Recommendation: Short (Initiation of Coverage)

£--

$20m

EV/EBIT

£--

£2.0bn

15x

~60%

BOO LN

Investment Thesis

- We see Boohoo’s business model as unsustainable and investors are not adequately discounting the significant risks to the business model and expected growth.

- We forecast EBIT margins to decline from 8% to 4% over the next three years as the costs of goods increase.

- Our primary research indicates the cost of manufacturing is likely to increase materially over the next several years.

- Boohoo’s lack of pricing power means it cannot pass these increased costs onto customers. Gross margins and returns on tangible invested capital are already declining.

- We see Boohoo’s sales reaching a ceiling as consumer habits are changing and fast fashion becomes increasingly unfashionable.

- Numerous accounting and corporate governance red flags merit a much lower earnings multiple.

Boohoo has been a stock market darling with its test-and-repeat fast fashion model that allowed it to grow from £67m of sales in 2013 to £856m in 2019, with the majority of this coming through organic expansion. However, Boohoo has all the core ingredients of a good short: an unsustainable business model, signs of slowing growth, and numerous corporate governance concerns. In this note, we outline why we are initiating today with £0.77 target price and 60% downside.

Boohoo’s agility has been a key component of the tremendous success of its test-and-repeat fashion model, turning inventory quickly and responding to what works —in some ways comparable to Zara’s business model (no current recommendation) but to an even greater degree. Nonetheless, there are now significant risks to Boohoo’s model that are not being priced correctly by investors and ultimately will lead to pressure on both margins and growth.

We would like to make it clear that this note is not a criticism of all UK-based textile suppliers; however, we expect the UK textile industry to come under increased scrutiny in the coming years due to unsustainable working practices by some of the industry. Broader ESG factors are likely to pressure share prices if companies cannot show best-in-class business practices.

Margins Are Unsustainable

We believe there is a high probability that manufacturing costs will rise and cause margin pressure. We see Boohoo’s manufacturing costs rising by at least 10% because its supply chain is unsustainable. We forecast at least a 10% increase in manufacturing costs over the next few years, resulting in a 4% reduction in gross margin and a 50% reduction in EBIT.

Boohoo manages to sell clothing at below peers’ pricing, yet realises a very high 57% gross margin (excl. wholesale) — implying Boohoo either has a structural cost advantage, or is undertaking potentially risky sourcing practices that other retailers are not.

We Do Not Believe Boohoo Has a Sustainable Cost Advantage

Boohoo manufactures a large proportion of its clothes in the UK, which should, in fact, lead to a cost disadvantage relative to peers. This UK-based manufacturing is essential to its rapid test-and-repeat business model. Boohoo states that UK manufacturing accounts for just over 40% of its supply base (Exhibit 1).

However, we ordered 41 items of clothes and 75% of them were manufactured in the UK, according to the tags on the items. There are two possible explanations for why the results of our small sample size differed:

- The items we ordered were biased towards UK manufacturing

- The press release should not be read as 40% of production is UK, but rather that of Boohoo’s suppliers, 40% of them are UK-based. However, IR did say on a call with us (13 August 2019) that less than 50% of the garments are made in the UK.

UK-based manufacturing could be considered as a positive, but in Boohoo’s case we see it as a high-risk activity for two reasons:

- Boohoo manages to sell clothes very cheaply and still generates substantial gross margins (57% excl. wholesale). Given labour is such a large component of the total cost of manufacture (as discussed below), we find it hard to reconcile this with the fact that we believe it manufactures a large proportion of its clothes in the UK, where wages are high.

