Recommendation: Short (No Change)

DKK --

$11m

EV/EBIT FY’21e

DKK --

DKK 56bn

54x

-57%

CPH: AMBU-B

23x

Investment Thesis

Competitive threats from other disposable endoscopy products likely to drive down sales growth, and price of existing products.

We consider that the current valuation can only be justified by unrealistic market share and revenues.

New endoscopy product launches are unlikely to generate revenues justifying current valuation.

The Invendoscope, which addresses 78% of Ambu’s proposed total addressable market is unlikely to gain significant market penetration based on product history, competition, and established market structure.

Background

We have covered Ambu as a short since 13 December 2016, with the thesis that the aScope Bronchoscope is not a unique product, can be easily replicated and it is highly unlikely that Ambu would be able to maintain sales growth at the existing sales price. This thesis is yet to play out and Ambu has seen high volumes of aScope sales, likely because of its first mover advantage. We think most of Ambu’s perceived value is based on speculation of future earnings potential, which we do not expect to ever be realised. To demonstrate this, we have conducted in depth research into different endoscopy markets. We have mapped the single-use endoscopy competition across the therapeutic areas Ambu intends to move into, identified the Invendoscope as the key product, and concluded that success is highly unlikely.

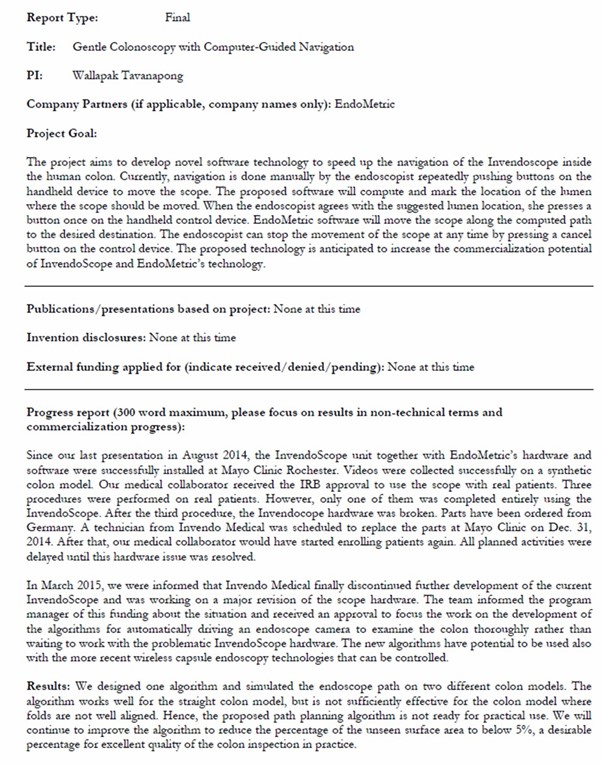

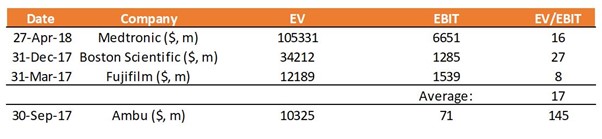

Ambu’s Current Valuation is Unrealistic

Ambu’s current valuation is a staggering 23x revenues (FY’18e), and 103x EV/EBIT. In our view, this is phenomenally high, especially considering comparable company valuations of 17x EV/EBIT (Exhibit 1). We maintain that this is a fair, if not slightly bullish valuation multiple, based on comparable companies’ average multiple of 17x (Exhibit 1).

Exhibit 1: Comparable Valuations

Source: The Analyst Estimates in August 2018

In order to justify these revenues with a 23x EV/EBIT, Ambu would have to achieve an EBIT of DKK2.9bn (€390m), corresponding to a revenue of DKK11.9bn (€1.6bn) at Ambu’s 2020 goal of 24% EBIT margins. This is 5x the FY’17 revenue of DKK2.4bn (€320m) (19% EBIT margins). In order to achieve these revenues, Ambu would have to capture 50% of the global bronchoscopy market (we currently estimate a 14% share of the global 5m annual procedure market by FY’18), 5% of the global ENT endoscopy market, and 5% of the global cystoscope market. On top of this, it would have to achieve 5% of the global gastrointestinal (GI) endoscopies market of 70m procedures, all at the 2020 target EBIT margin of 24% (FY’17 EBIT margin = 19%). Except for bronchoscope market share, we do not think any of these revenue targets are achievable as we will explore below, and believe the current valuation is driven by the market incorrectly reading across Ambu’s success in aScope bronchoscope sales to other endoscopy areas.

Ambu has laid out a plan called Big Five 2020 to achieve a revenue of DKK5bn and add 5% to EBIT margin by 2020. We do not expect Ambu to achieve these goals in the next two years, and even if these goals were met, this is still only halfway to achieving an EBIT to justify the current share price. To ensure we do not miss any upside, we have used Ambu’s 2020 target EBIT margin of 24% for all EBIT forecasting.

