Recommendation: Short (No Change)

£--

$20m

EV/EBIT (FY'22)

£--

£3.86bn

30x

75%

BOO LN

15x

Investment Thesis

- We see Boohoo’s business model as unsustainable and investors are not adequately discounting the significant risks to the business model and expected growth.

- We forecast EBIT margins to decline from 8% to 4% over the next three years as the cost of goods sold is likely to increase.

- Our primary research indicates the cost of manufacturing is likely to increase materially over the next several years.

- Boohoo’s lack of pricing power means it cannot pass these increased costs onto customers. Gross margins and returns on tangible invested capital are already declining.

- We see Boohoo’s sales reaching a ceiling as consumer habits are changing and fast fashion becomes increasingly unfashionable.

- Numerous corporate governance red flags.

- Given all of the above concerns, Boohoo shares warrant a much lower earnings multiple.

Whilst the bulls may see the recent news coverage as a short-term blip, we disagree. For us, the issues raised on the industry supply chain indicate that Boohoo’s leading online clothing margins and ROIC will not last (discussed here). Additionally, we believe the corporate governance concerns (large shareholder sales and tight family control) are significant and, as we have seen on other shorts, are often ignored until it is too late.

In this note, we summarise our findings from some laboratory testing we ran on Boohoo clothing and discuss our current corporate governance concerns. We remain short with a target price of £0.77, 70% downside from today’s price.

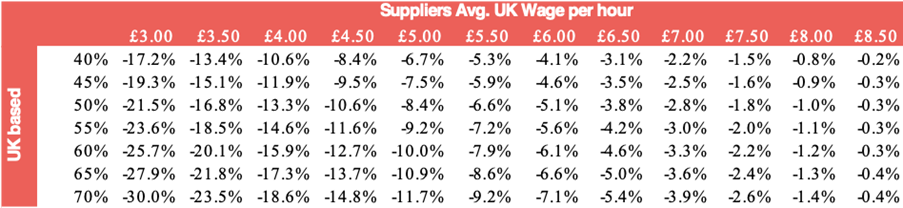

Testing: Gaps in Some Suppliers’ Chemical Compliance

In our initiation note we outlined our concerns around Boohoo suppliers and the risk associated with what we see as an unsustainable industry supply chain. As concluded by this study by the University of Leicester in 2015, commissioned by the Ethical Trading Initiative, “the majority of workers in Leicester’s garment sector earn around £3 per hour”. If this extends to Boohoo’s Leicester based suppliers, it could have significant implications for Boohoo’s 8% EBIT margins (Exhibit 1). Our analysis shows that if Boohoo benefits from UK low paid labour, the impact on earnings power could be very material as this normalises. In this note, we analyse in more detail further risks to Boohoo’s supply chain through analysing a sample of Boohoo’s products for chemical compliance.

Exhibit 1: Percentage Point Estimated Impact on EBIT Margins if Suppliers Average Wage Normalises from Level Shown

Source: The Analysts Estimate (Completed July 2020)

Background to Testing

We decided to undertake research into quality assurance as we were concerned about Boohoo’s chemical compliance with EU/UK laws given its fragmented supply chain and clothing quality. We commissioned laboratory testing on 20 items from Boohoo’s 22,000 SKUs, with the help of a consultancy with expertise in retail chemical compliance.

The results were not as clear cut as we were expecting, with plenty for the bulls and the bears. For the bulls a fail rate of only four fails on 109 tests implies relatively good compliance across the supply base as a whole and in line with the sector. For the bears, although small in number, the severity of some of the failures does highlight notable gaps in some of the suppliers’ diligence and compliance in sourcing safe raw material.

We utilised a third-party laboratory to run the tests and a total of 106 tests were conducted on the 20 items of clothing. We specifically targeted items that are considered higher risk, e.g. clothes that are dyed using specific colours, footwear with certain plastic, jewellery containing nickel, etc.

Brands have a responsibility to ensure suppliers are following the laws on restricted substances and should be running ongoing testing programmes to ensure adherence. It is not possible to test all products, but a reputable clothing retailer should be undertaking tests on 1% of its SKUs, targeting the items that are considered high risk. We estimate the cost of annually running compliance testing would be ~£2m for a company of Boohoo’s size. Those who choose not to operate testing programmes run the risk of breaking EU/UK laws, facing brand damaging news commentary, and product recalls. Only recently did several news outlets cover a story of an alleged Pretty Little Thing clothing item causing an adverse reaction to a customer.

Exhibit 2: Items Tested

Source: The Analyst Lens (June 2020)

Test Results

To have carried out 106 tests, on 20 products, with just four failures does demonstrate a high level of compliance across the supply base as a whole (see Exhibit 2 for detailed breakdown on the testing failures).The number of failures is comparable to what would be expected for other clothing retailers. However, although few in number, the seriousness of the benzidine (azo dye) and the extremely high levels of phthalate presence on the two trainers (which would be likely to trigger potentially brand damaging public recalls), does suggest that there are notable gaps in some suppliers’ diligence and compliance in sourcing safe raw materials.