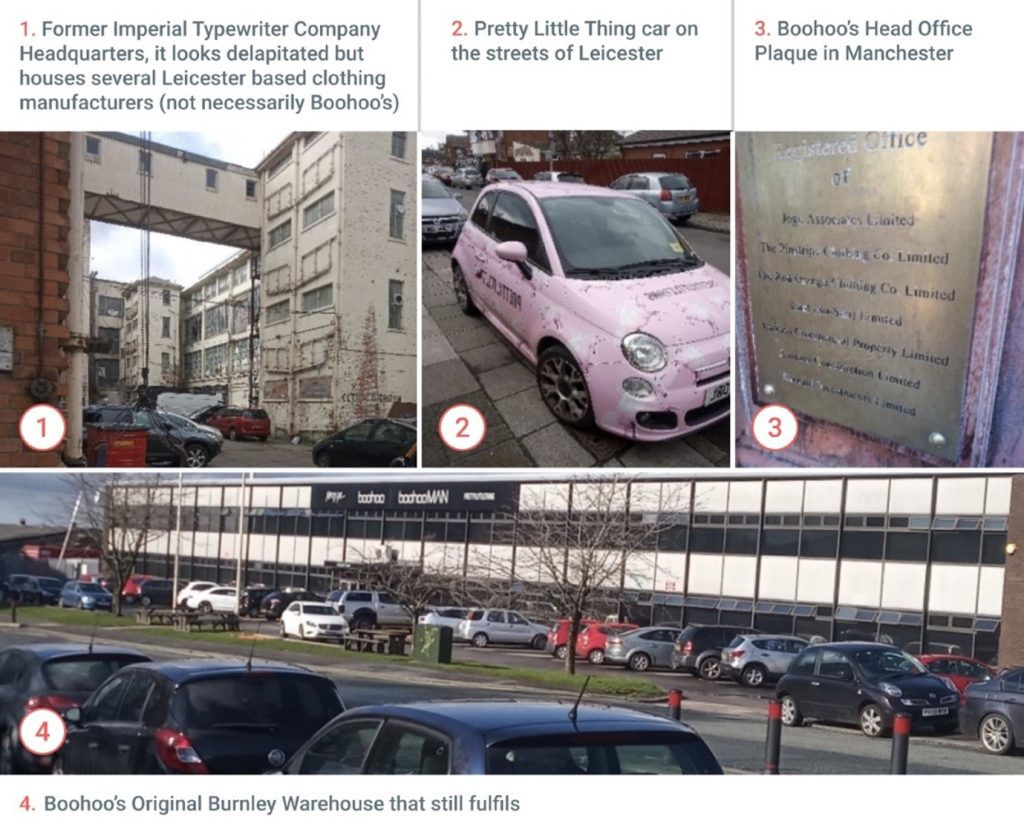

- We believe Boohoo’s suppliers are largely concentrated in Leicester. Our on-the-ground research suggests there is a very high fragmentation of Boohoo’s supply base, with much of the supply base employing a small number of people and manufacturing small quantities. This makes auditing the suppliers a challenging task.

Exhibit 2: Some Snaps from Our Primary Research in Leicester, Manchester, and Burnley

Source: The Analyst Lens (26 & 27 February 2020)

A study by the University of Leicester in 2015, commissioned by the Ethical Trading Initiative, echoed our concerns relating to both registered factories and smaller unregulated production units in Leicester. The study concluded the majority of the city’s garment workers were paid below the national minimum wage, did not have employment contracts, and were subject to intense and arbitrary work practices. Interestingly, Boohoo is not a member of the Ethical Trade Initiative, whereas almost every major clothes retailer is (including ASOS (short recommendation), H&M, Inditex, New Look, Primark, M&S, and River Island – all no current recommendation).

Our conversations with several senior industry veterans highlighted that several of the industry members could not understand how Boohoo is able to source clothes so cheaply.

Why Should Manufacturing in the UK Cost More?