Drivers of Ambu’s Current Valuation

We think that the current valuation of Ambu is based on the misunderstanding that the aScope bronchoscope’s success will play out in other endoscopy markets:

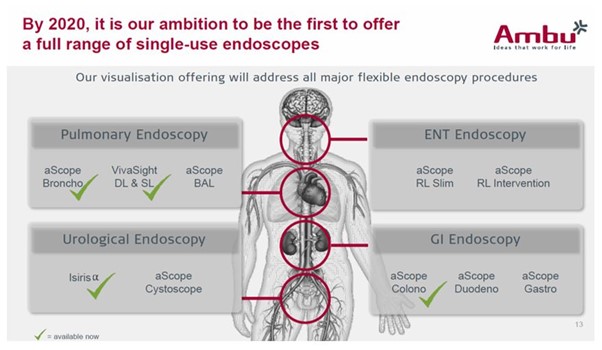

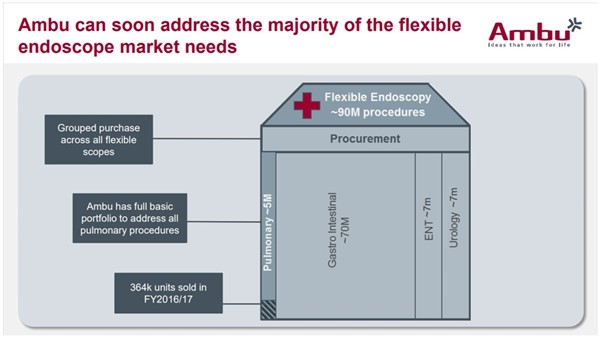

- As of FY’18e, Ambu is likely to have a 14% market share of bronchoscope procedures carried out annually worldwide (it currently has 7% share shown as ‘Pulmonary’ in Exhibit 2).

- The acquisition of Invendo Medical in H2’17 and its soon-to-be-launched single-use GI endoscopy systems (Invendoscope) is stated in Ambu’s FY’17 investor presentation to expand the total addressable market by 70m procedures annually, and the intention to expand into ear, nose, and throat, and urology to achieve a total addressable market of 90m procedures a year (Exhibit 2).

- In our view, the reasons for the aScope’s success in the bronchoscopy market, do not apply to other endoscopy markets, and that inferring success/forecasting similar market share for Ambu for other single-use endoscopes is a misjudgement. The key reasons for this are competition, fundamental differences in the nature of the different endoscopy procedures, and the lack of success of previous products.

Exhibit 2: Ambu’s Proposition of its Total Addressable Market

Existing Endoscopes – Paving the Road to Success?

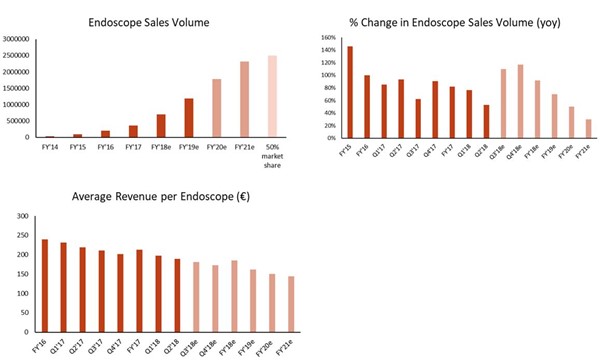

Ambu’s current endoscopes have seen great success in the form of increasing sales volumes of at least 50% YOY for at least the last six quarters (Exhibit 3). Ambu currently sells two disposable endoscopes, the aScope series bronchoscope and Isirisα (a urology cystoscope). Based on evidence outlined below, we expect that almost all of these sales are of the aScope.

- The rate of increase in volumes is starting to decline as of Q4’17, although we expect a new Ambu factory in Malaysia to contribute to sales growth. Optimistically, we expect the aScope to capture a ~45% share of the current market by 2021 (2.3m bronchoscopy procedures annually) (Exhibit 3).

- The average revenue per endoscope has been declining and we expect this decline to continue. The drivers for this are indicated in Ambu’s annual report FY’17 to be due to changes in sales channel, ie more sales through distributors. We expect that the sales price will fall even more as competitors compete for share.

Exhibit 3: Endoscope Sales (Numbers from Q3’18 Are Forecasted and Shown in Lighter Tone)

Source: The Analyst Estimates in August 2018

In order to ensure we do not miss any potential upside from the current offering of aScope bronchoscope, we define a super-optimistic ‘Blue-skies’ scenario in which the aScope will capture 50% of bronchoscope market (2.5m sales) and that revenue per unit will remain at DKK1455 (as in Q2’18), this will bring in DKK3.6bn revenue. As described above, in reality we expect the revenue per unit to decline, leading to endoscope revenue to be around DKK2.6bn in FY’21e (from DKK0.6bn in FY’17). This also includes sales growth of Isirisα, and another product, VivaSight although we expect these contributions to be minimal.

The Ambu aScope Bronchoscope

The aScope bronchoscope, is for viewing and treating the trachea and pipes in the lungs. Launched in 2009, this was the world’s first single-use bronchoscope, without the high initial capital costs of the traditional re-usable bronchoscopes (~€10,000). Re-usable scopes must be rigorously cleaned between use to ensure no infections are passed between patients. Although our previous research indicates that the cost saving argument for single-use endoscopes is not compelling, there are other advantages. For example, disposable bronchoscopes are always available for unforeseen circumstances and as such have been recommended for use by NICE in the UK in unexpected cases when a re-usable bronchoscope is not available.