Exhibit 3 explains the failures, how they would normally be dealt with according to the seriousness of not meeting EU standards, and the risk to consumer health.

Exhibit 3: List of Testing Failures

| Product | Reason for failure and EU Legal Standard | Interpretation of Result |

| Ruffle Hem Polka Dot Mesh Mini Skirt | Presence of benzidine (azo dye), known carcinogen above legal limit. EU maximum limit 30 mg/kg. Actual test result 41.9 mg/kg. | Azo dye failures are extremely rare. To put it into perspective across the whole EU over the last 16 years we have only found 175 cases submitted of azo dye failures in Safety Gate. The EU utilises Safety Gate to alert consumers in member states about dangerous non-food products posing a risk to health and safety. Item would typically be retested twice to confirm results. If confirmed fail, the retailer would need to advise trading standards and expected to implement a public product recall. |

| Colour Block Leopard Print Chunky Trainers | DIBP, a phthalate (plastic softener normally used in PVC), is present at an excessive 250 times the regulatory limit of 1,000 mg/kg. This is a listed substance of very high concern in REACH legislation, although only officially banned from adults’ products from 07 July 2020. | Given the magnitude of the failure (250x the legal limit), a public recall would be likely in our opinion. DIBP has been listed for many years as an unsafe chemical because it has disruptive effects on human reproduction if it reaches the mouth or gets into the body in other ways. |

| Holographic Panel Chunky Sole Trainers | DEHP, a phthalate (plastic softener normally used in PVC), is present at 30 times the regulatory limit of 1,000 mg/kg. This is listed as a substance of very high concern in REACH legislation, although technically only officially banned from adults’ products from 07 July 2020. | Given the magnitude of the failure (30x the regulatory limit), a public recall would be likely in our opinion. |

| Mixed Stud & Hoop Earring Pack | Nickel was detected at 0.9μg/cm²/week. With the legal limit of 0.2μg/cm²/week, this is over four times the legally permitted maximum for a post assembly in an earring. Nickel can trigger severe skin reactions which, once triggered, can become permanent and irreversible. | The first step would be a retest at two other independent labs to verify the result, to check if all the three labs were consistent in their findings. If all equally exceeded the legal limit, the retailer would need to implement product withdrawal from sale, due to the known risk to customers who have sensitive skin and its noncompliance to REACH standards. |

Source: Independent Testing Laboratory and The Analyst

Summary of Corporate Governance Concerns

We have numerous concerns on the corporate governance at Boohoo. The key points are as follows:

- Risk associated with the Kamani family’s (and associates’) business interests across the fast fashion industry

- Insider buying small relative to the money cashed out

- Questions of independence on review

- Tight control by the Kamani family

1. Risk Associated with the Kamani Family’s Business Interests

The Kamani family and business associates have ownership of multiple companies across the fast fashion industry in Leicester and Manchester outside of Boohoo Plc. In our experience across industries, it is unusual, but not unheard of, for a family to own so many businesses across an industry value chain. We show in the table below (Exhibit 4) some instances of Kamani family companies supplying to or competing with one another in the fast fashion industry. Although perhaps not surprising, given that before founding Boohoo the Kamani family supplied clothing to high street retailers, we believe this creates various corporate governance risks that require careful management at Boohoo plc board level.

The most significant ownership across the fast fashion industry value chain appears to be by Jalaludin (Jalal) Kamani, brother of Mahmud, former Boohoo senior manager and large shareholder who owns real estate in the space, a competitor (I Saw It First), and a fast fashion supplier (J&L). Mahmud, his children, and his other siblings also have extensive ownership of real estate and other businesses. We list several businesses in Exhibit 4 that appear to have links to either Boohoo or the fast fashion industry and the Kamani family. The Kamani family also own further businesses that appear to be unrelated to Boohoo or the fast fashion industry (based on Companies House filings and our research), so we do not list them in Exhibit 4.

Exhibit 4: Businesses Connected but Not Owned by Boohoo

| Business | What do they do? | Ownership |

| J&L (Leic) | Clothing manufacturer based in Leicester. We do not know whether it supplied Boohoo. | 50% of ordinary equity owned by Jalal Kamani, in addition to £3m of preference shares. |

| I Saw It First/LOTD | Appears to be a heavily lossmaking competitor of Boohoo. We estimate cumulative losses including LOTD (its predecessor) of over £30m. Discussed further here. | £24m of preference shares owned by Jalal Kamani and a large proportion of the ordinary shares. |

| Morefray and Revolution Painting Co | Former suppliers to Boohoo that were subject to the Sunday Times expose. | Jointly own by a business associate of Jalal Kamani with the holding entity address registered to The Robert Street Hub, a co-working space owned by Jalal. Discussed in more detail here. |

