Recommendation: No Current Recommendation

Price:

€14

3m ADV:

$15m

Price Target:

N/A

Market Cap:

€3bn

Forecast Return:

N/A

Ticker:

AG1 GY

Summary

- We previously issued a Short recommendation on Auto1, and continue to watch the name. We continue to see downside risks but we have no recommendation as the stock collapsed, sentiment is negative, and the business is growing.

- We visited multiple Wirkaufendeinauto.de locations, and saw evidence of how the business was exaggerated in the IPO process. We would have preferred to conduct this work last year, but travel restrictions were prohibitive.

- It is a real business, but may not yet have found a floor in share price. Merchant division possibly worth €12, but group is burning cash, and Autohero is very immature and unproven.

- Risk that volume and price gains in diesel car sourcing may be temporary.

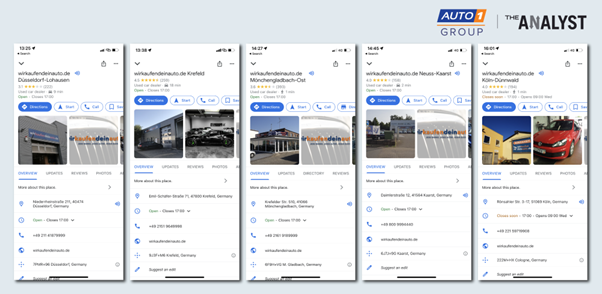

Site Visits Show Basic Locations and Many Old Diesel Cars

- Fieldwork confirms the business is real, but shows how the stock was overhyped as a digital platform in the IPO process: We saw multiple C2B locations around Dusseldorf (see Exhibit 1), confirming that the German locations exist, and the operations are material. Ideally, we would also investigate locations in Eastern Europe (e.g. Ukraine, Albania, Poland, Romania). We would also like to further understand the flow of inventory between regions. For example, are Auto1 usually buying old diesel cars in Germany to ship into lower priced markets such as Ukraine? If so, the business is less sustainable, and is simply arbitraging regional imbalances in supply, demand, and regulation.

- Auto1 has a network of >400 car inspection and collection centres across Europe, where they buy used cars from consumers through the (e.g. German) Wirkaufendeinauto.de platform.

- This inventory is turned quickly for sale to 60,000+ commercial buyers (e.g. dealers and auctions). A typical location is an out-of-town industrial park, with a large space to park cars, and a simple building where cars can be received and inspected.

- The locations were generally basic and shabby, often with plenty of old cars sitting outside, and a couple of employees only. This is a simple business, with cheap buildings just outside of city centres, allowing for easy access for customers to drop off. An attractive location is probably not necessary for the business.

- Seeing the locations really helped us understand just how the IPO had exaggerated the digital platform aspects of the business to new shareholders. Auto1 is primarily a low-margin, simple, C2B auto merchant, whereas the IPO presented it as a leading digital platform with scalable economics. The Autohero brand contributed heavily to the IPO equity story, but Autohero is not yet a substantial business.

Exhibit 1: Visiting Locations Around Dusseldorf (Rhine-Ruhr region Germany)

Source: The Analyst Lens, Google maps

- Wirkaufendeinauto.de may be a decent business but it won’t support the current share price: We do not see how C2B merchant reselling could ever add more than 2-3% operating margin in value, due to competition and increasing price transparency (e.g. AutoScout [NCR], eBay [NCR], local dealers). However, it is a capital-light business model with apparent high inventory turn. Locations help for sourcing, as does network density, brand presence, data resource, and scale. However, Auto1 is simply buying a car to sell a car a few days later. Traditional auto dealers make ~2% margins, which are very cyclical, with high aftersales profitability, and those stocks (e.g. Pendragon, Inchcape, Lookers – all No Current Recommendation) trade at ~0.2x price/sales.

- We understand how Auto1’s Merchant division is scaled and superior to a local car dealer, but the equity should not trade on a high multiple.

- At ~€6bn revenue if volumes grow (FY’24e), with used car pricing that may normalise (FY’21e revenue ~€4bn), it is possible Auto1’s Merchant division could be worth 0.4x sales – reflecting a 3% margin, a premium to traditional dealers, and some growth – equivalent to a ~15x two-year forward EBIT multiple.

- This implies that investors would get Autohero (digital consumer platform) at zero value if Auto1 share price fell to €12.

- However, Auto1 is heavily loss-making and burning cash (we estimate a ~€300m net loss in FY’22e and ~€400m cash burn), which means the stock is unlikely to find a floor valuation.

- We expect the scale of losses to surprise negatively for FY’22e, based on our own modelling.

- Old diesels: Some evidence of old diesel car stock in parking lots and locations suggests future volume and price risks. On our site sampling trip we saw that many cars appear to be ~5-year-old (or older) German diesel cars (e.g. VW Golf, Polo) or late-life vehicles (i.e. very well used). Five years ago, diesel cars made up 50% of the German market, but this has declined rapidly. In recent reporting periods, Auto1 has benefitted significantly from higher used car pricing. For example, Merchant division ASP will be >+20% (FY’21e) this year as shortages of used car inventory, lower new car production, and COVID supply-chain restrictions have reduced volume availability in a reasonable demand environment. It will take 1-2 more years for Auto1 to prove to the market it has a structural growth story, rather than an ability to exploit temporary market inefficiencies in regional supply-demand. In the longer-term, we would also be concerned about declining car ownership, car sharing models, and electric vehicle growth as potential structural challenges.

Exhibit 2: Parking Lots, Collection Centres, and Old Diesel Cars

Source: The Analyst lens, locations in North Rhine-Ruhr region

Conclusion

We will continue to follow Auto1 and look for a new entry point on the recommendation. We still see this as a potential Short because the business is losing money and does not have clear valuation underpinning at the current share price. That said, the stock more than halved since we initiated on the idea last year, and we will let the dust settle as sentiment seems very negative and the business is still growing.