In our view, the aScope bronchoscope has captured extraordinary market share since 2009 for two reasons:

- Lack of competition

After the launch of the aScope in 2009, single-use competitors only began appearing after four years (Exhibit 5). Our research indicates that this first-mover advantage promoted sales of the aScope. Our call with IQ Endoscopes indicated that the technology behind disposable endoscopes is not exclusive. An example of this is the optical sensor in previous manifestations of the aScope. This optical sensor was procured from Omnivision, a company which actively markets image sensors for disposable endoscopes and has since partnered with a variety of companies for production of single-use endoscopes, including Neoscope2020 and Biovision. This was supported in our call with Neoscope2020 on 13 July 2018, which indicated that most intellectual property was focussed on how to mount and integrate the third-party components into the scope, and the method of tip deflection, rather than detailed technical knowledge of the optical sensor. We deduce from the fact that at least two start-ups are breaking into this area, that the barriers of entry are not very high, and that many future competitors are to be expected, including existing players in the re-usable market such as Olympus moving to the single-use space if the disposable market continues to grow.

- The nature of the bronchoscopy procedure

Looking at the situations in which disposable products may be used, we estimate that 15% of bronchoscopies are unforeseen. In these cases, it may be difficult to schedule the washing of a reusable bronchoscope to ensure a bronchoscope is always available. This is ideal territory for a single-use technology because immediate access to a bronchoscope can mean the difference between life and death. However, the emphasis on urgency is less important in other endoscopies, for example emergency colonoscopies can take place between 24-48h after hospitalisation, and so a reusable scope can be reserved or prepared in advance.

Future Ambu Endoscopes Are Unlikely to Be as Successful as the aScope

We do not expect future Ambu endoscopes to be able to capture a similar market share to the aScope. Ambu plans to expand to a broad range of endoscopy procedures as indicated in its Q2’18 investor presentation (Exhibit 4). We will explore each of these in turn.

Pulmonary Endoscopy (Total Market = 5m Procedures Per Year)

Ambu’s offering

In addition to the aScope bronchoscope, Ambu markets the Vivasight, although this is not technically a flexible endoscope, it is a bronchial tube with an integrated camera. We expect this can be easily replicated by competitors, considering that the optical systems are widely available. Ambu intends to launch another single-use bronchoscope (aScopeBAL) before 2020. Little information is available about the aScopeBAL, although it can be inferred from the name that it may be targeted for carrying out a diagnosis technique called Bronchoalveolar lavage (BAL). This is curious considering the current aScope 4 bronchoscope model is advertised as being ‘highly suitable for management of tough retained secretion and BAL procedures’.

Competitors

Competitors in the disposable bronchoscope space have launched products since 2014 (Exhibit 5). As we see the market become more competitive, we expect Ambu to experience a slow in sales growth and a decrease in average revenue per endoscope. Neoscope2020 indicated in our call that an optical sensor costs around $40, we consider the cost of quality optics to have been the reason preventing earlier adoption of low cost of disposable scopes. Now that the cost of the optics is palatable, many companies (as seen in Exhibit 5) have begun exploring this disposable space.

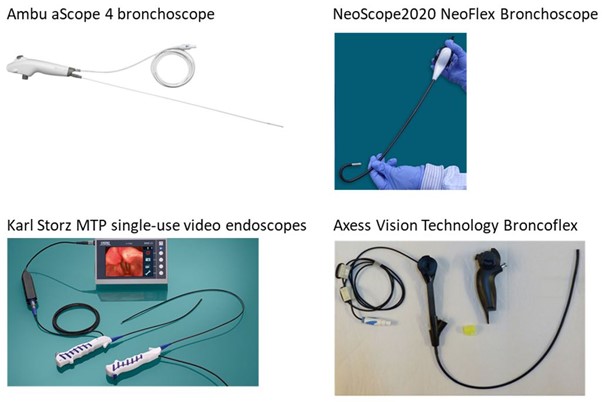

Exhibit 5: Ambu aScope Bronchoscope Competitors

Ambu aScope 4 bronchoscope: Price: $250; Launched: 2009; 280° bending angle; working channel.

NeoScope2020, Neoflex Bronchoscope: Price: comparable to existing players; launched in 2016; 280° bending angle; working channel.

Karl Storz MTP single-use video endoscopes: Launched 2017; 280° bending angle; no working channel.

Axess Vision Technology Broncoflex: Price: $360; Launched 2014; 290° bending angle; working channel; single use probe with re-usable handle.

Urological Endoscopy (Cystoscopy) (Total Market = 7m Procedures Per Year)

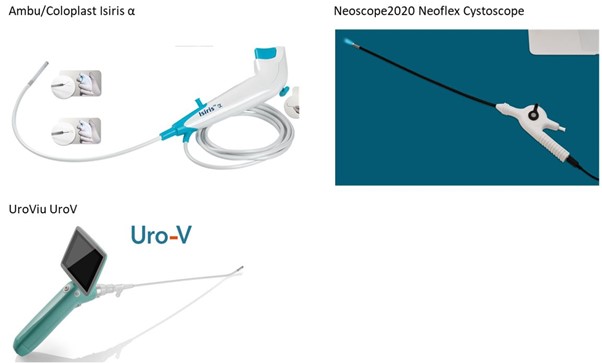

Looking at Exhibit 6, Ambu has already launched the Isirisα cystoscope. This single-use disposable endoscope for looking in the bladder is a collaborative project between Ambu and Coloplast, a medtech company with expertise in urology. We see no evidence suggesting this product is likely to be a success:

- Isirisα was launched in Q3’15. In Q3’16, Ambu indicated that 57,000 sales of the ~58,640 endoscopes sold were the aScope 3, suggesting that fewer than 3% of sales were from the Isirisα.