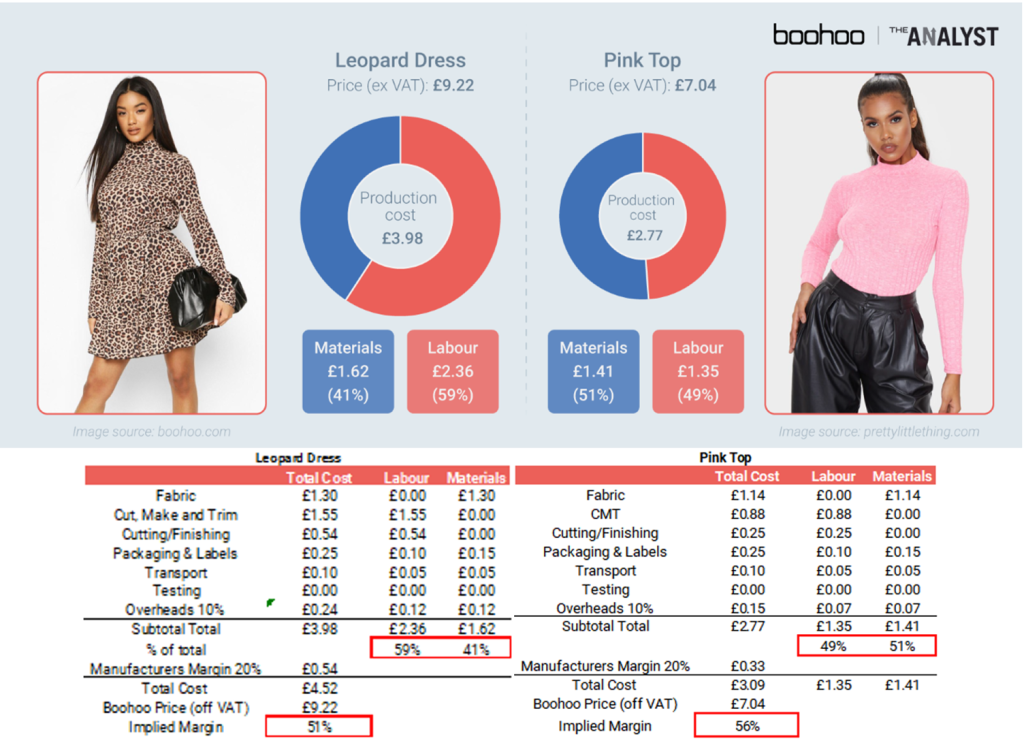

We had two independent manufacturers help us break down the cost of a dress and jumper for us to help us understand how much of the item cost is labour, how much is raw material, and what gross margin we would estimate Boohoo generates on the item. This is important to understand as the greater the labour component, the greater the cost of manufacturing in the UK relative to obtaining supply from lower cost countries (like most high street retailers do). From this costing exercise, we estimate ~50% of the cost to manufacture is labour.

Exhibit 3: Our Estimated Costing of Boohoo’s Items

Source: Costings from Two Manufacturers

In summary, we see Boohoo’s supply chain as unsustainable and manufacturing costs are likely to rise as Boohoo comes under increased scrutiny. Unless Boohoo does either of the below, we see the manufacturing cost rising by at least 10% and EBIT margins declining from 8% to 4%:

- Increase the pricing of their clothes, which we do not believe they can (discussed below) as we do not believe Boohoo has pricing power.

- Increasing supply from lower cost countries, but this could destroy the test and repeat business model that has given Boohoo its success so far.

Changing Consumer Habits Limit Growth

In the past several years, Boohoo has very successfully satisfied the desire of many twenty-somethings for an ever-changing wardrobe of clothes that can be worn for short periods of time (e.g. a night out or special event) and then discarded. The Guardian recently highlighted the lack of use the average fast-fashion dress gets: ‘On average, such dresses and other products are discarded by consumers after five weeks’. Boohoo’s customers are highly price-sensitive and want the latest in-vogue designs (stimulated by social media marketing) at ‘pocket money prices’.

Whilst some view the move to sustainability and ethical clothing as a middle-class trend, we tend to disagree. The economics are simple enough: wearing a £10 clothing item 5 times then replacing it is more expensive per use than wearing a £50 item 50 times (£2 per use versus £1 per use). However, whilst that maybe true, Boohoo’s customers thus far have desired newness over durability — but we believe the tide is changing.

McKinsey’s The State of Fashion 2019: A year of awakening highlighted the extent of this growing trend of ethical fashion, reporting the growing popularity of Certified B Corporations (businesses that balances purpose and profit) amongst Gen Z (demographic cohort succeeding Millennials i.e. Boohoo’s target demographic).

Although only anecdotal, our recent visit to Shoreditch (an incubator for growing trends) highlighted this. Patagonia, the epitome of a B Corporation, is very much in vogue with 1 in 7 people wearing Patagonia-branded clothing. Although privately owned, its strategy appears to be working, judging by industry commentary. We believe the brand’s strong ethics and sustainability are driving its significant success.

This growing popularity of sustainability is backed up by third-party market research, with Gen Z increasingly putting more effort into finding environmentally-friendly clothing than Gen X. The number of respondents from this specific report who put effort into finding clothing that was labelled environmentally friendly was:

- Gen X (born 1965 to 1980): 28%

- Gen Y (born 1980 to 1995): 35%

- Gen Z (born 1995 to 2010): 36%

As the demand for sustainable fashion grows, Boohoo, with its fast-fashion and potentially unsustainably-produced products, will likely face decreased growth.

