Recommendation: NCR

NOK 23

$30m

N/A

NOK 28bn

N/A

NEL NO

Investment Thesis

- Nel appears wildly overvalued (49x FY’20e consensus sales), with several accounting and corporate governance amber flags. Nel invests in its customers, including Nikola and Everfuel, which arguably puts to question its claimed technology leadership.

- Hydrogen is considered a potential green fuel alternative to hydrocarbon-based fuels. Multiple governments are considering green hydrogen as part of their commitment to Net Zero by 2050.

- Green hydrogen is uneconomical for most use cases at current capex and opex (electricity prices), but governments are keen to subsidise and invest in building green hydrogen production capacity.

- However, we believe the ESG story, growth momentum, and a large net cash position would make this a dangerous short for now.

Green hydrogen stocks look like an ESG bubble, with lofty valuations in a nascent industry which is unsustainable without subsidies or incentives. A large proportion of the manufacturing is manual due to lack of scale and the companies (Nel, ITM Power, Ballard, Plug Power, McPhy, Nikola etc.) are deeply loss-making (source: Sentieo). Nel is the one stock that appears most overvalued and the one we have the greatest concerns over due to its customer relationships, lack of an industrial partner, and older technology. However, the positive momentum in ESG stocks worldwide, a large cash position, and positive newsflow on green hydrogen would make this a difficult short for now. We will monitor for an opportunity in the next two years.

Green Hydrogen

Hydrogen is an industrial gas that is placed at the centre of the global decarbonisation. Its potential as a fuel is immense – it has more than double the energy density of natural gas per kilogram. It can be used in transportation, heating, and energy storage, and produced without CO2 emissions.

- Europe currently uses 339 TWh of hydrogen (~8,600 kilotons) per annum, of which 153 TWh is used in refining, 129 TWh in ammonia, 27 TWh in methanol, and the remainder in processing, other chemicals, and for liquified hydrogen. Hydrogen consumption globally is 4,000 TWh, about 4% of global end energy and non-energy use.

- 96% of hydrogen in Europe and more than 99% globally is produced using predominantly steam methane reforming (SMR) and, to a lesser extent, coal gasification – both carbon intensive processes.

- The excitement surrounding hydrogen is the potential to use electricity from renewable sources to generate ‘green’ hydrogen utilising electrolysis, which is the splitting of water into hydrogen and oxygen. The European Hydrogen industry believes that hydrogen could provide up to 24% of total energy demand by 2050 in the EU in its ambitious scenario.

- The European Commission published its hydrogen strategy in July 2020, proposing significant targets across Europe. For example, it aims to install 6 GW of electrolyser capacity by 2024 and 40 GW of capacity in Europe by 2030.

Green hydrogen is the term used for hydrogen production using low-carbon intensity methods, the main one being electrolysis. Electrolysis is the process of splitting water using electricity, which can be derived purely from renewable sources. The major cost (50-80% depending on the load factor) is the price of electricity. Around 50 kWh of electricity is required to produce 1kg of hydrogen (lower heating value of 33 kWh) at a 66% electrical efficiency. A MW of (alkaline) electrolyser currently costs around $800k.

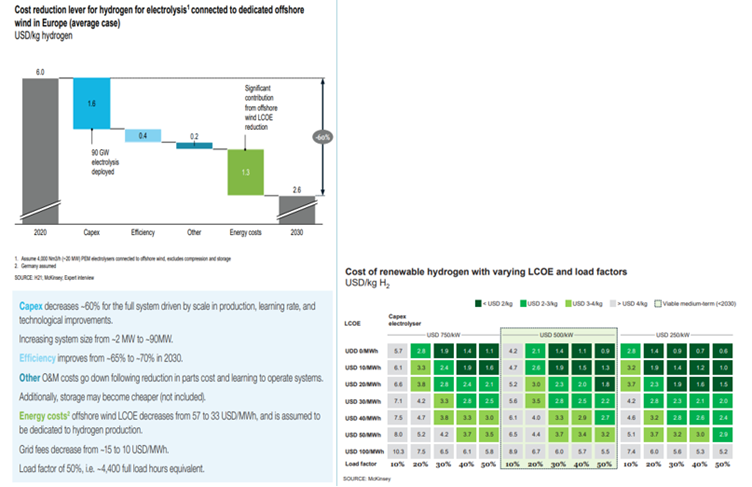

There is the potential for hydrogen consumption to 7-8x in 35 years driven by several use cases. Hydrogen is the only low-carbon feedstock alternative for industries such as steel. It can also be used as a fuel for transportation, heating homes, and energy storage. However, the economic demand for most use cases only makes sense below $3/kg, which is far above the current cost of green hydrogen generation, which is closer to $6-8/kg. Current production costs of grey hydrogen are €1-2/kg. To compete with SMR, the break-even electricity cost would be $11/MWh, or $25/MWh if SMR is coupled with carbon capture and storage.