- Isirisα is not mentioned in the Coloplast FY’17 annual report, while the report indicates that growth in the urology segment in this period was driven by sales in female urological implants. Furthermore, neither the Coloplast Q1’18 nor H1’18 reports mention Isirisα, but do indicate that urology sales were driven by male implants, rather than cystoscope sales.

We hypothesise that Isirisα will not see the rapid ramp up in sales seen for the aScope for the following reasons:

- Competition: Competing single-use cytoscopes were launched soon after Isirisα (Exhibit 6).

- The pre-planned nature of the cystoscopy procedure: Urological procedures are by nature less urgent than pulmonary procedures, and therefore it is likely that a re-usable cystoscope can be scheduled in advance of an appointment.

Exhibit 6: Isirisα Cystoscope Competitors

Ambu/Coloplast Isiris α: Price: $333; Launched: 2015; 170° bending angle; no working channel but integrated grasper and irrigator.

NeoScope2020, Neoflex Cystoscope: Price: $500; Launched 2017; working channel.

UroViu UroV: Launch TBC; 170° bending angle; no working channel; single use probe with re-usable handle.

Ambu indicated in its Q2’18 investor presentation the intention to launch another cystoscope (aScope cystoscope) before 2020. There is little information about this product, however we expect it will be similar to Isirisα, possibly including a working channel so that a variety of tools can be used in conjunction with the scope.

In the Blue-skies scenario, we expect Ambu will capture a maximum of 5% of the cystoscope market globally (volume = 350,000 per year). We consider this highly unlikely and in actual fact, we expect to see negligible sales of cystoscopes up to and including FY’21e, considering the performance of the Isirisα, and that the aScope cystoscope seems currently only to be a concept.

Ear, Nose, and Throat (ENT) Endoscopy (Total Market = 7m Procedures Per Year)

Ambu indicated the intention to expand into the ENT endoscope market before 2020 (Exhibit 4), although these products seem to only be concepts as of Q2’18. Considering the large global player Karl Storz has launched its MTP range (Exhibit 5) as a disposable single-use ENT endoscope, we do not expect Ambu to capture a significant portion of this market. In the Blue-skies scenario, we have assumed that Ambu will capture 5% of this market globally (volume = 350,000 per year), we consider this highly unlikely and in fact, we expect to see negligible sales up to and including FY’21e.

GI (Gastro intestinal) Endoscopy (Total Market = 70m Procedures Per Year)

This is an important market for Ambu and constitutes 78% of proposed total addressable market.

The Invendo medical acquisition and the Invendoscope

In H2’17, Ambu acquired Invendo medical, a German company with 35 employees, which is in the process of developing a platform for semi-disposable GI endoscopes (Invendoscope). GI endoscopy includes colonoscopy (lower gut), duodenoscopy (lower-stomach), and gastroscopy (stomach). The current offering from Invendo is the E210 supply and processing unit, and the SC210 colonoscopy single-use probe (Exhibit 5).

We think expectations that this Invendoscope will bring in large revenues is a key driver for the current share price, and the market is assuming that Ambu can easily capture around 5% as they have done with the aScope bronchoscope. However, we see the GI endoscope market as fundamentally different from the bronchoscopy market and therefore do not expect the Invendo offering to bring in enough revenue to justify the current Ambu valuation.

Using the Blue-skies scenario of 50% of the bronchoscope market, after discounting what we expect the other Ambu divisions to bring in (DKK1.1bn from anaesthesia, and DKK0.9bn from patient monitoring and diagnosis), and DKK1.1bn from an optimistic assumption of 5% global market share of the cystoscope and ENT endoscope markets, there remains a DKK5.2bn hole in the revenues. Ambu would need to capture 5% of the global GI endoscope market, corresponding to 3.7m GI endoscope procedures annually to fill this gap. GI View indicated that five uses per day was a reasonable usage of a colonoscopy treatment bed, and so we have modelled that this would correspond to ~2000 control boxes, using an average of five scopes per day (1,825 scopes per control box per year). Contrast this with the 364,000 disposable endoscopes sold in FY’17.

We consider this situation unlikely because of the following reasons:

- Significant drivers for adoption of single-use bronchoscopes are not applicable to GI colonoscopes

- Immediate availability: The Invendoscope is pitched as a revolutionary, single-use colonoscope, to address any issues surrounding contamination when using re-usable colonoscopes and drawing comparisons with the disposability of the aScope. Our research suggests that a key driver for the adoption of the aScope is immediate availability in unexpected scenarios. Urgent colonoscopies are usually carried out 24-48h after hospitalisation, this longer wait time is a consequence of the requirement to prepare the bowel for colonoscopy, which can ideally take up to four days.

- Infection rates: Multiple clinicians we have spoken to indicate that the rate of contamination between patients when using a reusable colonoscope is insignificant. Furthermore, hospital infrastructure is already in place to effectively and rapidly process used endoscopes.