Boohoo Does Not Seem to Have Pricing Power

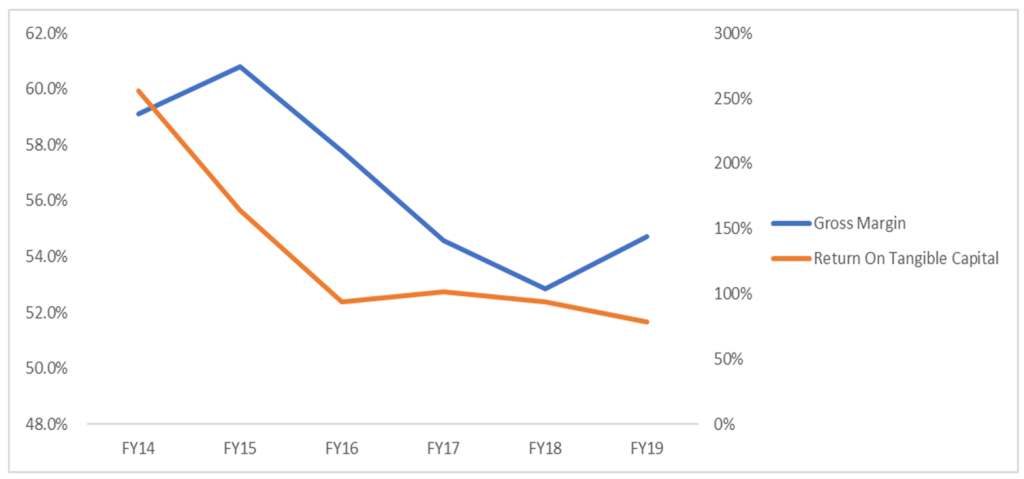

Boohoo’s current gross margin and ROIC seems to suggest a company that has pricing power, although we believe it does not. The trend for both gross margins and returns on invested capital actually suggests a business model already under pressure and generating unsustainable ROIC. Historically, customers have only cared about getting the latest fashion at the cheapest price. This was highlighted by our primary research, with every participant seeing Boohoo’s customers as fickle and phenomenally price sensitive.

This is important because if our hypothesis on Boohoo’s manufacturing cost increasing is correct, we do not see Boohoo being able to pass on these increased costs to consumers.

Exhibit 4: Gross Margin (LHS) and Return on Tangible Capital (RHS)

Source: Boohoo Accounts and The Analyst Estimates Adjusting for Constant WC to Sales (Completed March 2020)

Accounting Concerns

We have several core concerns when analysing Boohoo’s accounts:

- It appears that Boohoo is becoming more dependent on accruals and banks to finance its business model, despite having a large cash balance (£207m at H1’20).

- Boohoo’s subsidiary filings for the Boohoo brand suggest a business model under pressure with declining profitability.

1. Increasing Financing from Suppliers and Banks Despite Large Cash Balance

Boohoo, like ASOS, has seen an increasing trade and other payable to sales ratio that is not coming from paying the clothing suppliers late, given Boohoo’s generous payment terms (14 days, Exhibit 6). Furthermore, it appears that subsidiary Pretty Little Thing (PLT) recently received financing for its inventory from HSBC bank, which could be some form of reverse factoring. This is surprising given Boohoo has a large reported cash balance of £207m at H1’20.

The core driver of the increase (above sales growth) in trade and other payables appears to be coming from the accruals line, which doubled in FY’19 from £41m to £82m. The accruals line for Boohoo does not contain refund accruals and relates exclusively to invoices not received.

Exhibit 5: Trade Payables to Sales

Source: Boohoo’s Annual Reports Adjusted for Pro-Forma PLT Acquisition

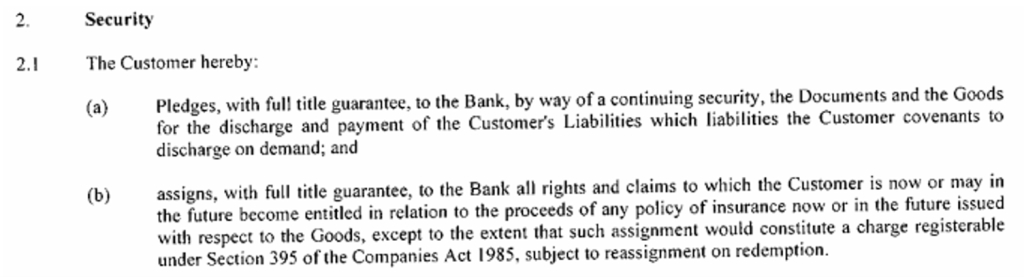

Pretty Little Thing Pledging

The Pretty Little Thing subsidiary (07352417) recently disclosed pledging for its goods to HSBC (26 June 2019); we do not know the amount, but at the very least, one of the ways to interpret this is that Boohoo is not funding growth from internally generated cash flow. This is not necessarily a bad thing, but could imply that either growth is increasing or returns on incremental capital are decreasing.

