Recommendation: No Current Recommendation

DKK 180

$60m

N/A

€24bn

N/A

VWS DC

Summary

- Elements of prior short thesis played out related to poor near-term cash-flows and large earnings downgrades, but stock did not decline materially.

- Market leader, growth business in an industry with undeniable megatrends and legislative drivers.

- Margins and cash-flow should eventually improve from the bad situation in FY’22-23e, but will take time and order recovery seems delayed.

- Service business underpins equity value and offshore is optionality in the stock. However, Siemens-Energy just made big impairments to their service business, raising perceived risk on Vestas.

- Large potential swing from €1bn negative cash-flows in FY’22 to €1.5bn positive cash-flows and EBIT in 2025.

We dropped our Short on Vestas late last year, but have kept an eye on the stock and update clients here. We have no active recommendation but our updated model is attached. This note discusses new accounting red flags, and the Siemens warning.

Vestas is a name we would theoretically like to have on a Buy, given their market leadership in a growth industry. However, we are concerned about the poor long-term track record of profitability in the wind sector, and even Vestas – arguably the best in the space – only averaged a 5% group EBIT margin in the last two decades.

At €24bn market cap, for a business guiding to €14-15.5bn revenue and -2 to +3% EBIT margin (mid-point of FY’23e guidance), we do not see enough upside. We also see some near-term risks;

- Project announcements are not accelerating as hoped after the announcement of the US Inflation Reduction Act. In Europe there still appears to be severe project approval delays in permitting (Source: Recent IR conversation with Nordex).

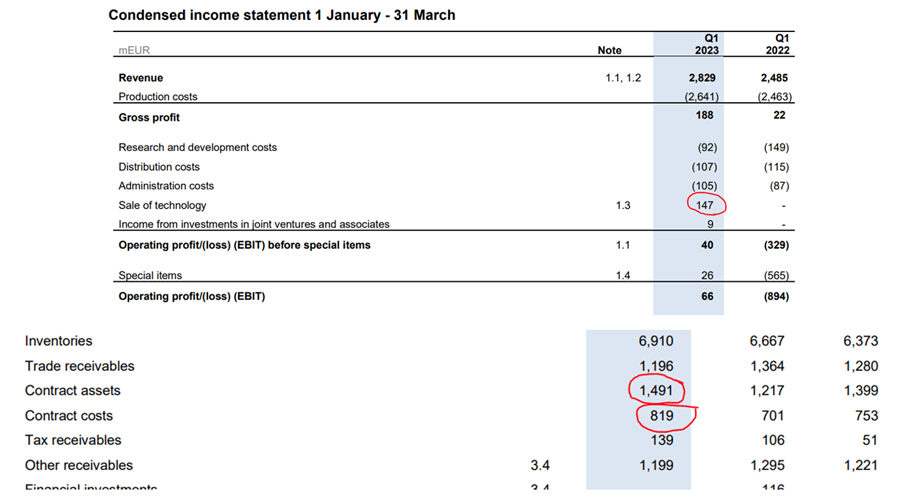

- Vestas accounting remains concerning. In Q1’23, the company reported a positive EBIT margin (1.4% and €40m) compared to heavy negative in the prior year. However, looking at the P&L statement in Q1’23 in more detail, we see the result was supported by lower depreciation and R&D charges (related to historic impairments on V164/174 platform), and a €147m sale of technology (‘consideration received relating to a manufacturing license granted to KK Wind Solutions’) booked in Power Solutions division and boosting ‘EBIT before special items’. This sale may be one off in nature, but was not included in special items.

- Q1’23 cash flow was poor, surprisingly even worse than Q1’22, with a build of inventories, reduction in trade payables not offset by increase in prepayments, and another increase in contract costs (capitalised amounts relating to pre-mobilisation of projects).

Exhibit 1: Accounting Red Flags Just Won’t Go Away: One-Off Income and Contract Assets/Costs

Source: Vestas Q1’23 Report

Service Headaches

In theory, Vestas’ large service business should underpin valuation. With a ~€3.5bn revenue service division with 22% operating margins – at 20x EBIT, investors could attribute €18bn value in FY’25e, ~75% of the current market cap.

Unfortunately the sector was rocked last week when immediate peer Siemens-Energy lost 40% of its value on a profit warning (owner of Siemens Gamesa, the number 2 in onshore, and number 1 in offshore).

- Siemens Wind has seen a substantial increased in failure rates of wind turbine components. Their board initiated an extended technical review that will incur significantly higher costs, in excess of €1bn. Productivitiy improvements are not materialising and there are ramp-up challenges in Offshore.

- These technical problems may now structurally impair the long-term profitability of their wind service business, in our opinion. In the past, we had been Short Siemens Gamesa due to accounting concerns and poor cash generation. In fact, our analysis showed the business had never generated free cash for equity holders before Siemens Energy acquired it, in full.

- More recently, we’d been inclined to look at the positive value case on Siemens Energy due to their positioning across the energy value chain and a potential turnaround in margins under the new structure – the stock had been pitched at a value conference.

- Siemens Energy lost ~€8bn market cap on the warning, but they’d only paid ~€12bn (100% value) for Siemens Gamesa at the end of 2022. This was a huge hit to sector sentiment, and Vestas has sold off in sympathy.

- We look for renewed confidence in Vestas Service margins to be more positive, but our previous discussion of contract accounting and margin risks at Vestas is also brough back to the fore.

Key Events and Catalysts

Listed players report quarterly, watch Vestas Q2’23, Siemens (September year-end) interim results in July with more details post the profit warning. Nordex is also listed (Germany) owned and tightly-linked to Acciona (Spanish listed).

There is consistent newsflow on order intake and project bidding.

Political newsflow is important around infrastructure programs and incentives (US IRA). There is a large backlog of orders in Europe (discussed in last note) so permitting and project approval is key.

Conclusion

We keep a watching brief on Vestas and the wind sector and have follow-up meetings with the company, and Siemens Energy scheduled.

Please note: We have No Current Recommendation on any stocks referenced in this research, unless otherwise mentioned.