Recommendation: Short (Initiation of Coverage)

€--

$20m

€--

€6.5bn

~50%

AG1 GY

Investment Thesis

- Overhyped used car dealer. Shares overpriced on market belief it will be a scalable digital platform, and is a ‘de facto’ winner.

- Increase in capital-intensity likely, which could pressure returns and balance sheet. Long-term economics, in our opinion, could be less attractive than expected.

- Intense competition likely due to low barriers to entry and massive private capital flows into the space.

- Some risk to near-term earnings expectations given marketing and cost investments and European used car environment.

Shorting growth companies can be challenging, but we see the loss-making position of Auto1 and the capital cycle in the space as supportive of the Short idea. In food delivery (JustEat) and, to some extent, in online grocery (Ocado), we have seen how aggressive private capital can damage returns and investor perception. In addition to the competition points, we are unconvinced that the economic profile of the business model will support the current valuation.

The idea is actionable for clients today because it is liquid, there is low short interest, potentially significant downside, and possible near-term catalysts. Risks on the short include the strong top-line growth and tailwind of structural shift of car retailing into online channels. We do not note any major red flags on accounting or governance.

What is Auto1?

- This year they will trade ~600k cars across Europe, primarily buying from consumers (~400 drop-off and inspection centres), reselling to dealers in their merchant division (wirkaufendeinauto.de and auto1.com) and retailing to consumers online in the smaller, but fast growing, Autohero business (~40k cars in FY’21e).

- FY’21e revenue guidance is ~€4-4.4bn revenue, with an EBITDA loss of -2.5-3% of sales. The business currently operates at a ~9% gross margin and will spend ~5% of sales in marketing this year.

- Long-term, Auto1 targets 2-2.5m cars sold p.a., a 10% share of the European used car market, and a mid-to high-single-digit adjusted EBITDA margin.

Exhibit 1: Overview of Auto1 and Autohero Business Model and Operations

Source: Auto1 Investor Materials

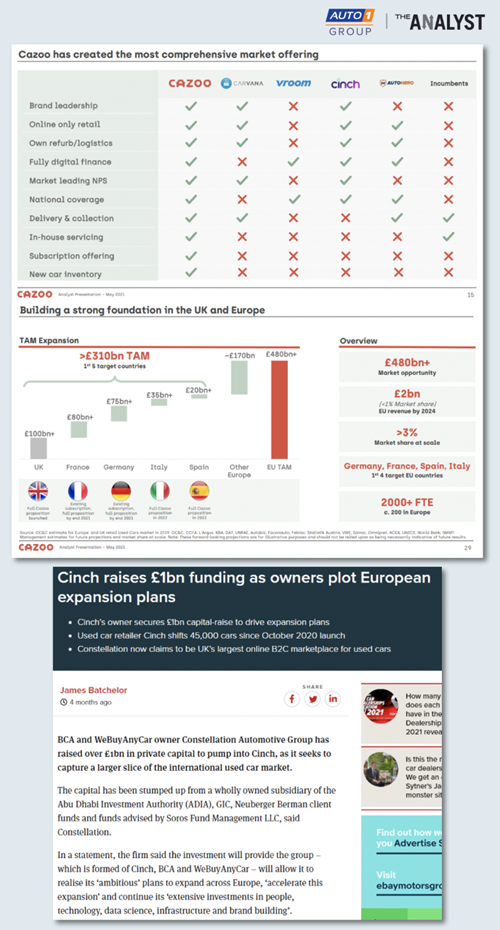

Everyone Wants to be the Next Carvana

Scalable Digital Platform Unlikely

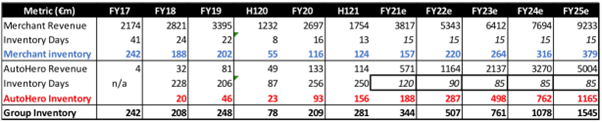

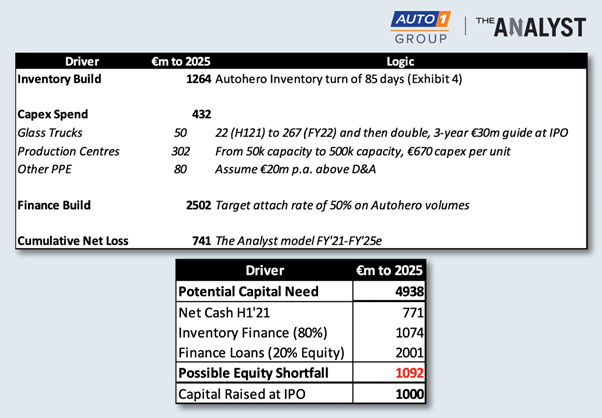

- Inventory-carrying: Auto1 carried €280m group inventory at H1’21. The inventory turn in the Merchant division is rapid at ~15 days (the company aims to sell 70% of cars in 7 days), which reduces car price risks. However, competition may drive more risk-taking on inventory as more options need to be offered to attract customers, and the growth in Autohero will drive levels significantly higher, because it has 80-85 days inventory. As discussed later in this note, we expect a build of >€1bn inventory. At the IPO, the company guided that 85% (medium-term) can be primarily funded through securitisation programs (non-recourse financing).