Exhibit 7:PLT Pledge to HSBC

Source: Companies House (Accessed March 2020)

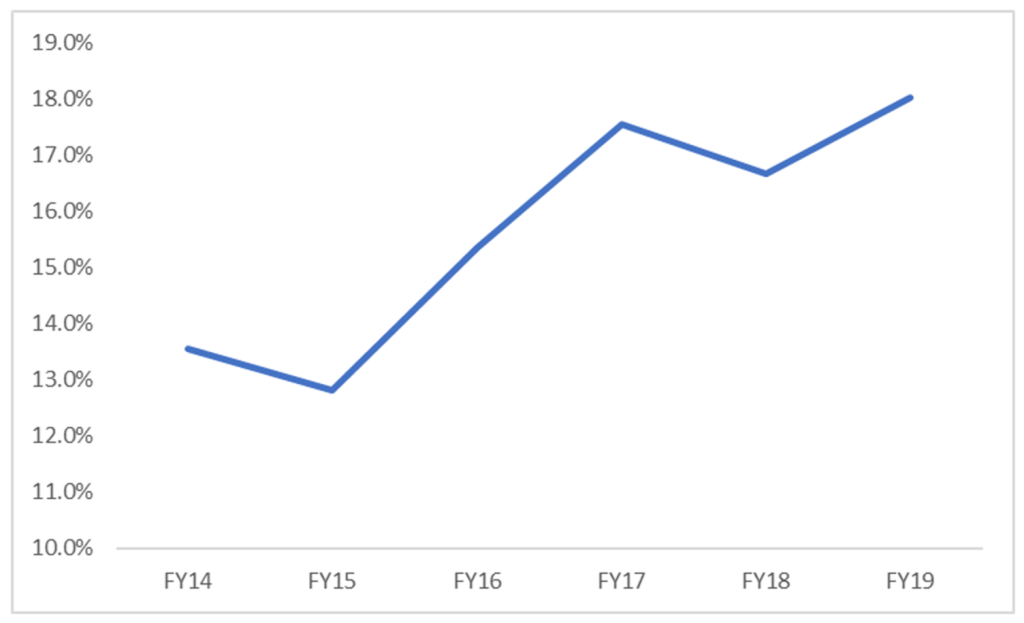

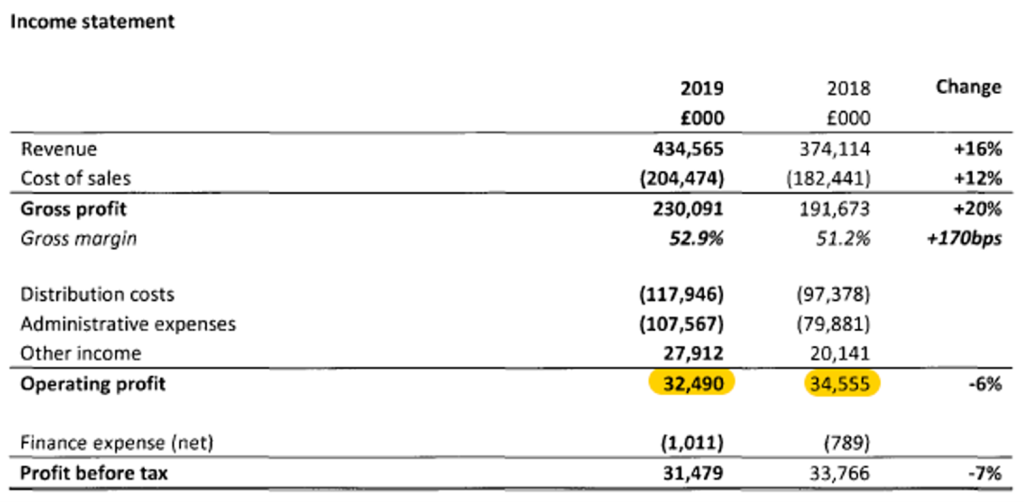

2. Profitability Going Backwards in Core Boohoo

When looking at Boohoo’s subsidiary filings, we notice worryingly that Boohoo brand profitability as reported in the filings is going backwards. We believe the Boohoo.com UK subsidiary concerns exclusively the Boohoo brand given the sales figures correspond exactly to those in the annual report.