- Large initial capital cost: The Invendoscope is not actually disposable in the same way as the aScope, and it is expensive. The Invendoscope system consists of a re-usable supply and processing unit costing $35,000, and plug-in single-use probes costing around $250 each. The investment in the re-usable control box is a similar price as a re-usable colonoscope costs to purchase, adding to our conclusion that it is unwise to draw parallels between the aScope’s success and the Invendoscope.

- There is evidence that Invendo’s previous product was not successful

- Before Ambu acquired Invendo from private investors, Invendo launched a similar semi-disposable colonoscope platform called the C20/SC20 system in the US market in 2013 (Exhibit 7). There is little evidence that this product was adopted in the market beyond the two launch hospitals. Even before the quality issues discussed in the next section came to light, it seems semi-reusable colonoscopes are not an attractive proposition in the current market, likely because of the significant capital investment for the supply and processing unit, little urgent demand, and infrastructure already in place for re-usable colonoscope reprocessing, service, and repair.

- Invendo’s offering is not unique

There are a number of competitors launching similar products to the Invendoscope in the coming 18 months. The presence of these competitors in the single-use GI space suggests that Ambu/Invendo does not have a significant first-mover advantage in this field. Furthermore, if disposable GI scopes do begin to capture large market share, existing players such as Olympus and Fujifilm would likely move to produce single-use scopes. Beyond the colonoscopy offering, single-use gastroscopes exist, for example the IntroMedic EG Scan.

- The GI View Aer-O-Scope was approved by the FDA in H2’16, is conceptually similar to the Invendoscope, consisting of a control box and single-use scope (Exhibit 7) and intending to launch before the end of The company indicated that they are in direct competition with Invendo, and that their price was in line with the Invendoscope price (around $30,000 for the control box and $200 per disposable scope). Furthermore, GI View indicated that their products had some advantages over existing scopes, including a more complete field of view.

- IQ Endoscopes aims to launch a range of single-use GI endoscopy scopes globally in Q1’20, providing a similar offering to other players in the space, and in-line with pricing of other single-use players. The company also suggested that the underlying technology behind these scopes is not complex and that the products are simply cameras in flexible rods. IQ said that technology is transferable between different types of scopes after optimizing some features. Therefore, we deduce from this that any company with existing disposable flexible scope technology is a threat to Ambu.

Exhibit 7: Single use GI endoscopes

Invendo E210/SC210: Price control unit: $35,000; Scope; $250; 360° bending angle; working channel; launching in 2018.

Invendo C20/SC20: Launched 2013 in NYU Langone Medical Centre, and New York-Presbyterian Hospital

GI View Aer-O-Scope: Price control unit: $30,000; Scope: $200; 360° bending angle; 2 working channels; launching before the end of 2019.

We see the success of the Invendoscope as a key determinant of the future success of Ambu. Therefore, we have looked into the Invendo Medical offering in further detail:

A Closer Look at the Invendoscope

In summary, it is highly unlikely that the aScope bronchoscope will be able to secure enough revenue to justify the current valuations, the Isirisα does not seem to be greatly growing sales, and the future ENT and urology scopes are only concepts at the moment and will face competition when launched. An easy push-back to our thesis is that the Invendoscope will be widely adopted and capture at least 5% of the global GI endoscope market. After all, Ambu would only need to install around 2,000 control boxes which if used five times a day year-round, which would yield ~DKK5bn revenue each year. Therefore, we conducted detailed research into the background of Invendo Medical and the Invendoscope offering to determine how successful the Invendoscope is likely to be, in the context of existing re-usable scopes, and single-use competitors.

A Brief History of Invendo Medical

Invendo Medical was founded in 2001 as STM Medizintechnik GmbH, initially funded and incubated in the Heidelberg Innovation Bioscience Venture II fund. The first CEO (Berthold Hackl) was managing partner at Heidelberg Innovation. The Company subsequently changed name to Invendo Medical in February 2006 and raised €6.5m in 2008-2009 in a funding round led by Wellington Partners, TVM Capital, and 360° Capital partners. The aim of this funding round was allow Invendo to complete the development of the Invendoscope and enable regulatory approval in the US.

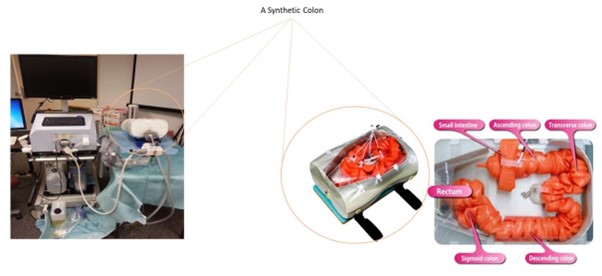

The Invendoscope was going through a number of developmental iterations (Exhibit 8), with evidence that the SC40 and C20/SC20 models were developed before 2013, and the C20/SC20 model gaining FDA approval in 2012. The C20/SC20 was subsequently launched in 2013, with initial installations in the NYU Langone Medical Center and New York-Presbyterian Hospital/Columbia University Medical Centre. The C20 system is described in the FDA submission and news releases as being moved by a device-drive unit under direction of a hand-held controller, rather than manually pushed or pulled, resulting in decreased forces on the colon wall and increased comfort. This is supported by a video from a German clinic showing an Invendoscope C20 being used, and explaining that their procedure leads to an “unprecedented level of comfort” (Exhibit 9), on top of the single-use nature of the scope.

