Recommendation: No Current Recommendation

€160

$2m

N/A

€1.1bn

N/A

HYQ GR

Summary

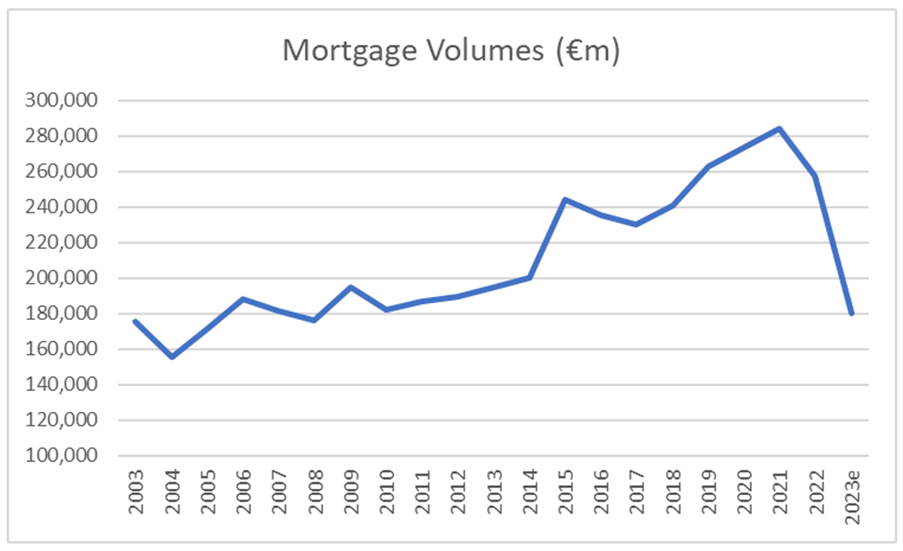

- Dominant B2B mortgage platform that currently has 33% market share in Germany, which could double over the next 5-10 years. As the market gradually moves more to an intermediary model like the UK, where ~90% of the market is done through intermediaries.

- Material earnings pool if Hypoport were to successfully disintermediate the traditional broker given so much of the value in underwriting accrues to the broker (10x the value Hypoport earn).

- Series of new disruptive verticals within Real Estate and Insurance divisions, that are currently in aggregate loss making (EBIT of -€17m in FY’22) but where the market is large and at sufficient scale economics could be attractive. Equally, if they didn’t reach commercial success, they could be closed down and EBIT would be ~€17m higher than FY’22.

Hypoport is a business we would like to have on our buy list – founder-led, a track record for innovation, strong economics, and an underpenetrated product. It has also fallen in share price by 75% since its peak a function of ‘tech multiples’ compressing and its underlying markets souring (German mortgage markets).

However, given the recent recovery in share price, the valuation is less appealing and equally its low liquidity ($2m) makes it less actionable for clients. Hence, we move the name to our library for now.

Credit Platform: Jewel in the Crown but Cyclical

Hypoport’s current jewel in the crown is the mortgage platform that is branded Europace (Deep Dive). As the names suggests, it’s a platform connecting mortgage providers with mortgage brokers, providing search functionality and help on the application process (probability of approval/document collation etc.). It is a desirable business model for several reasons:

- Europace charge ~10bps (net of pooling arrangements) on each mortgage origination. For your average German mortgage this translates to €300 (€300k mortgage) with very low marginal cost given the fixed cost of running the platform.

- Europace generates impressive +20% adj. EBIT margins in a normal mortgage environment. Although arguably the margins are understated by 50% due to pooling agreements, that are pure pass-through costs. In pooler agreements Hypoport collects the origination fee (150bps) in addition to its 10bps fee and passes 149bps back to the smaller mortgage brokers. Adjusting for these arrangements, the underlying margins (gross margin/EBIT margins) are ~40% in a normal market.