Exhibit 8: Boohoo Brand (Subsidiary) Profit Going Backwards

Source: Companies House (Accessed March 2020)

We offer two core explanations as to why the brand profitability is going backwards:

- Core Boohoo underlying profit went backwards, and it has reached maturity. To acquire additional customers, it is having to invest more.

- The subsidiary incurred exceptional costs. Boohoo disclosed £6.7m of exceptional costs associated with dual warehousing for PLT in its consolidated statements. However, these costs were recognised in the PLT subsidiary, so unless they have been double counted, we do not believe they should be included here. In fact, Boohoo.com UK recognised a record amount of ‘other income’ from warehousing for PLT.

Corporate Governance Red Flags

Boohoo has several corporate governance red flags:

- Mahmud Kamani’s brother and large shareholder of Boohoo has sold or gifted over 80% of his shareholding and is the majority owner of similar, and competing, fast fashion businesses (LOTD and I Saw It First). Both appear to be losing cash. We are concerned that the founder’s (and former CEO) brother not only owns shares in Boohoo, but has sold shares in Boohoo, and runs a loss-making online fast-fashion business. At best, in our opinion, it implies a well-capitalised competitor willing to push growth.

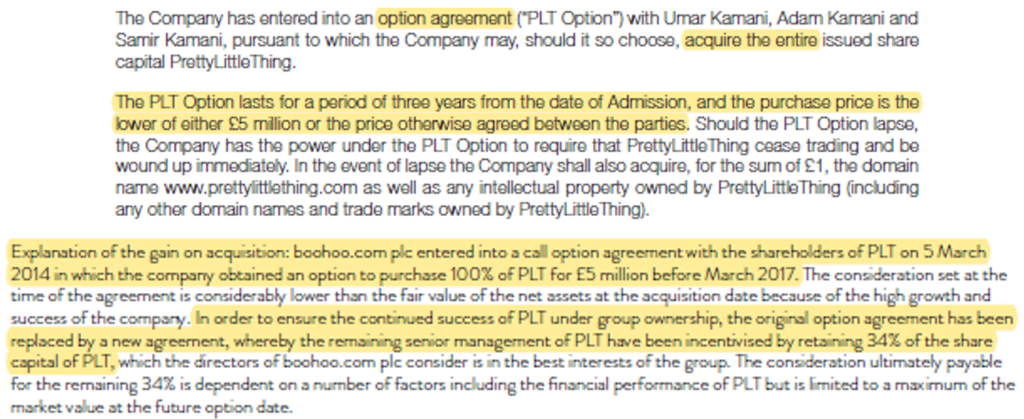

- Pretty Little Thing (PLT) was founded by Mahmud Kamani’s sons and originally Boohoo had the rights to acquire it for £5m or below at the time of IPO. This agreement was later revised with Boohoo acquiring 66% for £5m, with the remaining shares held by the sons. Boohoo shareholders may eventually end up paying a large sum to the Mahmud’s sons when this option is exercised.

- Large insider selling: The Kamanis and Carol Kane (Boohoo co-founder) have sold 200m of shares since listing.

1. LOTD and I Saw It First

Jalaludin Kamani is Mahmud’s brother. Of all the siblings, Jalaludin has sold or gifted the most of his Boohoo holding (~60m shares). We note a lot of similarities between Boohoo and I Saw It First. Not only are the two businesses run by the two brothers, but our scraping of the websites of each showed very similar products at similar pricing. We also note that both companies either directly advertise on Love Island or collaborate with Love Island contestants, another sign that they are targeting the same customers and same marketing channels. Although the businesses appear to be separate corporate entities, these observations raise the risk of deeper, possibly undisclosed related-party links. The losses incurred in I Saw It First may ultimately be funded with sales of Boohoo stock (by Jalaludin), and could mean the fortunes of the two companies are interlinked.

