Recommendation: Strong Buy (Initiation of Coverage)

£--

$25m

FY’23e P/E

£--

£6bn

13x

~100%

SGE LN

22x

Investment Thesis

- Dream combination of high margin, structurally growing business with sticky customer base that is hugely cash generative.

- New senior management and a transformed organisational culture remove the shackles of previous mismanagement that stunted the SaaS transition.

- Product deficiencies are narrowing with rollout of new Intacct offering that will act as a launch pad to accelerate customer growth and upsell.

- On 22x FY’23e adjusted net income plus the £2bn in cash the business is expected to generate by then, we arrive at our target price of £11.10, representing ~100% upside.

We gave Sage a miss as a short in January 2019 after our no current recommendation note considering in detail the bear case around stalling revenue growth due to under investment in product and the margin sacrifice needed to alleviate this. With the shares now back to where we started, but the business culture transformed under new management and margins reset, we initiate on Sage as a Strong Buy recommendation with £11.10 price target. Sage is everything you could want in a business: high margin, hugely cash generative, with sticky customers and long-term structural growth. Management is taking all the right steps to transform the business into a proper tech company and with the shares down ~30% since recent highs, we believe this is an excellent entry point into one of the FTSE 100’s best businesses.

The note below details these thoughts and what we believe has changed in the last year.

One of the Best Business Models Around

The recent market turmoil got us thinking what businesses we have always wanted to own given the right price which had rock solid balance sheets that we could hold for the long term. Running through the FTSE 100, we struggled to find many better names than Sage, which benefits from:

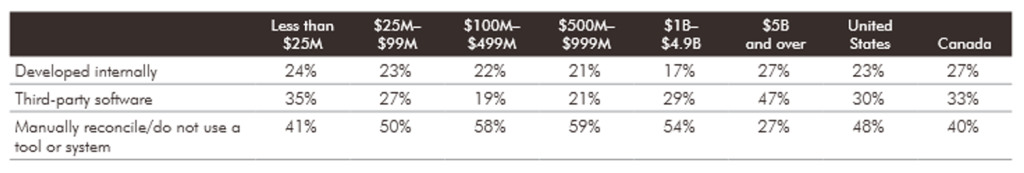

- Long-term structural growth. Sage’s underlying market is expected to grow ~8% CAGR globally between 2018 and 2026, driven by cloud product adoption, demand for more efficient financial administration, and greater business intelligence. The vast majority of companies are slow adopters of new accounting technology, meaning the headroom for growth is vast. Per Exhibit 1, >50% of medium-sized businesses in North America still do not use any system/tool to perform account reconciliations.

- Sticky customer base with pricing power. While Xero has captured small and micro business customers, ~80% of Sage’s revenue derives outside Xero’s core target market of business with <20 employees. Migrating accounting systems for larger business remains a headache most accountants are keen to avoid and hence Sage’s strong pricing power.

- Huge cash generation. With sustainable operating margins of >26% possible long term, we expect Sage to generate annual FCF of ~£580m by FY’23e, representing a 9% yield. Cumulatively, that means >£2bn in free cash generation between FY’20e and the end of FY’23e, including the £250m disposal of Sage Pay.

- A value-add product to businesses. From automating the order to cash process, to cost optimisation through data analytics, efficient financial software can save several days per month of staff time.

- A solid balance sheet. With minimal net debt of £395m that will be quickly wiped out given the cash generation, the business is well placed to ride out any market turbulence.

These are the fundamental reasons Sage reaches our strong buy list.

Exhibit 1: Tool or System Used for Account Reconciliations in the US/Canada by Business Size (Revenue)

Source: Robert Half Benchmarking Accounting and Finance Functions 2019 Report

What’s Different to Last Year?

Our previous no recommendation note highlighted the bear case around:

- Sage’s cloud product offering lagging peers, meaning further R&D investment and weak new customer acquisition in the meantime;

- Revenue growth slowing as existing customer upsell opportunities run out; and

- A hollowed-out cost base leading to poor employee morale and necessitating rising selling/admin costs.

So, what has changed since last year to make this a strong buy?