The high sensitivity to electricity costs is bullish as solar and wind LCOE continues to fall, according to Lazard. Hydrogen can solve one of the major concerns around renewables which is their lack of dispatch characteristics of conventional fuels. Electrolysers can be used to take excess renewable power generated, storing it either in the gas grid or in salt caverns for use in peak demand or when neither wind nor solar power is available. The ranges of opportunity for green hydrogen are estimated to be between 8 and 58 EJ, which would require 600 – 4,600 GW of electrolyser at a 40% load factor. However, demand for hydrogen beyond current applications is highly uncertain. A large portion depends on large-scale infrastructure investments; for example, gas pipelines, port infrastructure, renewable energy plants, fuelling stations, and caverns for storage. Some of these require localised testing (as is happening in the UK, Australia, and elsewhere) to determine whether it is viable from a financial, technical, and safety point of view. Green hydrogen also competes with blue hydrogen, which is produced using SMR combined with carbon capture and storage, which costs approximately $2-3/kg. These challenges need to be overcome and will require significant government support in order for green hydrogen to become the energy vector of the future.

Nel – Overvalued but Lacking Catalysts in the Short Term

Nel is a Norwegian listed manufacturer of electrolysers and fuelling stations. We think Nel is one of the most hyped stocks, with significant trading on Tradegate and Avanza, two retail-focused platforms. Nel hits numerous criteria that we believe would make it a good short.

- Green hydrogen’s path to mainstream relies on Nel’s product prices declining 50-60% over the next decade and levelised costs of electricity falling below $0.03/kWh versus $0.097/kWh, the global industry average in 2018. Any scale efficiencies need to be passed on to customers.

- The Norwegian core is a company that came out of bankruptcy with a key patent having expired in 2016. Most of the growth has come from two acquisitions – Proton OnSite in the US (emerged from bankruptcy in 2007) and H2 Logic in Denmark.

- Nel is primarily a heavy capital goods company – even with a large TAM, we expect Nel to generate low double-digit EBITDA margins at best. Nel manufactures and installs the balance of plant, which we think is a lower margin business in which Nel is significantly disadvantaged compared to large peers such as Air Liquide or Linde.

- Despite a significant pipeline of electrolyser projects announced globally, Nel’s largest purchase order in the backlog is from Nikola, an R&D company with no revenue from external customers and facing an examination from the SEC into fraud allegations.

- Current management is from REC Solar, a Norwegian solar panel manufacturer that listed in the late 2000s and later went through a restructuring as prices for panels collapsed. We believe the electrolyser industry could face similar pricing pressure.

- Nel is heavily investing in expanding its alkaline electrolyser capacity, which we believe is the least differentiated technology, with first commercial applications in the generation of chlorine gas beginning in 1892. The list of competitors is large and growing, including Siemens, Cummins, ITM Power, Thyssenkrupp, and Chinese players. Competing technologies such as solid oxide electrolyser cell (SOEC), Proton Exchange Membrane (PEM), and others could be winners.

- Numerous customers within Nel Fuelling are JVs partially funded by Nel including the installation and operation of hydrogen refuelling stations (HRS) in Norway, one of which exploded.

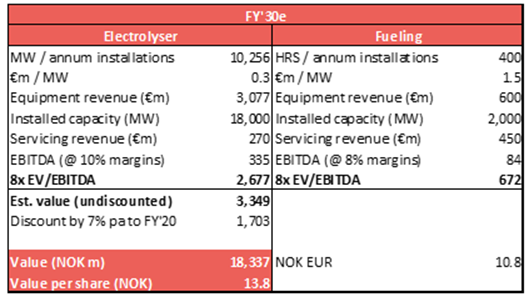

- The company is deeply loss-making, with NOK 516m of LTM revenue and negative NOK 254m of LTM EBITDA. We believe Nel could be worth €1.7bn or NOK 14 per share based on an ‘optimistic’ FY’30e hydrogen scenario, with Nel capturing 30% market share, and 10% EBITDA margins at maturity. We think the downside case may be materially lower.