Exhibit 9: The Guardian Recently Highlighted the Love Island Battleground between the Brothers

Source: The Guardian

We believe over £30m of capital has been injected into these two businesses that look very similar to Boohoo. Given the prior acquisition of PLT from Mahmud Kamani’s sons, we wonder whether Boohoo may one day acquire I Saw It First.

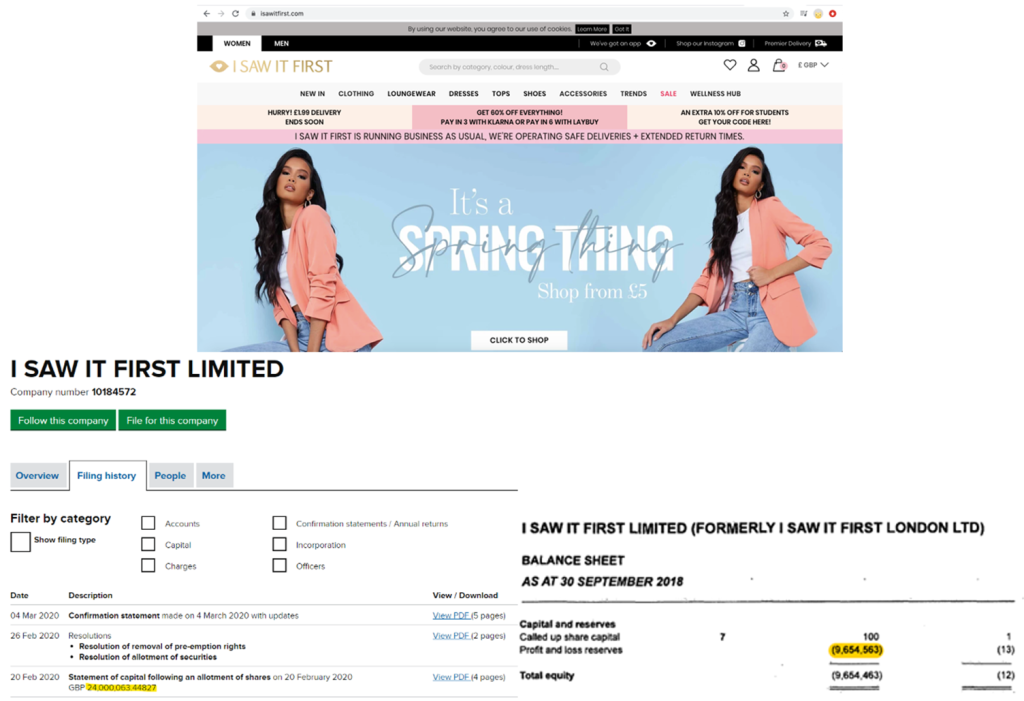

- Isawitfirst.com is still trading, according to its Companies House filings. At 30 September 2018 (Exhibit 10), it had generated a £10m loss and we believe the accounts suggest that an additional ~£24m of capital has been injected since through preference shares, suggesting it is still heavily loss-making (Exhibit 10).