Culture Transformed

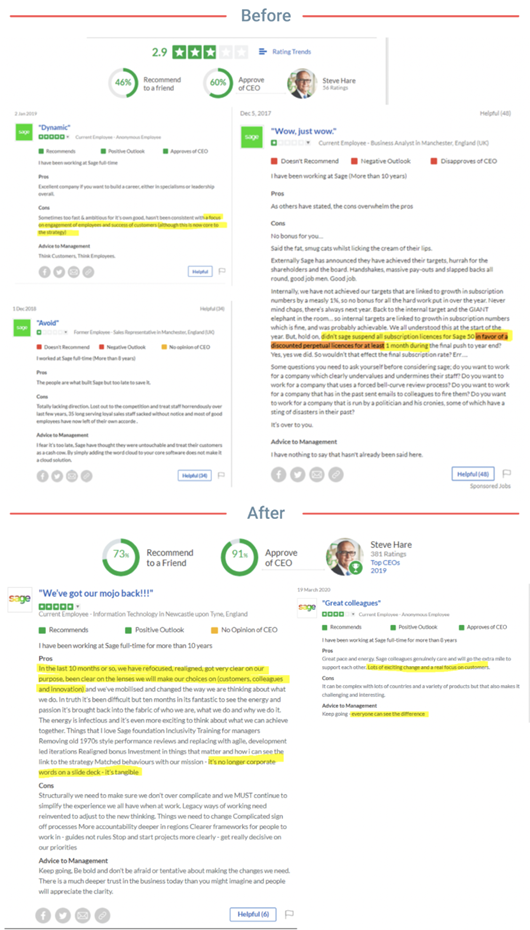

- These issues stemmed from years of mismanagement exacerbated by previous CEO Stephen Kelly. He presided over a toxic tone from the top where costs were slashed and unrealistic sales targets pushed, ruining staff morale. Glassdoor reviews had described Sage as ‘the fastest revolving door in tech, most people want to leave within 3-6 months of joining’. They also indicated an inconsistent strategy towards transitioning to a SaaS business model, with one sales rep noting that perpetual licenses were favoured over subscriptions sales in order to meet targets. This was a critical error for a business dependent on the quality and motivation of its tech and sales staff and one we believed would be difficult to turnaround.

