribution models at listed peers such as; Fastenal, Grainger, Bunzl, IMCD, Arrow and Avnet. These companies have all commanded >20x multiple because of the attractive financial and growth profiles, with high ROIC on cash flow reinvestment.

- >30% of profit is now generated in the Americas, so a US-listing may be premature without further M&A. However, it is possible to see RS Group following the route of Ferguson and CRH onto US markets, over time.

Exhibit 5: Private-Equity Could Potentially Double Money Taking RS Group out at 30% Premium

Source: The Analyst estimates

Key Events and Catalysts

Q2 reporting through the summer; Fastenal, Arrow, Avnet, Grainger, and broader list of electronics suppliers are available to follow.

RS Group report regular quarterly updates, next for Q1’24e (Apr-Jun) due in early July.

Premier Farnell, the direct peer previously listed in the UK, was acquired by Avnet in 2016 and appears to have been performing well under new ownership as part of a larger, global group.

New CEO, Simon Pryce was only appointed as CEO on 3rd April 2023 and presented his preliminary views at full year results in May. With time, targets need revisiting. In our opinion, revenue growth >2x the market is only 4%, may lack ambition, and the ROCE was reported at 31% last year compared to a historic goal of >20%.

Conclusion

We considered adding RS Group to our Buy list, but are concerned there may be more cyclical headwinds in the coming months, and there is risk of margin normalisation as supply chain constraints have eased, coupled with some questions we have raised on M&A.

The stock is cheap, to a large extent pricing in earnings downgrades, but it may be too early to get overly excited.

We continue our work, looking for conviction and upside.

Please note: We have No Current Recommendation on any stocks referenced in this research, unless otherwise mentioned.