Shorting today risks running into a wall of positive news, whilst concerns such as the competitive environment, sustainable demand, and profitability at maturity may not materialise for a few years.

- The announced government plans in terms of green hydrogen production capacity are 10x where we are today. It is possible that Nel is selected for some of the planned 100 MW+ projects, which would boost the shares.

- Major countries like the UK and the US have yet to announce their plans on hydrogen. The US president-elect Joe Biden and the UK government have shown strong support for decarbonisation, with hydrogen potentially being one of the key elements.

- Nel’s alkaline electrolysis technology is most mature, with a proven track record of reliability and efficiency. This may end up being the deciding factor in the short term.

- Nel could be subject to M&A from oil majors who have stated their ambitions to become net zero businesses, such as Shell and BP.

- Nel finished Q3’20 with NOK 2.5bn net cash on the balance sheet, ruling out any imminent balance sheet event.

Therefore, we do not believe today is an opportune time to short the stock.

Nel’s History – Bankruptcies and H2 Logic

Nel has beginnings in 1927 as part of Norsk Hydro. However, the Nel today is a product of a bankruptcy in 2013. Nel Hydrogen had incurred significant claims and liabilities associated with three major projects the company worked on at the time and the company found it had unlimited liabilities on two of the projects going forward.

The company became listed through a reverse merger into a biotech company called Diagenic ASA after renegotiating the problematic contracts and halving its employee count from 40 to 20. Nel specialised in atmospheric electrolysis, a two century-old chemical process which splits water using electricity. One of the key technologies that Nel patented in the production of electrolysers had its patent expire in 2015 in Norway and in 2016 in other countries.

Nel later acquired two more hydrogen fuel-related technology companies – H2 Logic in Denmark in 2015 and Proton OnSite in the US in 2017. H2 Logic is a supplier of HRS, which was acquired for NOK 300m. Proton OnSite focuses on the development of PEM electrolysers and was acquired for NOK 585.2m ($70m). Founders of Proton OnSite and H2 Logic sold the majority of remaining shareholding to Nel in June 2019 at NOK 7.47 per share after their lock-up period was cut short.

Nel generates 56% of its revenue and other income from sales and the installation of electrolyser plants; the other 44% comes from hydrogen fuelling stations. The company has increasing EBITDA losses due to ongoing investments into product and engineering, with 52 employees working in R&D, of which 19 are in electrolysers and 33 are in fuelling.

Electrolyser – Ambitious Expansion

Nel has three productions sites. Both the alkaline and PEM electrolyser production annual capacity is 40 MW. The Danish facility for its fuelling business can produce up to 300 hydrogen refuelling stations. We believe Nel’s alkaline electrolyser business has been close to flat for the past three years despite an almost doubling of capacity in 2018 from 25 MW to 40 MW, as indicated by the accounts of Nel Hydrogen Electrolyser AS in Norway and the pro forma growth disclosures of the group. To accelerate its growth, Nel is investing in a significant expansion of its alkaline capacity. We have three main concerns about the investments.

- Uncertainty in the timeline. The project has been delayed several times with increasing capacity promises (explained below). It remains to be seen whether Nel can execute on this and improve its profitability profile.

- Alkaline vs PEM. Alkaline electrolyser’s main advantage is cost which may be temporary according to various industry reports. PEM has more flexibility, lower physical footprint, does not use a caustic solution, and has higher efficiency producing hydrogen at high pressure.

- Oversupply and potential overreliance on Nikola. Electrolyser production capacity is increasing rapidly with a number of pure players and large industrials announcing expansion. Nel has stated many times that Nikola is a key customer at the new plant.

Investors Have Been Asked to Wait

Nel announced that it is considering expanding its alkaline electrolyser capacity to 250 MW in Q4’17, with an option to expand to multi GW to accommodate an order from Nikola. It estimated the costs to be NOK 150m. The company originally wanted to expand its Notodden facility (pictured below, February 2020) and Nel purchased the building next door to its existing plant.

Nel upgraded its expansion guidance to 340 MW and told investors it would be operational by early 2020. In August 2019, Nel announced that it secured a separate location for the expansion in Heroya Industrial Park. By August 2020, the company upgraded its guidance for the size of the plant to 500 MW with a potential to expand to 2 GW in the same building. However, the ramp-up date has been moved to Q3’21, with significant investments still to be made according to the Q2’20 earnings call.