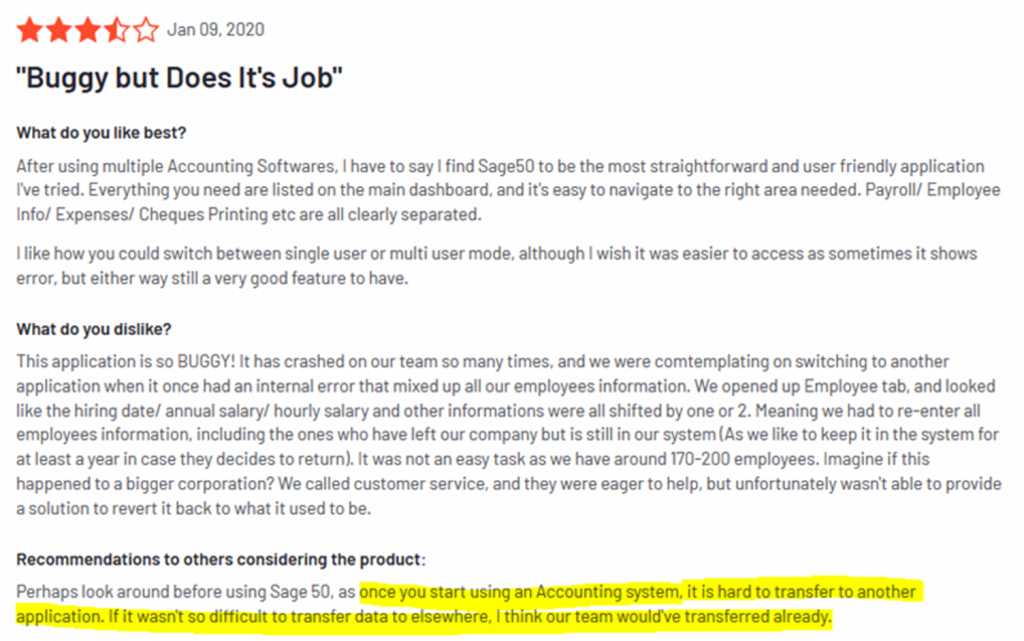

- However, Exhibit 2 demonstrates how quickly current CEO Steve Hare has transformed this culture. One reviewer highlights how the business ‘has refocused, realigned and got very clear on our purpose’. This is just one of several reviews and interviews we have noted that corroborate a significant cultural transformation underway at the company. The painful reduction in SSRS revenue, down 18% in FY’19, also demonstrates a concrete commitment to move away from perpetual licence sales. This is the context we believe Sage’s SaaS transition should now be viewed through.

Exhibit 2: Steve Hare Has Led a Cultural Transformation

Source: Glassdoor (Accessed March 2020, December 2018)

Margin & Expectations Reset

- Our previous note assumed 22% underlying operating margins for FY’20e, falling from 28% in FY’18, driven by increased expenditure on R&D and staff costs relating to sales/distribution. This has happened. Sage reset investor expectations on margins to 23-25% in FY’19 and now to ~23% for FY’20 due to increased investments in both the product and its organisation.

- We still believe margins will approach a trough of 22% for FY’20e. While we do not expect an instant or sharp margin recovery given this is a multi-year transformation, we believe it can trend towards 26% by FY’23e. This is driven by refocusing the business on its core product set, developing its cloud native offering, and the benefits from operational gearing as top line grows 25% to £2.4bn.

Improving Product Portfolio

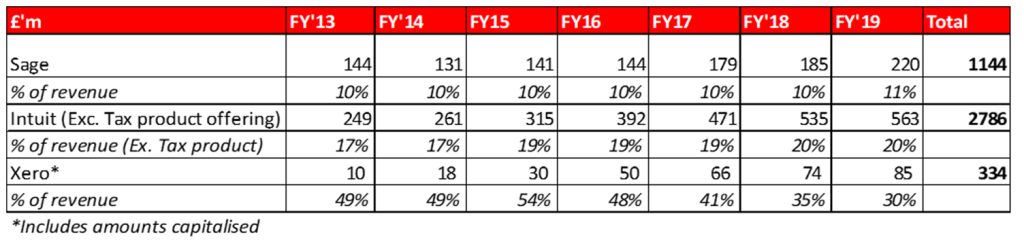

Exhibit 3: R&D Spend for Sage, Intuit (Small Business Segment) & Xero

Source: Sage Annual Reports, Intuit 10-Ks, The Analyst Estimates (Completed March 2020)

Per Exhibit 3, Sage has accumulated a £1.6bn deficit in R&D expenditure compared to rival Intuit, spending around half the share of sales despite a larger product portfolio spread across multiple jurisdictions. We acknowledge Sage still requires investment in its product offering, but point out:

- Smart acquisitions are plugging product deficiencies. Sage has spent ~£990m on acquisitions since FY’12. One such acquisition, Intacct (a US cloud native platform for medium sized businesses), we believe is a gamechanger. Acquired in FY’17 for $850m, it was not cheap and represented ~9.5x sales, but gives Sage:

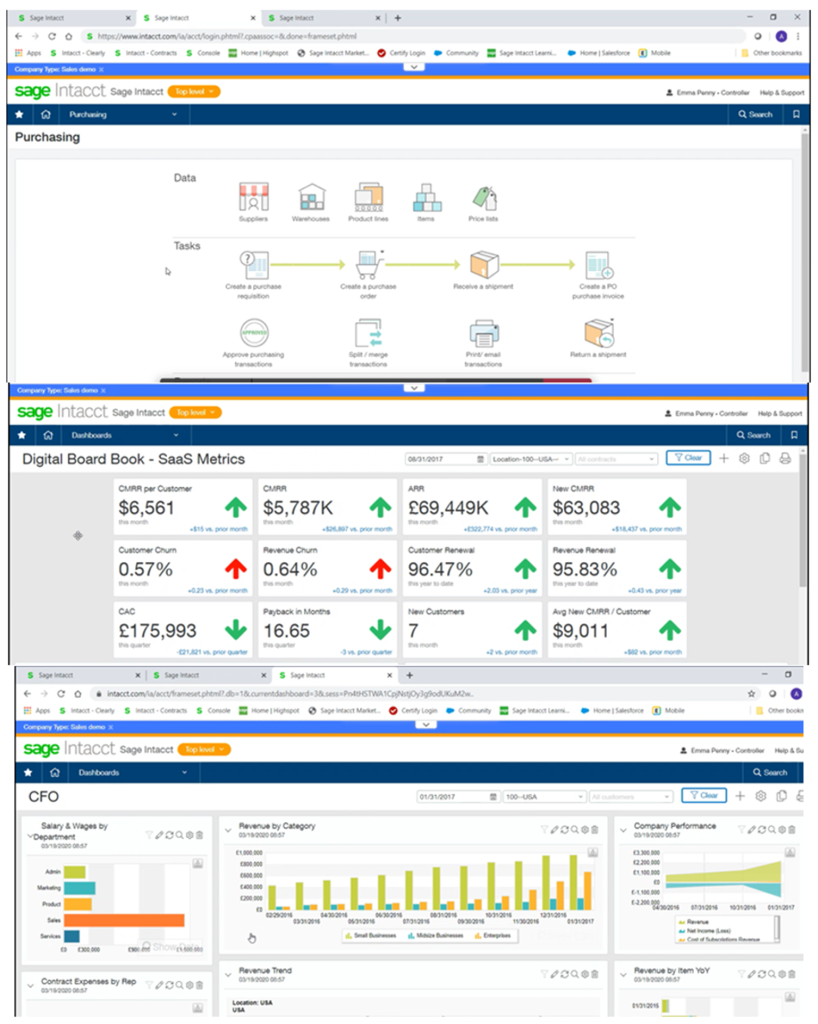

- A best-in-class, fully cloud native offering for medium sized businesses. Reviews consistently place Intacct top of the pack in this customer segment, with G2 crowd citing a 98% customer satisfaction score, compared to an average of 72% for competitors. We attended a product demonstration and noted, per Exhibit 4, a clean and user-friendly interface, with product features now in line with what Xero and Intuit provide to smaller businesses, but with easier multi-entity consolidation. Crucially, Intacct has one of the strongest integrations with Salesforce (no current recommendation), which is pre-built, meaning no third-party middleware necessary. It is bi-directional, allowing updates in customer information in one system to be reflected in the other (e.g. quotes on Salesforce converted into orders in Intacct).

- A core platform to build a cloud ecosystem. Sage has already launched integrations into Intacct using its recent acquisitions in HR (Fairsail) alongside budgeting and planning (Budgeta) to build a comprehensive cloud native mid-market offering. However, Intacct also brings with it an established third-party app ecosystem, with over 154 add-ons/integrations available. This is more than the entire Sage app marketplace we noted last year of 133. An extensive third-party ecosystem is one of the key advantages of cloud native products and we believe critical to Xero’s success in the small business space. Sage is now closing this gap.

- High-quality management and a blueprint for running a true SaaS business. Motivated staff with quality working environments is a key feature of successful technology companies. Intacct is in the top 50 SME places to work in the US in 2019 on Glassdoor, with its CEO achieving one of the highest employee approval ratings in the US. This management team has been retained and brought into senior management positions at Sage. For instance, former Intacct CEO is now Sage Chairman of Mid-Market Solutions; Intacct’s CTO is now Sage Group’s CTO. We believe this is a turning point for Sage as it empowers staff that have already built a high-quality SaaS business to do the same with the wider Sage group.

Exhibit 4: Sage Intacct User Interface

Source: Sage Intacct Webinar 19 March 2020

- Growing R&D expenditure and disposal of distractions. Leveraging Intacct’s expertise, we expect Sage to grow annual R&D expenditure by 45% to £320m by FY’23e, representing ~13% of sales. While this still lags Intuit’s current levels, this will be accompanied by a more focused product offering, removing the drag on maintaining legacy products. Currently, 50% of Sage’s revenue stems from a mix of >100 products. However, management is already consolidating offerings and disposing of non-core products, such as Sage Pay and its Brazilian operations to refocus attention on core markets of Europe and North America. Sage Financials, Sage’s own cloud native mid market offering, has been sunset in favour of rolling out Intacct, for instance.

