Recommendation: Buy (Initiation of Coverage)

£45

£18m

£135

£4.5bn

~110%

~~

Investment Thesis

- Risk/reward is asymmetric and positive: 50% upside in $12bn industrial. Higher conviction given internal changes, activist interest, and potential for value creation with focus on downstream assets.

- Raise valuation of Sales & Marketing to $8bn: Hidden value in the asset base. Downstream division is a stable-margin, high-return, logistics and distribution business, that should trade on a much higher multiple than Yara, as a group, does today.

- Large, quality portfolio: Weighted towards specialty products, with attractive market positions and largest producer of Nitrogen-fertiliser globally.

- Cyclical low margins: Tightening of supply/demand between 2019-22 should boost earnings towards mid-cycle levels of NOK 50-60/share, compared to NOK 10-15 in the last two years.

Finding ‘Hidden’ Value: France

This note is the second in a due diligence series focused on the ‘hidden’ value in the downstream Sales & Marketing division. Yara split the division out after 2018 and shows $613m EBITDA was made in FY’18. However, margins are lower than historically, and a more focused management, an asset review, and higher volumes could generate meaningful upside. Considering Sales & Marketing at a 7% EBITDA margin (compared to 5.5% FY’18) on 5% higher volumes, Yara could make $800m in this division. On 10x EBITDA, the same multiple as Brenntag, we value Sales & Marketing at $8bn. This effectively leaves Production/Upstream valued at <$6bn, or <$300/t, in an industry where newbuild costs >$1,000/t, and Yara has large, specialty product portfolios. There is upside on the rating if Yara can deliver consistent growth and margin improvement.

However, Yara’s European production assets should rightly command a discount to US peer CF Industries. Yara faces a higher gas cost than US producers, and this disadvantages it on the cost curve. Since 2012, Yara has consumed gas at an average global cost of $5.7/mmbtu and European gas at $7/mmbut. In the same period, US Henry Hub has averaged $3/mmbtu. As a reminder, nitrogen fertilisers are made from ammonia and, very broadly speaking, investors should multiply the gas cost by 30x to get the gas cost in a tonne of ammonia or urea. The marginal content cost of gas in US production is therefore ~$90/t, compared to $210/t in Europe. Ammonia prices have been $250-300/t in recent years, compared to $500/t previously (FY’11-’14), which means European producers are loss-making in the current cycle.

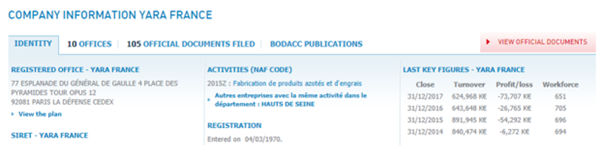

After running through the UK subsidiary, we have now looked through France. France is more production-heavy than the UK, operating three loss-making plants. The comparison of Yara UK and Yara France is a useful exercise for investors as it contrasts the two businesses of upstream versus downstream within Yara. In this context, we are concerned that Yara is running loss-making plants in Europe to flow volumes through the profitable downstream division. The French plants are small, dated, and high-cost. In the long run, we suggest that only the Ambes plant near Bordeaux is large enough to compete and Yara should consider closing these plants and ‘liberating’ sales & marketing to source third-party volumes where necessary to replace the Yara product. The French plants are continually burdened by asset impairment and environmental, restructuring, and personnel provisions.

Review of French Operations

Yara France is a larger operation than the UK, with 2.5x the number of employees (635 versus 259). Of interest for our purposes is that France has the same level of revenue ($716m) but lost $81m PBT in 2018. The UK was nicely profitable as it is a distribution and logistics operations, whilst France is highly loss-making as it is a production-heavy, high-cost operation. France has >5x the fixed asset base than the UK and invested 6x the capex over the last two years (per subsidiary filings). We understand investors would always favour the UK operation over France for the higher returns, stability of returns, and infrastructure considerations. Essentially, France would struggle to achieve a positive value in a market sale, whilst the UK could trade on 10-15x EBITDA. Yara, as a group, is a combination of both, and is marked at 7x EV/EBITDA by consensus.

Whilst Crop Nutrition (Sales & Marketing) and Industrial Solutions operate at the HQ site near Paris, Yara also had four production facilities in the country, prior to the closure of Pardies, in:

- Ambes: 0.5mt urea, 0.6mt nitrates, also in the West, on the Gironde near Bordeaux.

- Le Havre: a small plant with 0.4mt ammonia, 0.3mt urea, built in the 1960s, rented at the Port.

- Montoir: another small plant with 0.3mt nitric acid, 0.4mt nitrates, 0.3mt NPK, mainly supplying the west of France on the Atlantic coast near Nantes.

- Pardies: sub-scale plant with 0.2mt urea and 0.1mt nitrates (closed in 2018).

Small plants in high-cost gas and high-cost countries in Europe are unfavourably positioned globally. Yara clearly has problems in France; Pardies was closed in 2018, Montoir was impaired again in 2018 ($13m, after $18m in FY’17). Tragically, in the same year, an employee was killed at Montoir.

Exhibit 1: Yara France Is Heavily Loss-Making on High-Cost, Sub-Scale Production

Source: Infogreffe.com, Accessed June 2019

On the France corporate website, Yara describes five industrial sites, and the company operates out of new headquarters in ‘La Defense’ on the outskirts of Paris (Exhibit 2). Less information is given on market access sites, such as we see on the UK corporate site.

Exhibit 2: Yara France, Unlike the UK, Is Primarily Loss-Making Production

Source: Yara France Corporate Website, Accessed June 2019

Conclusion

We have increased conviction in Yara and continue our due diligence work to add conviction and detail for clients. The company will host a capital markets day in London on Wednesday, 26 June 2019, which we will attend.

We will keep clients informed as we work through Yara’s group structure in more detail. It is likely that our next note (Part 3) will cover Brazil. We will also conduct physical facilities visits, particularly focused on port, storage, and terminal positions.

We have raised Yara to a Strong Buy recommendation, and this note should be read in conjunction with the review of UK operations. Yara Brazil is the largest single country by revenue ($3.5bn), and this will be a vital case study for Part 3.