The company increased its guidance on 05 November 2020 for the investments to NOK 250m. The scale-up and automation of production is crucial to the investment thesis as the company is significantly loss-making (negative NOK 254m EBITDA versus NOK 516m of revenue) and burns through NOK ~100m of cash per quarter. It is aiming for more than a 30% cost reduction due to semi-automation of the manufacturing (Prospectus).

Exhibit 3: Planned Expansion Site for Nel’s Alkaline Electrolyser Capacity

Source: Company Presentations (Accessed November 2020)

The building used to be an old factory of REC Wafer, a Norwegian solar industry player that filed for bankruptcy in 2011. It was later taken over by ChemChina and combined into Elkem Solar. Ole Enger, current chairman of Nel, is the ex-CEO of Elkem Solar. A number of ex-employees of REC Group have made it into Nel’s management or board, including Jon Andre Lokke, CEO, Kjell Bjornsen, CFO, and Anders Soreng, CTO. We are concerned that management may be repeating mistakes of the past – ‘rapid capacity expansion into an industry hampered by excess investments, overcapacity, and poor profitability’.

Alkaline Is Cheaper but PEM Is More Flexible

Alkaline is the oldest and hence the most commercial option right now with the lowest capex per MW. However, we believe PEM is more attractive for the following reasons.

- Lower start up and shut down time means that PEM is better adapted to intermittent power sources such as solar and wind.

- Higher electric current density leads to smaller form factors and higher efficiency.

- Works at higher pressure which is necessary for pipelines and is beneficial for other uses, such as in the chemical industry, underground storage, and refuelling stations. Alkaline electrolysers require a separate mechanical compressor which adds to balance of plant costs.

- The difference in cost is likely to shrink over time as manufacturing is scaled. ITM claims to have already halved costs over the past three to four years (source: call with CEO on 06 November 2020).

- Recent project announcements and discussions have favoured PEM electrolysers, including the recent bids for hydrogen infrastructure in California.

Oversupply Possible in Next Few Years

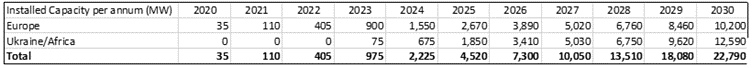

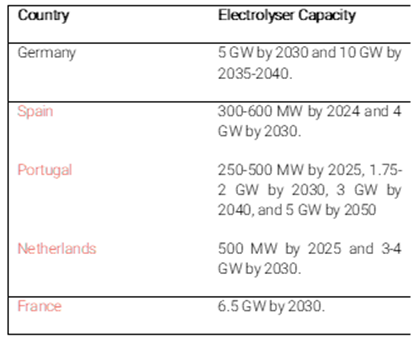

Hydrogen Europe, an industry and trade association, has mapped out the following installation of electrolyser capacity by 2030 in line with the European Hydrogen strategy (2×40 GW). This is so far the most established government strategy for green hydrogen in our opinion.

The IEA hydrogen project database (updated June 2020) only sees cumulative global (ex-China) demand for electrolyser of 3 GW until 2025, compared to 1 GW annual capacity currently and over 2 GW of planned capacity in the next few years.

Exhibit 5: Electrolyser Projects Announced Before June 2020

Source: IEA Database

The announced project pipeline has grown rapidly from 3.5 GW at the end of 2019 to over 15 GW by August 2020, according to Wood Mackenzie. IEEFA estimates share similar estimates, although notes that 34 out of 50 largest announced projects so far are either in study or memorandum of understanding phases, which means that not every project will be commissioned and there is a possibility of delays. Several European countries have unveiled individual targets for electrolyser capacity, summarised in Exhibit 6.

Exhibit 6: Electrolyser Capacity Targets by European Countries

Source: National Hydrogen Strategies (Accessed November 2020)

We believe that without additional GW demand orders from Nikola (which are highly uncertain in our opinion), Nel’s expansion plans could result in significant oversupply and underutilisation. For example, we believe that the capacity for electrolyser production could exceed 4 GW as soon as 2022.

- Thyssenkrupp already has 1 GW of electrolyser capacity in cooperation with De Nora. Thyssenkrupp has recently signed a strategic cooperation agreement with Air Products, a leader in onsite hydrogen production, on large-scale electrolysis plants. Air Products will build and own the plants using Thyssenkrupp’s engineering, equipment, and technical services.

- ITM Power is expanding its Sheffield facility for capacity of up to 1 GW (opening Q4 2020).