- However, this division is cyclical with revenues highly correlated with the underlying mortgage market given the transactional revenue model. Due to the sharp fall in revenues Hypoport have responded by removing overhead not just within the credit platform division, but across the group. It expects a €35-€40m annual reduction in overhead relative to Q3’22 (peak OPEX). With reduction in FTEs in some verticals, reduction in office space and scaling back of consultancy agreements.

- Historically, the credit platform has reinvested excess profits into adding functionality and seen limited margin expansion during periods of growth.

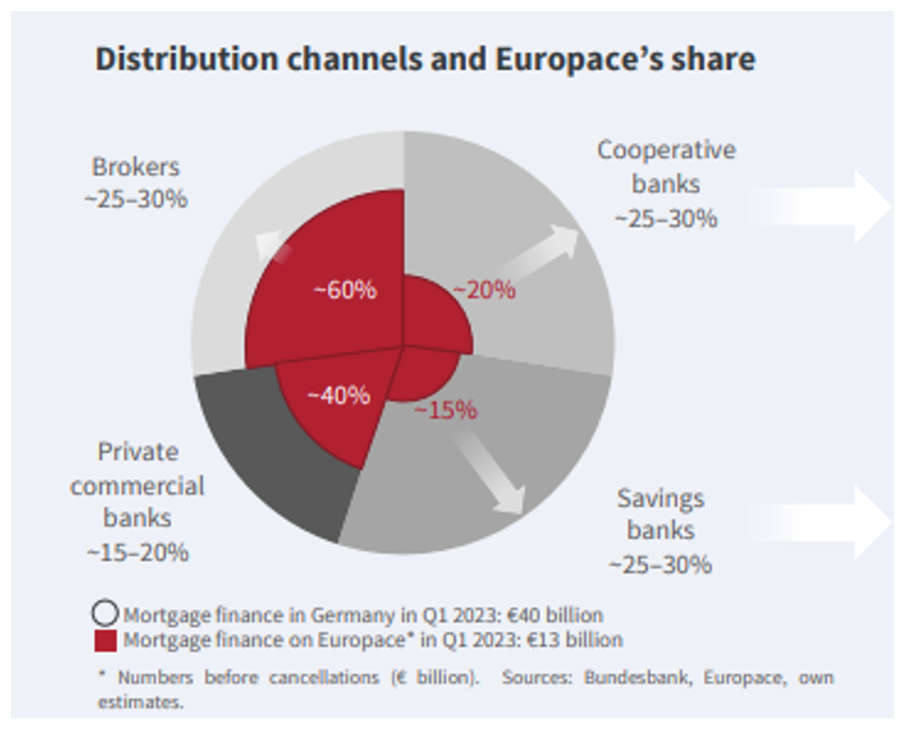

- Europace generates 33% of German mortgage volumes on the platform with 60% market share in brokers driven channels and considerably lower market share in savings bank of 15%. As the market gradually moves more to an intermediary model like the UK, where ~90% of the market is done through intermediaries, it is likely its share of the German mortgage market will only increase

Exhibit 2: Europace’s Market Share Across Distribution Verticals

Source: Hypoport Q1’23 Presentation

Pipeline of Innovation

Direct to Consumer (D2C) Offering: Game Changer?

Hypoport are continually innovating and now offers a direct to consumer (D2C) solution on a limited supply of mortgage products. Although strictly speaking it’s not a pure D2C solution, as it is still provided with the oversight of a distribution company. The borrower uses the platform and distributor steps in if problems arise.

If this solution saw widespread adoption, it could become a material profit contributor. A D2C platform has the potential to disintermediate the distributor (or at the very least the brokers) and in this case a much large share of the economics would flow to Hypoport than its current 10bps fee.

For your €300k average mortgage:

- Hypoport currently generate €300 (10bps) per mortgage originated via its credit platform.

- Distributor collects more than 10x €4.5k (150bps), a large proportion often flows through to the broking employee.

If the mortgage broker (or even the distributor) could be disintermediated a large chunk of this fee could flow to Hypoport at likely very high margins. Although in its current form, the mortgage process is still supervised through a distributor and Hypoport generates 35 bps on originated volumes (3.5x its current fee), with the rest of the fee flowing to the distributor.