- Production centres: On 10th September, the company confirmed the strategic decision to open in-house production centres for the purpose of reconditioning used cars. The first site at Hemau, Bavaria, has capacity for 16k vehicles per year. 50k total capacity is being signed as per H1’21 report, with 150-200k projected to be in the next six months. Beyond this, 500k+ is being screened across nine markets. The company guides to €80m capex for production centres, or €670/unit on 120k capacity (Source: IR call). At ~500k capacity, total capex requirements could reach >~€300m. Reconditioning used cars should be accretive to the business model, providing quality assurances and representing further vertical integration. However, it is not a differentiated digital business, and is simply what used car dealers have been doing for decades.

- Glass trucks: Auto1 had only 42 trucks on the road at H1’21, and will grow this fleet to 143 at year-end. Glass trucks have a dual purpose; providing a delivery service to delight customers, and marketing benefits on brand awareness. 267 have been ordered, expected to be on the road by 2022. We estimate Auto1 will run 50-60 trucks on average in FY’21e, doing delivery on 25% of Autohero volumes (~10,000 cars). This means one glass truck does on average ~180 deliveries p.a. At a 25% delivery rate, for every 100,000 of additional auto volume at Autohero, we estimate Auto1 will need another ~100-150 trucks, which will drive capital-intensity and logistics costs higher. Using glass trucks benefits brand recognition and customer service, which means logistics may come in-house despite the potential cost disadvantages relative to outsourcing.

- Collection and inspection network: Auto1 has >400 drop-off locations for sourcing cars from consumers looking to sell their used car. The company guides for limited growth in this network, given they already established European coverage, but there is some capital and fixed cost associated with this footprint. Collection centres and production facilities generate lease liabilities. Auto1 has ~€20m of annual lease payments, which are excluded in their guidance of adjusted EBITDA. This is another -0.5% of operating margin cost, in addition to the current financial guidance of EBITDA losses in the range of -2.5-3% for FY’21e. As the physical assets grow, so will lease costs.

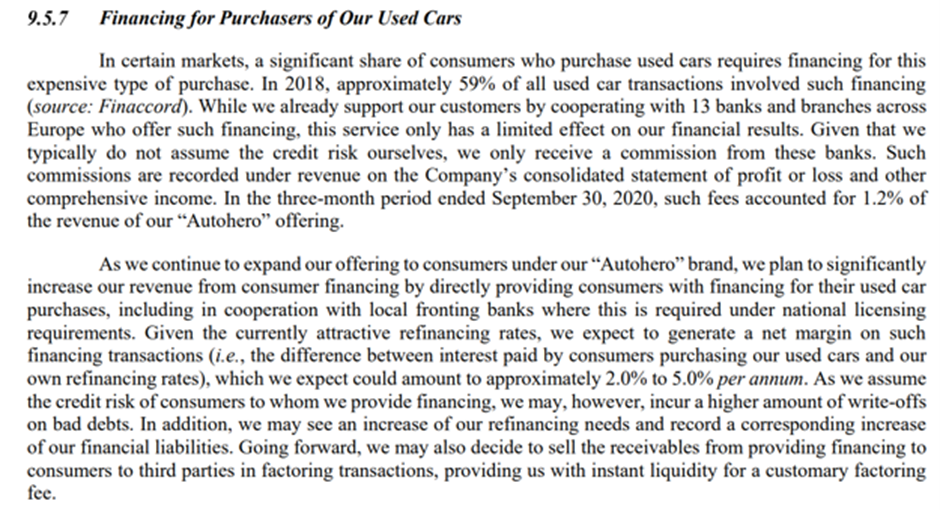

- Finance book: One element of the growth story is the potential to add financing to the used car sale, adding addressable market and gross profit per car (GPU). Auto1’s ambitions are clear, with financing already offered in Germany. At H1’21, the loan portfolio was only ~€15m (Source: IR call), covering ~1,000 cars at a 40% attach rate in Autohero. This could become substantial, driving higher gross profit per unit through financing income, but also driving balance sheet size, and turning Auto1 into a bank. The target is a 50% attach rate across Europe (Source: IR), and consensus estimates are at ~140k units in Autohero in FY’23e. This translates into a loan book of up to ~€1bn at current ASPs. Whilst much of this growth can be debt-funded, or in potential banking partnerships, an equity component may be needed and it is unclear whether investors would pay the same price/book multiple for a bank, as a digital auto retail platform. We do note Carvana’s success in providing pre-qualified loans regardless of credit score.