- Plug Power is building a ‘gigafactory’ capable of producing 500 MW of electrolysers and 60,000 fuel cells per year. It expects to start production in mid-2021.

- Cummins, which acquired Hydrogenics, is building out the world’s largest PEM electrolyser in the world (20 MW) and partnering with Air Liquide. In a recent conference, the company mentioned an increasing visibility into electrolyser projects and increasing its investment in related R&D.

- The available capacity in China is unclear. However, BloombergNEF reported that China has been supplying electrolysers at prices as low as $200/kW, which is a 60-80% discount compared to Western peers. ITM Power’s CEO suggested we should be sceptical of the claim on call with us on 06 November 2020, specifying that the $200/kW figure may refer only to the stack rather than the total system, which is likely higher than $600/kW. We believe a significant player is Tianjin Mainland Hydrogen Equipment (THE), which supplies through HydrogenPro into Europe and US. There are eight other Chinese competitors.

- Siemens Energy, the recent spin-off from Siemens, plans to continue investing into its hydrogen portfolio having launched its first MW production solution in China, and will be supplying a 6 MW electrolyser system in Bavaria, Germany using its PEM modular solution available.

- Belgian John Cockerill recently formed a JV with Suzhou Jingli Hydrogen to open a 18,000 m2 electrolyser production centre in China capable of producing 350 MW of electrolysers annually.

Oversupply in a capital-intensive industry would mean that Nel continues to lose money despite substantial growth in volume, as pricing would remain subdued. We would not expect pricing to improve until the market consolidates, just like in wind and solar before it.

Fuelling – Chicken and Egg Problem

Demand for stations is growing as countries are setting targets and aspirations for the number of full cell electrical vehicles (FCEVs). Nel faces tough competition here as well from both large industrials and other hydrogen hyped players. We believe there are more barriers to demand in hydrogen refuelling stations for three reasons. Firstly, the total cost of ownership of consumer FCEVs is significantly higher than battery electric and combustion engine cars. Secondly, to incentivise auto manufacturers into investing in lowering the upfront cost of FCEVs, governments need to subsidise refuelling infrastructure. However, part of the high refuelling cost ($16/kg at the nozzle in California, versus $4-7/kg where it becomes competitive with ICE vehicles) is the low utilisation of these stations and their small scale, which makes the relevant delivery infrastructure expensive. The chicken and egg problem will be difficult to solve especially with the popularity of battery electric vehicles (BEVs). The positive angle for hydrogen in transport is its potential in heavy duty vehicles (HDVs) where an electric battery would most likely be too expensive and heavy to be economical. However, the total cost of ownership (TCO) for HDVs is much more sensitive to the cost of fuel.

Competition Is There

There are several competitors in refuelling. Air Liquide (120 stations installed to date) has significant global participation due to its expertise as a leading industrial gas company. We have seen Air Liquide compete with Nel in Germany, South Korea, and California. We think Air Liquide’s manufacturing scale, its distribution network, and expertise in gas supply could help it extract more value from contracts than Nel. Nevertheless, Nel is one of the leaders with significant market share in Europe.

There are smaller pure players such as Atawey – a small French supplier and part of the MAT consortium, is supplying 14 HRS in France, and McPhy, selected to supply five large hydrogen stations. The project is funded by Michelin as part of its investment in Hympulsion. In the US, the listed Plug Power is building 35 fuelling stations in 2020. Although Nel supplied Shell’s previously installed hydrogen refuelling stations in California, it has yet to confirm whether it will be supplying Shell’s next 51 station upgrades. Instead, Nel appears to be instead supplying a competitor, Iwatani.

Fuelling Division Makes Meaningful Investments in Customers

There are several instances of Nel funding its customers through associate or JV structures. We think Nel could be investing in these companies to support its top line growth which is crucial to investors at this stage of the company’s lifecycle. We are less concerned with the bottom-line impact since the company is deeply loss-making.

- Uno X Hydrogen – a joint venture between Uno-X Norge AS, Praxair Norge AS, and Nel. Nel had invested NOK 20m into the JV and loaned an additional NOK 5m. Nel received purchase orders worth €4m in 2018 alone. One of the stations under this JV exploded due to an incorrectly installed plug. Nel later took ownership of the JV whilst Uno-X took ownership of the two stations (Asane and Hvam). Upon taking full ownership, Nel reversed an impairment of its loan to the JV and recognised the revenue from the contract liability on its balance sheet. It is unclear whether any liabilities remain.