There are multiple hurdles to overcome to increase adoption:

- Regulators are not keen on the idea of mortgages originating without an advisor explaining the process/risks etc.

- Current customers are the distributors, that would be hard to disintermediate completely given they’re Hypoport’s core customer.

Insurance Platform: Market Big but Platform Adoption Slow

- German insurance market is comparable in since to the German mortgage market with €224bn of annual net premiums.

- Hypoport’s solution (Smart Insur) connect insurance suppliers with distribution (intermediaries, banks, poolers) and offer an administrative platform for the ongoing administration for policies.

- At the moment its subscale and hence generates negative EBIT (EBIT of -€5m, €1m of EBITDA, FY’22)

- But it is not hard to build a case that if Hypoport succeeded in winning market share the economics could be comparable to the credit platform given the value in aggregating suppliers and providing admin functions to distributors.

Real Estate Platform:

- With the real estate segment there are several core products, each operating in niche markets, designed to save costs/administrative burden to brokers and property management:

- FIO

- Value

- Klein Wowi

- Again in aggregate the real estate platforms are loss making (-€12m EBIT €-4.5m EBITDA, FY’22)

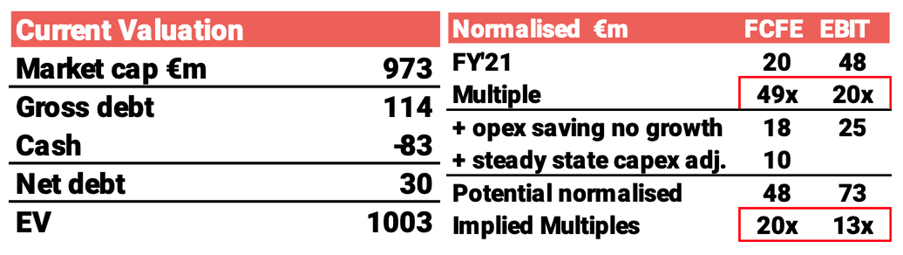

Valuation

We believe the market will return to volumes of +€250bn. Based on this and our view on underlying earnings, the stock looks reasonably priced at ~20x normalised FCFE; although arguably if one of the several new revenue lines starts to gain momentum or the mortgage market returns to growth from the prior peak the stock would likely double from here.

We make the below adjustments to derive our normalised FCFE/EBIT.

- Cost savings on operational costs if Hypoport were to reach steady stop and cut innovation. We estimate €25m which is the equivalent of just under 15% of the FY’21 personnel.

- Reduce intangible capex to reflect a lower need for growth capex; ~5% of personnel as mostly capitalised wages

Exhibit 3: Hypoport’s Current Valuation

Source: The Analyst Estimates

Accounting

Hypoport’s accounting is relatively clean although a few areas to highlight:

- Capex vs. intangible amortisation has always had a large gap, that potentially overstate reported earnings vs. historic level:

- Over the last couple years amortisation of intangibles has been on average ~€20m less than capex.

- If one was to treat this purely as opex, as it is largely capitalised staff costs, it would materially reduce analyst’s adjusted earnings.

- Although arguably a large proportion of this should be considered growth capex, rather than maintenance capex given the innovation ongoing within Hypoport.

- Large hold company charges (€20m):

- Stayed consistent as % of revenue so unlikely to be hiding margin pressure.

- But could be argued a proportion of this should be allocated to individual segments, reducing reported segmented margins.

- Working capital swings/other liabilities:

- Quarterly large swings in receivables. Although sales outstanding have reduced over the last five years, so less of an issue.

- €32m of earn-out liabilities remain to be paid (non-current)

Conclusion

Hypoport is an interesting potential buy idea, but given the recent recovery in share price, the valuation is less appealing and equally its low liquidity makes it less actionable for clients.

Please note: We have No Current Recommendation on any stocks referenced in this research, unless otherwise mentioned.