Intense Competition?

- In Europe, Constellation (Webuyanycar, BCA, Cinch) had been taken private at a £1.9bn valuation by TDR Capital in 2019, before raising £1bn in May’21. Constellation reports trading >1.5 million cars (mainly in the BCA auction business) and £12bn GMV. Cinch has powered growth annualising 45,000 cars eight months after launch with +45% month-on-month growth. Press reports earlier this year pegged Cinch at £5bn standalone valuation. Whilst these valuations are clearly demanding, they are used to anchor fundraising to accelerate growth and represent a clear competitive challenge to Auto1.

- Cazoo is trading with a $7bn valuation after joining the AJAX SPAC, and targets $1bn revenue in FY’21e. It listed in the US after raising $1.6bn at a £5bn valuation. Cazoo acquired Cluno, a subscription business in Germany.

Exhibit 3: The Marketing Battle Begins

Source: Source: Google images

- Auto1 has raised cumulatively >€1.3bn in equity and debt since 2016, burning ~€500m of cash pre-IPO. They are now faced with the dual challenge of competition and the expectations of shareholders in the listed entity. Cazoo and Cinch conducted the large raises outlined above, but CarNext also raised €400m to accelerate growth.

- Cazoo outline plans to lose >£300m EBITDA on the way to profitability in 2024e, whilst they generated negative GPU (gross profit per unit) in FY’20 and guide for only 8% gross margins in FY’22e.

- Autohero/Auto1 may find it challenging to match these ambitions. For example, expectations are for reducing losses next year; consensus EBITDA for FY’22e is ‘€103m, followed by -€74m in FY’23e. We believe it is possible Auto1 could lose more EBITDA next year, relative to consensus. Revenue growth may be insufficient to offset escalating costs in personnel, marketing, and logistics, alongside the cash spending on increased inventory and capex.

- According to IR, consensus has the company troughing at net cash of €400-500m, implying only ~€200-300m of cumulative losses from now to break-even.

Capital Needs Could Explode

- Inventory Build of €1-1.5bn: The merchant channel has rapid inventory turn around 15 days, but Autohero carries higher inventory (IR guide of 80-85 days) to offer choice and availability to consumers. The majority of inventory can be securitised with non-recourse debt facilities and the company can raise >80% via senior and mezzanine Notes. However, investors should be aware of relative increased capital-intensity- and inventory-risk as the business grows, and the equity component will still need funding from cash-flows.

Exhibit 4: Gross Inventory Could Grow to >€1.5bn

Source: Auto1 filings, The Analyst Estimates

- Capital Expenditure of >€400m: Auto1 started life as a business with very low fixed-asset intensity. Capex only reached a total of €20m in the first five years (FY’16-FY’20). In the IPO prospectus the company outlined €110m capex for building Autohero (€30m for 250 branded transporters and the rest for refurbishment centres). However, the company is now screening ~500k production capacity, compared to ~120k for the capex guidance. More glass trucks are needed for further growth and marketing and we identify another potential ~€300m of capex spending for Auto1 to achieve growth ambitions.

- Cumulative net losses in the P&L of >€0.5bn: Consensus forecasts cumulative EBITDA loss of only ~€200m through to break-even in FY’24e. We believe it could be larger, and the company has already increased guidance on the EBITDA loss for FY’21e.

- Potential growth in financing book of €2-2.5bn: We already discussed the potential to add financing products to the used car sale. A 50% attach rate is targeted across Europe (Source: IR), and consensus estimates are at ~140k units in Autohero in FY’23e. This translates into a loan book of up to ~€1bn at current ASPs near-term. Beyond that, Auto1’s ambitions suggest growth in Autohero revenue towards ~€5bn, which would generate ~€2-2.5bn financing size.

Exhibit 5: Capital Needs Could Become Material

Source: Auto1 filings, The Analyst estimates

Who will Pay?

Warning Signs

Exhibit 6 Push Into Autohero Pre-IPO

Source: IPO prospectus

Tech claims may be overblown: Auto1 describes itself as ‘first and foremost as a technology company’. However, tech spending is merely ~€20m pa, which is only ~5% of the company’s opex. Challenges of scale, marketing, and logistics are significant for the business, but the pure technology challenge may not be as demanding as presented. Essentially, online used car dealers need a decent website, an app, an inventory-management system, and strong data analytics. These tech functions can all be replicated, and are likely, in our view, to look similar at competitors, which means it will be hard to differentiate the business model competitively solely on tech platform offer.

Exhibit 7: Low Tech Expense Relative to Claims

Source: IPO Prospectus