- Throwing money at the problem is not always a solution. Despite the gulf in expenditure with Inituit, Sage’s small business applications are still competitive: G2 reviews place Sage’s 50c and cloud native products at an average of 3.8/5, compared to Quickbooks’ equivalent offering at 4.0 and Xero at 4.3. Per Exhibit 3, Xero’s expenditure illustrates an astronomical budget is not essential to build high-quality products, although we acknowledge Xero is not burdened with the need to support legacy products. Hence, we believe a targeted and well-utilised R&D budget of ~13% of sales can suffice to produce competitive products, now the playing field has evened with the Intacct acquisition. A key test of this will be Sage’s FY’20 launch of a professional version of its cloud native Accounting product, which we believe will take lessons learnt from Intacct and narrow the gap in functionality with cloud native competitors in the smaller business segment.

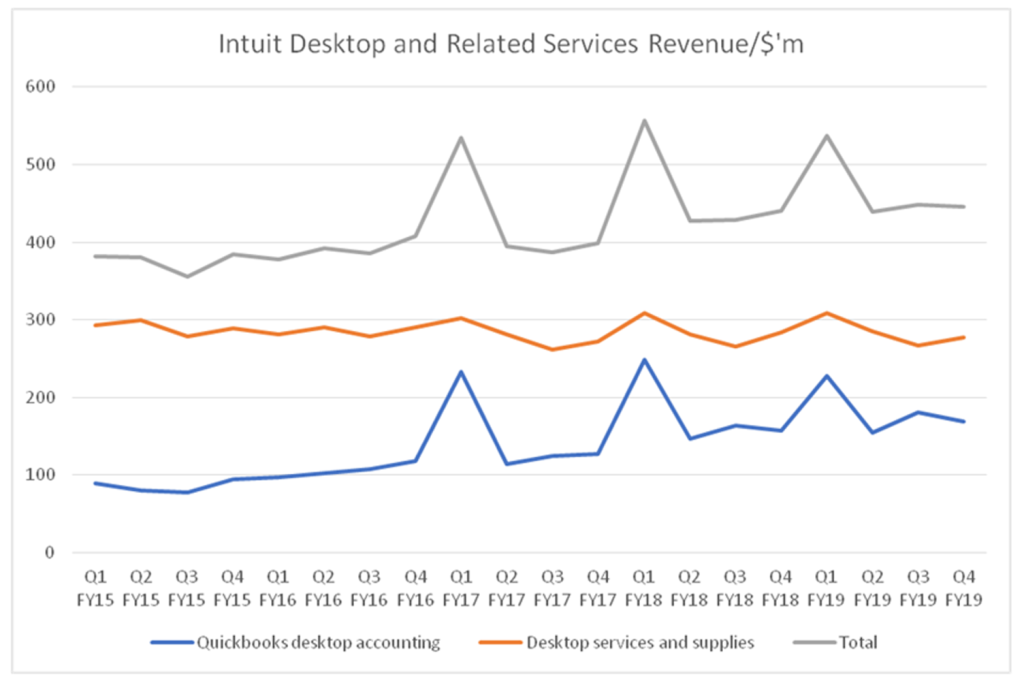

- Cloud connected still has a place for medium and larger businesses. We were concerned Sage had spent R&D resources building a suite of ‘cloud connected’ versions of its popular desktop products (e.g. Sage 200c). These are not fully cloud products, but rather software which allows synchronisation between different installed versions, still requiring the user to download software onto the relevant device. This removes some of the benefits of cloud, notably around having a single live dataset and frequent, iterative software updates. However, there is clearly still demand for such desktop-based products, arguably due to their familiarity to accounting professionals and security concerns around where data is stored. Exhibit 5 highlights how Intuit’s QuickBooks desktop sales are still a growing part of the business, having risen from $476m in FY’14 to $732m in FY’19.Arguably, Sage’s cloud connected product caters to this demand and should be seen as more than a just a quick fix or halfway house for customers eager for cloud native.