- Everfuel – initially established as a Nel subsidiary, 80% of the ownership was sold to Jacob Krogsgaard, an ex-Nel employee and founder of H2 Logic, its hydrogen subsidiary. To finance his involvement, Krogsgaard sold 43m out of 70m shareholding in Nel. Nel and Everfuel signed an exclusive equipment sales and service agreement with a potential value of up €100m. We wonder how good of a deal this is for existing shareholders. Everfuel was recently listed on the Merkur market with investment from Saga Tankers, a previous shareholder in Nel. Soon after, Everfuel acquired two fuelling stations from Uno-X, which was supplied by Nel. In its 2019 annual report, Nel stated there are material transactions between itself and Everfuel Europe A/S.

- Danish Hydrogen Fuel – Nel has delivered four stations to this JV so far.

- HyNet Korea – Nel invested NOK 7.8m into a Korean joint venture between 13 industrials building hydrogen refuelling stations in South Korea. Nel has received three purchase orders from HyNet for five stations worth €10.6m (~NOK 110m).

- Nikola – Nel invested $5m of proceeds from its own capital raise into Nikola’s series C in June 2018. The relationship has been at the forefront of Nel’s filings but is yet to translate to material financial upside for Nel.

Nikola

In our opinion, the elephant in the room for Nel is likely to be Nikola, which recently faced allegations of fraud. Nikola is mentioned 12 times in Nel’s 2019 Annual Report and 59 times in its September 2020 prospectus. There is a multi-billion NOK framework contract from 2020 through 2025 where Nel could potentially deliver 1 GW of electrolysis plus fuelling equipment. Around a quarter of the Q3’20 backlog is from Nikola. If Nikola follows through with the rollout of its HRS fleet, its orders are likely to make up a significant portion of Nel’s mid-term earnings.

We do not intend to cover Nikola nor attempt to fully corroborate Hindenburg’s research. There are several facts that makes us sceptical about Nikola’s ability to execute on establishing large scale hydrogen infrastructure and bringing FCEV trucks to commercial viability.

- Chairman and founder Trevor Milton resigned 10 days after Hindenburg’s allegations were published. Milton was ‘the source of many, if not most, of the ideas and execution driving Nikola’ according to Nikola’s Q2’20 10Q.

- Several allegations were independently confirmed by reputable newspapers such as the Financial Times and Bloomberg. Nikola is under investigation by the SEC and DOJ. Nikola and Trevor Milton received grand jury subpoenas from the U.S. Attorney’s Office for the Southern District of New York on 19 September 2020 according to its Q3’20 10Q.

- Nikola’s revenue in 2020 came solely from solar panel installation services to Milton.

Nikola does have $908m of cash remaining on its balance sheet as of 30 September 2020 with a ~$100m per quarter cash burn, thus it is still wholly possible that the company executes on at least some of its ambitions. However, we believe the collapse in the share price displays waning investor confidence and the deal with General Motors, which appears critical to Nikola’s truck manufacturing plans in the US, remains unsigned.

Valuation

In the upside case, we could see a reasonable scenario where global electrolyser installations rise to 34 GW per annum by 2030. We assume Nel can capture a 30% market share, resembling a best-in-class product and pricing. We expect pricing per MW of electrolyser to fall dramatically to €0.3m/MW as we believe that is necessary for green hydrogen to become economical at that scale. Both margins and multiples can be debated but we see it as a reasonable assumption looking at other heavy capital goods companies, in particular the historical trading ranges of Vestas.

Exhibit 7: Possible Valuation Estimate for Nel

Source: The Analyst Estimates

We believe M&A is unlikely at current valuations. Many deals in the space have occurred at much lower price tags e.g. Linde’s minority stake in ITM Power for $235m, Cummins acquisition of Hydrogenics for $290m, Plug Power acquisition of United Hydrogen Group for $65m and Giner ELX for $58m. Our view on the current valuation is clearly negative; however, we see little to drive the stock downwards.

Conclusion

Arguably, hype around green hydrogen has led to a stratospheric rise in Nel’s valuation. We believe the fundamentals are likely to weigh Nel down as it appears to lack significant differentiation, is focusing on the inferior technology, and is lacking a significant industrial partner. However, we avoid initiating a short recommendation on an ESG concept stock based on valuation alone and await a better entry point. We look for overambitious projects and guidance which could lead to execution issues to initiate a short.