In March 2014 Invendo received a second round of funding led by Xeraya capital, a German family office, and existing investors raising €20.3m. In fact the CEO Barthold Hackl commented that the opportunities in the US market are huge, and the fresh funds will be used to build marketing and service infrastructure in the US, enhance production capacity, and “to support ongoing development projects that address optics and ease of use, among others”. After extensive research, we can find no further mention of the Invendoscope C20 in commercial use. The German clinic shown to be using the Invendoscope C20 in 2014 in Exhibit 9 states on its website (accessed 20 July 2018) that it currently performs all colon endoscopies with the Olympus 180 Series, suggesting that the Invendoscope was not adopted in the long-term.

Exhibit 8: Invendoscope Iterations (Note Two Versions of the Invendoscope C20 Are Shown)

Exhibit 9: The Use of the Invendoscope C20 in A German Clinic

We found references in 2014 to the Invendoscope C20 being used in a research project in the University of North Texas which provides some useful information into what happened during this period (use of the Invendoscope C20 model is described in a project over this time period on the researchers CV). A project collaborator from the University of Iowa, described their progress in a University of Iowa FY’15 Annual Economic Report (See Appendix 1). This report states that the Invendoscope C20 used in the project collected videos successfully in a synthetic colon model, but completed only one procedure in a real patient, and broke down after three attempted real-patient procedures, the break-down occurring sometime in H2’14. The report states that an Invendo engineer was scheduled to replace parts of the Invendoscope on 31 December 2014, and that the research was delayed because of this. However, in March 2015, the research team was informed that Invendo had discontinued further development of the current Invendoscope (C20) and were working on a major revision of the Scope hardware (we deduce this is the start of the work on the E200/SC200 system). The report adds that “[t]he team informed the program manager of this funding about the situation and received an approval to focus the work on the development of the algorithms for automatically driving an endoscope camera to examine the colon thoroughly rather than waiting to work with the problematic InvendoScope hardware”. This suggests that the Invendoscope C20 was not a high quality system, particularly because it broke down after three real-person experiments and required an engineer for repair. From this report, we suspect that the hardware problems were not necessarily due to the robotic drive system, because the scope was able to repeatedly navigate the synthetic colon model in the research project (Exhibit 10), a probable explanation for the break down was likely something that was associated with operating in a real gut. Even though there is data from larger studies using the C20 system (61 participants), with no mention whether the scopes broke down in these cases. Considering that Invendo Medical discontinued development of the C20 model in March 2015 for a major revision of scope hardware suggests that these problems were likely widespread, suggesting the product was not widely accepted, and that customers may have lost confidence in the company, especially considering the case study of the Iowa University research group, in which repair does not seem to have been a customer-friendly, simple, routine procedure.

The subsequent E200 (FDA approved in 2016) and E210 models (FDA approved in 2018) (Exhibit 8) are indicated on their FDA approval notifications to be manually propelled rather than through the drive system of C20. Even though the outcomes of the Iowa University study suggest that in this case, the breakdown wasn’t due to the use of the propulsion mechanism. It seems Invendo decided to remove the assisted-drive feature after the C20 debacle and now emphasise the single-use feature of the scope as its unique selling point. This coincides with a CEO change in the company, Berthold Hackl, the CEO who had been with Invendo since the Heidelberg times was still in place on 20 March 2014. By July 2014, Timo Hercegfi (the previous CFO who had also been with Invendo since the Heidelberg Innovation days) was CEO, according to his Linkedin. Furthermore, the current COO joined Invendo in April 2013 (two years before the 2015 discontinuation of the C20), and current Head of Quality Assurance has been in this position since 2005, we find it concerning that the same people that were responsible for the Invendoscope C20 quality assurance are still key personnel in the 2018 launch.

The CEO Timo Hercegfi stated in a recent article that the SC200 control unit “remains in operation for years, taking part in approximately 1,500 examinations annually” (he does not mention how often repairs are required). Furthermore, our call with Klinikum Hanau on 27 July 2018 suggests the E210 system performs comparably to re-usable scopes in small studies (but has only been tested on hundreds of patients at this point). We expect that in a practical hospital setting, the frequency of breakdowns will be significantly higher than the CEO states, considering what was observed after the launch of the Invendoscope C20, and that current re-usable endoscope repair rates are around 100 uses per repair. It is also concerning that the private investors supporting the company for almost 10 years were willing to sell the company for only €115m upfront (DKK857m) (potentially up to €225m) less than a year before the launch of the next generation product which Ambu is relying on to bring in at least €700m a year in the context of the Blue-skies scenario with the rest of its products being forecasted extremely optimistically.