Exhibit 5: Intuit Still Sees Growth in Its Desktop Product

Source: Intuit Quarterly Factsheets FY’15-’19

Trapped Customers Buys Time

For medium and larger businesses, customer stickiness should not be underestimated. While it has become easier to transfer accounting systems, with several specialist data transfer companies offering to hand-hold businesses through the process, it remains hugely disruptive. Alongside retraining often reluctant staff, multiple migration companies cited several weeks to three months to complete migrations smoothly for medium sized businesses. This is a costly endeavour to ultimately improve a non-directly revenue-generating function. Exhibit 6, a negative review for Sage 50c, demonstrates that despite a painful experience with the product, the customer believes it just is not worth the hassle to switch platforms. Clearly this is a not a sustainable method of retaining customers, but it does illustrate Sage has time to invest in its product offering.

Exhibit 6: Negative Sage 50c Review Illustrates That Trapped Customers Buys Sage Time to Improve Product

Source: G2 (Accessed March 2020)

The Long Ladder of Customer Upsell

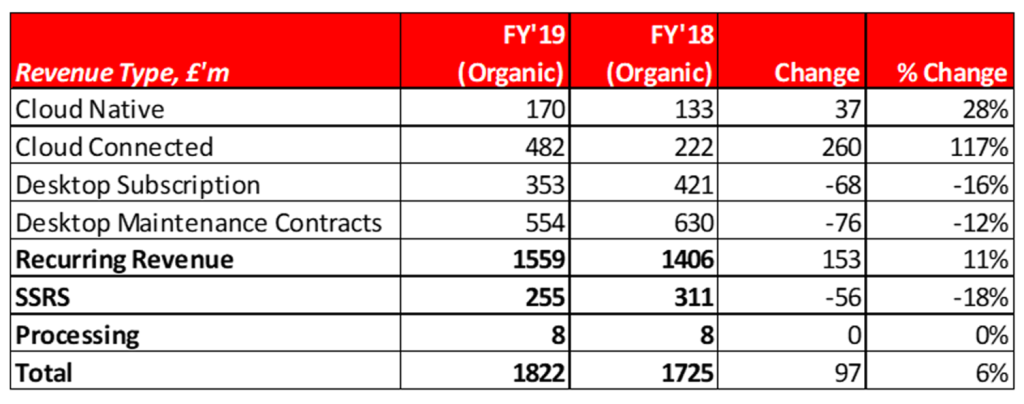

Sage’s incumbent position means it already has a significant installed base to continue to upsell. Per Exhibit 7, ~60% of recurring revenue comes from fully desktop products, 85% of which has a clear path onto either a cloud connected or native product. This could represent ~£215m in additional annualised revenue just from moving these existing customers onto cloud connected. This is broken down into:

- £35m from converting desktop subscribers to cloud connected. £350m in FY’19 revenue related to users on the subscription model, but using less feature-rich desktop products. These typically attract 10% premium moving onto cloud connected.

- £80m migrating those with a perpetual licence but paying for a support and maintenance contract. £550m in revenue still derives from in this bucket. As these are transitioned to cloud connected, they attract ~15% premium.

- £100m from customers that had purchased a perpetual licence but have no current contact with Sage. This assumes a reengagement rate of 25% to an installed base of ~700k customers, signing up at £600/year.

Exhibit 7: Sage’s Revenue by Product Type

Source: FY’18 & FY’19 Results Presentations, FY’18 Annual Report, January 2018 CMD

Cash Washes All Sins

With cash conversion consistently >95% and estimated FCF generation of ~£580m by FY’23e, representing a 9% yield, the business has lot of options.

- It can maintain an attractive dividend policy yielding at least 3%.

- Sage can use further M&A to accelerate cloud product transition. Despite the acquisition of Intacct in FY’17, Sage has a relatively modest net debt balance of <£400m, representing <1x EBITDA. As this continues to fall towards a £850m net cash position by FY’23e, management has options to continue to acquire their way out of any product deficit.

- The business is an attractive target for private equity, and we highlight KKR’s acquisition of Australian accounting software firm MYOB.

