Recommendation: Short (No Change)

Price:

€--

3m ADV:

$20m

Price Target:

€--

Market Cap:

€6.5bn

Forecast Return:

~50%

Ticker:

AG1 GY

Investment Thesis

- Glorified used car dealer, shares overpriced on market belief it will be a scalable digital platform, and is a ‘de facto’ winner.

- Increase in capital-intensity likely which could pressure returns and balance sheet. Long-term economics, in our opinion, could be less attractive than expected.

- Intense competition likely due to low barriers to entry and massive private capital flows into the space.

- High risk to near-term earnings expectations given marketing & cost investments and European used car environment.

We update clients following the Q3’21 results. We now expect Auto1 to lose twice as much money next year compared to street expectations. Aside from the issues created for share prices by earnings downgrades, we believe it may unsettle investors within a year of the IPO. The stock was presented for IPO based on expectations of growth alongside a rapid decline in operating losses, with a scaling of margins in the mid-tern, which may not transpire.

With the stock at a market cap of €7bn, in an immature and competitive industry, we believe there is significant downside.

We Cannot Understand Consensus FY’22

According to Bloomberg, street consensus EBITDA for Auto1 next year (FY’22e) is -€93m, compared to current company guidance this year (FY’21e) of -€114m (-2.5% EBITDA margin at mid-point of €4.5-4.6bn revenue guidance). Our estimate is that an outcome of -€200-250m (FY’22e) is possible based on the following analysis;

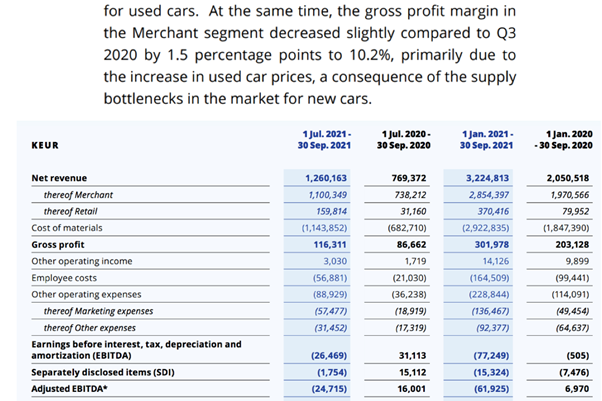

- Gross margin could decline next year: Revenue growth has some risks to the upside given the strong used car pricing environment, but gross margin may present negative risk. Street consensus of €6.1bn revenue (Source: Bloomberg) could be beaten given the recent revenue guidance raise and increase in used car prices. However, on our analysis the FY’21e guidance implies a weak gross margin in Q4’21e driven by mix towards Autohero (currently a 2.5% gross margin business) and, more importantly, a sequential decline in Merchant in Q4’21e (from 10.2% to 9.6% sequentially, and down 160bps YoY). The company trumpets increased gross profit and GPU increases in the financial report, but the gross margin development is negative (‘primarily due to the increase in used car prices, a consequence of the supply bottlenecks in the market for new cars’).

- Opex is exploding: Personnel and marketing expenses essentially tripled YoY in Q3’21, which means EBITDA deteriorated by €40m, despite a €30m gross profit increase. Operating expenses into the IPO in 2020 were unsustainably low given cost cutting in the COVID environment and FY’21 guidance implies an even larger EBITDA loss in Q4 (~€50m) with an associated step-up in expenses. We would expect all expense lines to increase significantly in FY’22e, driven by the annualization of the structurally-higher cost base alongside ongoing investments in marketing (building Autohero brand), supply chain & logistics, and refurbishment capacity.

- EBITDA loss could double: Even with good revenue performance, we expect the two factors described here lead to a reasonable conclusion that EBITDA losses could more than double next year, whilst the street expects a material reduction in losses. As Auto1 is a recent IPO, we believe street models may not yet reflect accurate quarterly modelling or detailed consideration of cost lines – rather, they may simply ‘hard code’ an expected EBITDA margin.

The company, and their backers, had high incentives to promote a story of shrinking losses during the IPO process, but the adverse outcome described here raises questions around the validity of the current valuation.

We acknowledge that building a digital-winner platform requires heavy spending for a large long-term prize, and this made Auto1 an exceptional private investment for early backers. We also know that some stocks (e.g. Delivery Hero, Hellofresh, and Ambu) under our coverage can be driven by top-line, with investors that can look through poor short-term profitability performance.

However, we believe in the case of Auto1 the core business is the Merchant division, which does not have the highly-scalable and exciting economics of the D2C platform, Autohero. Furthermore, a high valuation was achieved in the IPO and insiders have been selling shares (as described in the previous note), which means risks to the share price are more asymmetric to the downside.

Exhibit 1: Gross Margin Pressure, EBITDA declines, Higher Expenses

Source: Auto1 Q3’21 Report

In future notes we will dive deeper into Autohero, which we believe supports >50% of the current group valuation. The market expects a rapid scaling of volumes from 40,000 (FY’22e guidance) to ~400,000 (FY’25e). These growth ambitions may be difficult to achieve given the need to build marketing and logistics capacity (e.g. refurbishment centres could act as a capacity limit) and potential competition.

Cash Burn

We see higher risks in the cash-flow statement after Q3’21 and we note the following on the cash-flows;

- Increasing cash burn: We estimate free cash flow has deteriorated QoQ to ~-€115m, which is significantly below reported net income of -€35m, driven by the increase in net operating assets (trade receivables and inventory). Depending on inventory build, we estimate another -€140m cash burn in Q4’22e. At the current burn rate, the company only has another 4-6 quarters of cash on the balance sheet, although step-ups in ABS borrowing against inventory can provide the capital bridge to some extent.

- Inventory build drives capital intensity: Inventory increased by €103m sequentially (revenue increased by €195m), reflecting the build-up of Autohero’s inventory offering to customers and the higher used car prices. The company drew €95m from the ABS programme for inventory financing.

- Receivable and capex growth: The company recognised €21m non-current ‘trade and other receivables’ (relating to instalment plans in Germany) and current ‘trade receivables’ have increased by €55m this year. Capex remains at a low level (€5m per quarter) but is likely to increase materially in FY’22e as the company builds refurbishment capacity.

At the time of the IPO, we believe investors questioned why Auto1 was raising so much primary capital. We now see cash-flow developments as supportive of our negative investment thesis. We expect Auto1 to become a capital-intensive business, with an increasing inventory position related to the Autohero brand, which raises financial risk.

Conclusion

We are early in coverage of Auto1 and reiterate our Short recommendation with a €16 price target. Given the business is loss-making, and cash-flow negative, we find it hard to value the company.

We received feedback from clients that ‘Auto1 could be the Carvana of Europe’ because it is a leading platform in a large used car market. For reference, Carvana has a market cap of $50bn. Auto1 has a market cap of $8bn meaning investors already attribute quite a high (~20%) probability to that scenario. Auto1 will face stiff competition from well-funded players such as Cazoo and Cinch, whilst it is possible Carvana enters Europe in the future. Furthermore, the European car market cannot be seen as one scalable market place due to language, currency, and legislative barriers, and used car prices are significantly lower than in the USA on mix (meaning lower GPU in the business model).

We believe it is far too early to attribute a high valuation to Auto1 based on a low-probability scenario (that Auto1 is the clear winner in European used cars), sometime in the future. For now, the company has escalating EBITDA losses, and cash burn. We see scope for significant estimates disappointment in the next year, and there is execution risk on the scaling of Autohero that is not reflected in the share price.