This question of repair infrastructure raises further questions. Considering that Invendo had only 35 employees at the time of acquisition, and disposable nature of Ambu’s existing products, there is currently no repair-network infrastructure for the Invendoscope product range. This contrasts with the national multi-provider networks for existing players such as Olympus, in which colonoscopes can be sent for routine repair, and replacement substitutes provided while the repairs are taking place. The current repair network includes delocalised fabrication of parts according to the original equipment manufacturers specifications. Again, the Iowa University report suggests the Invendo Medical strategy for repair is far less efficient, and it concerns us that Ambu has no expertise in this. If hospitals were interested in the Invendoscope, considering the importance of colonoscopies in the clinical setting, we would expect hospitals to trial the system alongside their current offering, which was indicated in our call with Klinkum Hanau which intends to offer the Invendoscope to patients, alongside their existing offering when carrying out the next trial. Furthermore, the likely hardware problems, lack of repair and service infrastructure for the Invendoscope, established and trusted infrastructure for re-usable scopes (Industry forecasts the re-usable endoscope repair market to be worth $1.6bn by 2025) lead us to the conclusion that the Invendoscope will never be able to bring in €700m a year in revenue. A further concern is the need for disposal, storage and delivery of these scopes, with some colonoscopy centres performing 100 procedures a day. This contrasts with re-usable colonoscopes, which can be reprocessed for as little as $20 in a few hours.

Our call with Klinikum Hanau suggests that the E210/SC210 Invendoscope is still undergoing evaluations to determine how effective the product is compared with re-usable scopes, despite being indicated as “available now” (aScope Colono) in Ambu’s investor presentation (Exhibit 4). This further exacerbates the impact of competing scopes stealing market share form Ambu.

If the idea of single-use colonoscopes began to gain traction, the period required to become widely adopted would likely be significant. The infrastructure for reprocessing endoscopes would remain as long as any type of re-usable scope was used, so the cost of reprocessing colonoscopes on top of this would be marginal. Our research indicates that endoscope re-processing facilities are multi-room cleaning facilities, commonly integrated with sterile services for cleaning surgical equipment, processing more than 12,000 tools per month for a large hospital. Any ramping-down of this facility or reducing employee numbers would not be a decision taken on a whim and would likely involve lengthy trials to justify that the single-use system was as reliable and accurate as the existing offering. We expect this to be more than enough time to see multiple competitors bring similar products to the market, as well as enabling market incumbents (Olympus, Fujifilm, Hoya/Pentax) to produce their own single-use offerings, and retain their dominant market share (Olympus alone has 70% of the global market).

Other Competitors

Boston Scientific’s single-use ureteroscope (LithoVue) does not directly compete with any of Ambu’s products, however our calls with IQ Endoscopes and NeoScope2020 indicated that the technology is transferable between different types of scope. Therefore, we expect Boston Scientific to launch a range of single-use scopes competing with Ambu’s products.

Another Perspective on Ambu

In order to justify the current Ambu share price, at the company’s target 24% EBIT margin, Ambu would have to bring in $1.9bn (DKK11.9bn) in annual revenues. Olympus currently holds a 70% share of the global GI and pulmonary endoscope markets, 30% of the urology/gynecology endoscope market, and 50-60% of the ENT-scope market. Olympus reported revenues of $4.4bn in 2017 from its GI, pulmonary, urology, and ENT -endoscope business including service contract revenue for all devices. This means that Ambu would have to return 40% of Olympus’ revenues to satisfy the current valuation. Considering existing competition, we expect this will never be achieved.

Potential Catalysts for our Thesis

Timing is everything when shorting a growth stock, and Ambu is currently in the ‘dreaming’ stage. Below we outline a number of catalysts that may bring the market’s view of Ambu crashing back to reality:

- Lack of sales of Invendoscope E210/SC210: Ambu does not expect to recognise any sales from the Invendoscope in FY’18, although we expect the revenue for FY’19 to be relatively small compared with the Big Five 2020 targets. We think this will be propagated by hardware problems with the Invendoscope product and a lack of repair infrastructure, reflecting what happened with the Invendoscope C20.

- Decreasing endoscope sales growth and decreasing endoscope average unit price: In Q2’18, existing endoscope sales growth was 53%, down from 82% for FY’17. We expect this growth may bounce back to >100% in Q2/Q3’18, and this to be the sales peak, as competitors compete for market share. The average revenue per scope has been changing YOY -15% and -14% for Q1’18 and Q2’18 respectively and we expect competitive threats to propagate this decrease in sales price. As the revenue per unit falls, it should become clearer that the current Ambu valuation is unrealistic in our view. This would contribute to Ambu not meeting its Big Five 2020 targets.

Risks to the Thesis

- Uncertainty behind current valuation: We are not precisely sure what has been driving the share price valuation, for example the stock doubled between Q1’18 – 01 July 2018. We expect this is expectation of future sales of the Invendoscope product, which we think to be an unjustified. It is therefore uncertain what it will take to undermine the confidence of the dreamers who are backing Ambu’s vision. Although we expect that falling vastly short of the 2020 targets is likely to break the spell.

- Acquisition and subsequent hype: Any further acquisitions to expand Ambu’s total addressable market are likely to lead to an increase in share price, even if the expected sales are unlikely to ever be realised. We expect Ambu to be pre-occupied in getting the pre-2020 endoscope products to market, and there are no other large endoscope markets remaining to move into, indicating this risk is minimal.