Alongside a £250m cash boost from sale of Sage Pay, such a cash generative business with strong a balance sheet is exactly what investors will look for to weather current market turmoil.

COVID 19: Sheltered, but Not Immune

With a share price decline of ~30%, Sage has been relatively sheltered in recent weeks as investors seek refuge in the business’ >80% recurring revenue base. While we could see an uplift of customers keen to transition to cloud products to allow remote working for their finance teams, this will be outweighed by a weakened economic environment where upgrading or changing accounting platforms will not be a top priority for businesses. Hence, whilst existing revenue is relatively secure and we could even see a reduction in churn (~14%), it does mean a greater drop in SSRS revenue and reduced growth rate of recurring revenues than currently indicated by management. Given near half the year has already transpired we believe in line with management’s expectations, we expect SSRS revenues to decline 14% in FY’20e and recurring revenue growth reaching 4-5%, compared to 8-9% currently guided by management. This is clearly dependent on the duration of business disruption and the level of smaller business which may cease trading altogether, although we highlight only ~20% of Sage’s revenue derives from business with <20 employees. Ultimately, we see this as a shorter-term headwind that is reflected in the ~30% fall in share price.

Valuation

- With increasing investment in product, we estimate revenue growth accelerating to 8% by FY’23e, driven by growth in recurring revenue of 10% offset by continuing declines in SSRS ~11% per annum. This means £2.4bn in revenue by FY’23e (FY’19: £1.9bn).

- With underlying operating margins reaching a trough of 22% in FY’20e, we expect operational leverage from this revenue growth, alongside a greater share of the business migrated to subscription, to deliver an FY’23e underlying operating margin of 26%, representing £636m (FY’19: £448m).

- On 22x net income, excluding amortisation of acquired intangibles, alongside an estimated £2bn of free cash generation (including disposals), we reach our target price of £11.10, representing ~100% upside.

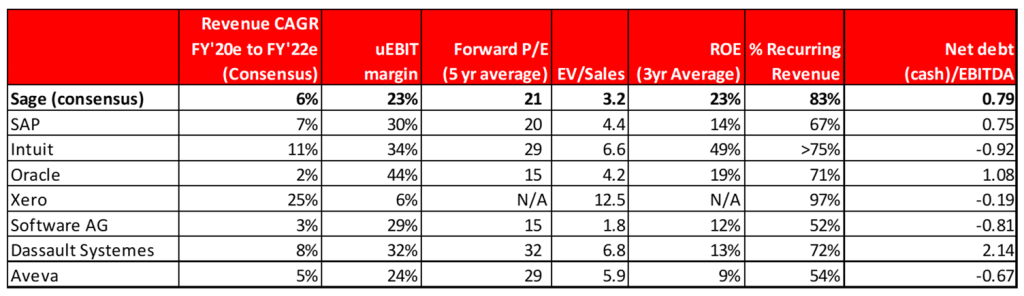

- Per Exhibit 8, we believe 22x is reasonable in context to peers and an appropriate multiple for a business that, by FY’23e, can achieve 26% operating margins with a 93% recurring revenue base and >20% ROE whilst delivering >8% top line growth. Sage’s forward P/E on a five-year average is 21x and a slight premium to this is justified given the perception shift that will occur alongside earnings growth as the business cleans up its product portfolio. We also note the shares traded on 23x before February 2020, despite 45% of sell side analysts holding a sell recommendation. An £11.10 valuation implies a 4.8% FY’23e FCF yield.

Exhibit 8: Sage’s Valuation in Context

Source: Company Annual Reports, Bloomberg (Accessed 24 March 2020)

Conclusion

Sage has all the ingredients to be one of the best businesses in Europe with a large, sticky installed customer base and high-margin and capital-light business model in an 8% underlying growth market. Mismanagement under the previous CEO stalled the SaaS transition and created a toxic culture which is rapidly being reversed by new management. Combined with a best-in-class product acquisition in Intacct, Sage now has all the tools to accelerate its transition with a clear prize: a £12bn business with a 10% growing recurring revenue base producing >26% operating margins.

Hence, we initiate with a Strong Buy recommendation with £11.10 price target, representing ~100% upside.