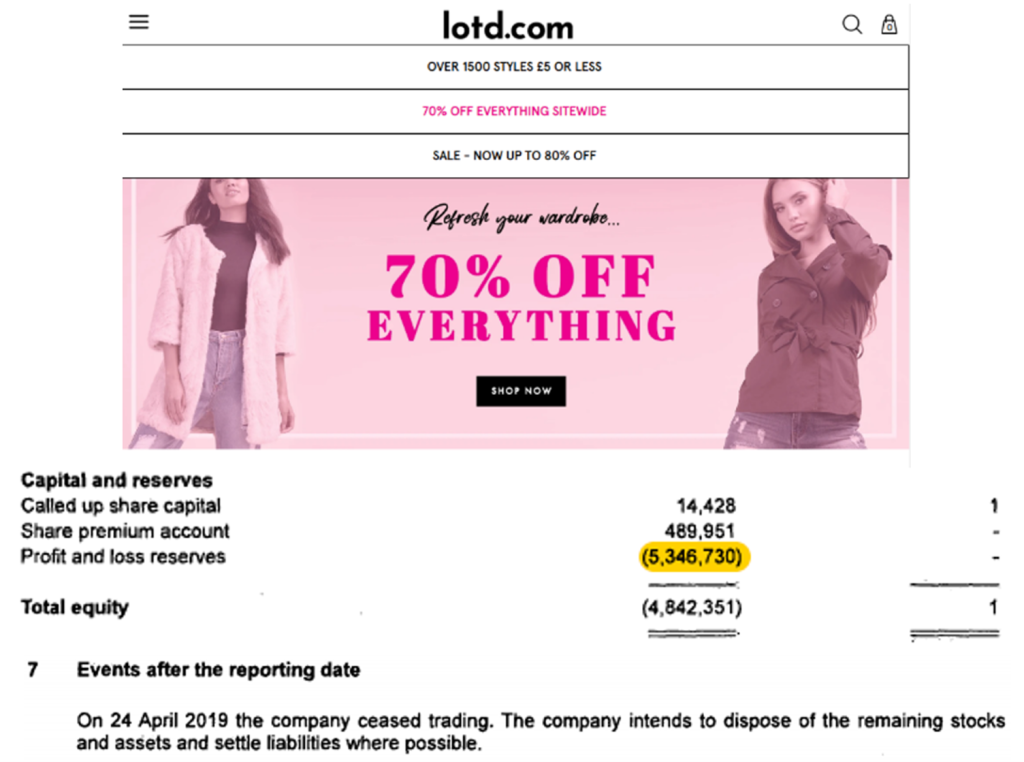

- Lotd.com was being wound down according to its 04 July 2019 accounts (Exhibit 11) with a £5.3m loss.

Exhibit 10: I Saw It First Website and Accounts

Source: Website (Accessed 30 March 2020) and Company House Filings

2. PLT Option

Before the IPO, an option agreement was entered into with Pretty Little Thing (PLT), giving Boohoo the rights to acquire PLT for less than £5m. We think this was a fair agreement given PLT was founded by Kamani’s sons, likely with the support of Mahmud Kamani. However, as PLT started to show success, the option agreement was changed, with Boohoo acquiring 66% of PLT and the minority interest owned by the Mahmud’s sons. The current value of the minority interest is unknown, but will be determined by the market value of PLT at exercise. Given PLT’s impressive reported performance, we would imagine Boohoo shareholders will be paying a large sum to Mahmud’s sons.

Exhibit 12: Original Agreement and Renegotiated Agreement

Source: IPO Admission Document and Boohoo’s 2017 Annual Report

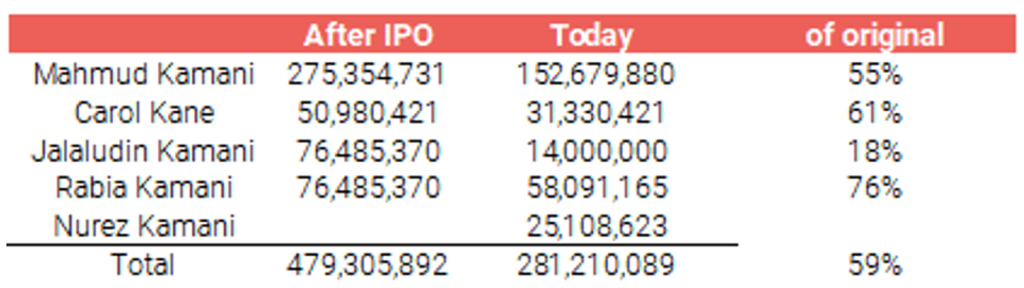

3. Kamani Family and Carol Kane Selling Down

We calculate that the Kamani family and Carol Kane (co-founder) have sold or gifted nearly 200m shares since IPO. Whilst founders selling down is not necessarily a bad thing, it could imply they consider the business over valued. Interestingly, Mahmud Kamani’s brothers and sisters had material shareholdings at IPO and have been selling down more aggressively than Mahmud. Two siblings are now below the reporting threshold of 3%; hence the figures below for current holdings could be below 281m.

Exhibit 13: Kamani and Carol Kane’s Shareholding

Source: Boohoo Filings and AGM Statements

Valuation

Our valuation for Boohoo assumes it achieves £1.5bn of sales at maturity at a 4% EBIT margin (as we see the cost of manufacturing increasing by at least 10%) and generates £60m of EBIT, for which investors would be willing to pay 15x. This implies an equity value of £900m.

Conclusion

We initiate a short on Boohoo with ~60% downside and a target price of £0.77. We have multiple concerns on the sustainability of Boohoo’s business model, sustainability of returns, accounting, and corporate governance.