- Potential success of the Invendoscope: We think the Invendoscope capturing 5% of the global market is unlikely considering the similar competition, and the failure of the previous C20 Invendoscope launch. However Ambu estimates that it’s disposable aScope is used in 3000 hospitals worldwide, corresponding to around 15% of the world’s 20000 hospitals. It is possible that Ambu will utilise these links to convince a portion of these hospitals to trial the Invendoscope. However, we think the product is unlikely to achieve significant market penetration due to probable hardware problems, lack of repair infrastructure, and infrastructure in-place for existing endoscopes.

Conclusion

In conclusion, we think that the success Ambu has seen for the aScope bronchoscope is unlikely to occur in the other endoscopy markets Ambu intends to move into. This means that applying Ambu’s current market share to the potential total addressable market (which the market seems to have done) is an invalid valuation. In our view, the most important product for Ambu will be the Invendoscope from recently acquired Invendo Medical. We see the success of the Invendoscope as highly unlikely, considering the quality of the previous Invendoscope brought to market, the board members in charge of quality control remaining unchanged, similar competition, and lack of infrastructure for repair and servicing.

Call with GI View

GI view are developing a single-use probe colonoscope (Aer-O-Scope) and indicated that they are looking to enter the US market within the next year. The company indicated that the publicised concerns of infection between patients were mainly due to an isolated case of duodenoscope procedures and improper cleaning, which has now been addressed. However, in addition, GI View suggested that cross-contamination between patients is a problem with 1.6% post-colonoscopy patients returning to the doctor within seven days, compared with only 0.6% of mammogram patients. The company indicated that the ‘ick-factor’ of using a colonoscope used by someone else makes single-use devices appealing and the company was not concerned with the threat from blood-based cancer tests. Regarding competition, the company indicated that large companies like Olympus are moving to improve cleaning procedures and introduce disposable parts, and competitors such as Boston Scientific already are already making single-use tools for working channels in any scope. GI View indicated that image quality from a CMOS in its disposable scopes is comparable to the CCD optics in re-usable scopes. Finally, the company indicated that the GI endoscope market would be difficult to break into.

Call with IQ Endoscopes

IQ Endoscopes is a start-up looking to globally launch a suite of single-use GI endoscopes in the next 18 months. The company believed the market would move entirely to single-use GI scopes in the future. Furthermore, the company indicated that it aimed to offer its products at a comparable price to competitors, and that there would be room for multiple players in this space. IQ also indicated that the technology behind single-use scopes is relatively simple, and that it is not difficult to move into other endoscopy areas.

Call with Neoscope2020

Neoscope2020 is a MedTech company based in California, which produces a range of single-use endoscopes. The company indicated that fundamentally, single use scopes consisted of three main components; an image sensor costing around $40, a processing centre, and a light source. The company indicated that re-usable competition had an inbuilt bias to maintain re-usable scopes as the status quo because they make a lot of money from repairs and service contracts. In terms of intellectual property, Neoscope2020 indicated that in their case, the articulating tip of the endoscopes is developed by them, and that in general, the barriers to entry for competitors were 1) integration of the electronic components, and 2) the tip deflecting mechanism.

Call with Klinikum Hanau

We discovered an abstract published in the Journal of Gastrointestinal Endoscopy which described a preliminary study on the Invendoscope E210/SC210 carried out in the Klinikum Hanau. Our aim of this call was to get an independent view of the Invendoscope performance such as that described in Appendix 1, however, at the start of the call, a doctor from the clinic indicated that they had been following Invendo Medical for around 10 years and that the clinic has a cooperation with the company so was unable to give details on the product itself. The doctor indicated that they did most of the comparable studies between the Invendoscope and re-usable scopes in Germany. They suggested that even though multiple single-use products had started development in around 2005, such as Stryker (which ceased single-use colonoscope development in 2008), but had been stopped in development, and that Invendo remained one of the last on the market. Furthermore, they indicated that the previous system (Invendoscope C20) had been withdrawn from the market, supporting our findings shown in Exhibit 1. They indicated that the E210/SC210 is comparable to re-usable scopes in terms of ease of use, except that the joystick controller is new, precision of viewing is also similar. The doctor indicated that in general, the system is comparable to a re-usable scope, except for the joystick navigation systemand also suggested that the friction with the wall of the gut when using the Invendoscope was lower because it is more flexible than re-usable scopes. The doctor indicated that the clinic is planning to do another study with the Invendoscope with a larger number of patients (around 500 cases) and to publish within the next 12 months. The doctor suggested this would involve five or six centres, each doing 100 colonoscopies at a rate of 20 colonoscopies per day. The doctor indicated that the work they had done (published 2018) was during the developmental stages in which their team were testing to compare how the scope performed. The doctor said that they appreciated that Invendo medical had reached out to clinics to help develop the scope and that no such discussion normally occurred with the Japanese suppliers. The doctor indicated that only five or six studies had been carried out on the Invendoscope system so far, each of a similar size to the study in his clinic (50 patients). From this call we deduce that the Invendoscope is still in early stage development and so competitors will likely launch a similar time as when the Invendoscope begins to be widely marketed. It is clear that the doctor has a positive view of the Invendoscope system, although it is unclear if this is influenced by the doctor’s association with Invendo Medical. We also recognise that the previous Invendoscope C20 model which was withdrawn from the market in 2015 was trialled in similar studies and those studies concluded that the systems were comparable to existing re-usable scopes.

Appendix 1