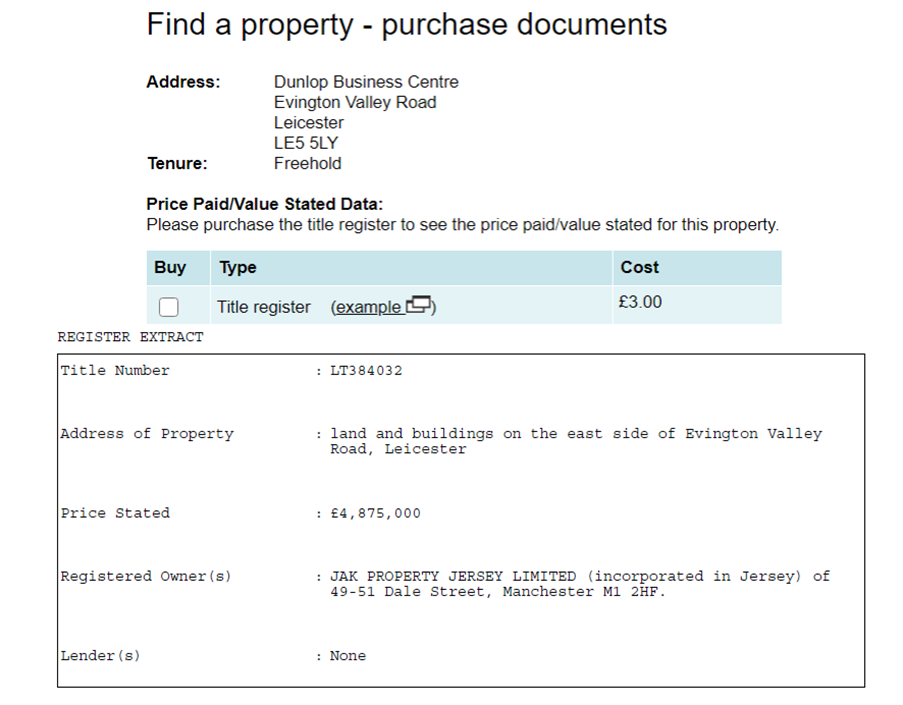

| Dunlop Business Centre | Andrew Bridgen (Leicester MP) cited this building, in an interview for LBC, as an example of locations where sweatshops exist. | Owned by JAK Property Jersey Limited (Appendix) with a registered address as Boohoo’s Headquarters. |

| Kamani Commercial Property | Leases real estate to Boohoo and PLT. Boohoo income statement contained £889k of depreciation for right to use assets with respect to the property leased from Kamani Commercial Property in FY’20 (Source: Boohoo FY’20 Annual Report). | Owned by the Kamani Settelment Trust. |

| Kamani Construction Limited | Construction company. £270k of purchases in FY’20 made by Boohoo (Source: Boohoo FY’20 Annual Report). | Owned by Kamani Commercial Property. |

| The White Cube Creative | Creative company. £65k of purchases in FY’20 made by Boohoo (Source: Boohoo FY’20 Annual Report). | Mark White, husband of co-founder Carol Kane. |

Source: Companies House, Boohoo’s Annual Report

2. Insider Buying Small Relative to Money Cashed Out

On 16 July 2020, it was disclosed that Mahmud Kamani and Carol Kane bought £15m shares. Relative to the £143m they sold on 09 December 2019, we consider this purchase relatively small, and even immaterial when considering it relative to the total £538m (estimated) cashed out by the Kamani family and Carol Kane from May 2017:

- £400m of share sales since May 2017. We calculate the equivalent of £400m of share sales based on 166m shares sold by the Kamanis and Carol Kane since May 2017 (from regulatory filings and AGM statements) at an average price of £2.40.

- £138m cash paid by Boohoo to Umar Kamani to acquire his minority interest in PLT. In total, Boohoo paid £269.8m to PLT minority owners (85% Umar Kamani and 15% Paul Papworth); £161.9m in cash and £107m in Boohoo shares subject to a lock-up.

3. Questions of Independence on Review

Boohoo announced further details on 28 July 2020 about the independent review that it commissioned. The announcement and review have been seen positively by the market; however, we would have preferred if a firm other than TLT LLP ran the independent investigation, as TLT LLP is listed in Boohoo’s annual report as Boohoo’s solicitors. The firm recently advised on the acquisition of Oasis and Warehouse, the appointment of John Lyttle in late 2018, and the acquisition of Boohoo’s 66% stake in Pretty Little Thing.

4. Boohoo Tightly Controlled by the Kamani Family

With Mahmud Kamani as Group Executive Chairman, Umar Kamani as CEO of PLT, and Samir Kamani as CEO of BoohooMAN, the structure and management of Boohoo is akin to a private, family run business. Since IPO, shareholders have been handsomely rewarded for this organisational structure and given the business was cofounded by Mahmud, this is perhaps natural. However, the tight family control of operations is unusual in a listed company of this size and could pose a corporate governance and operational risk.

Conclusion

Appendix

Exhibit 5: Summary of Chemicals and Compounds Tested

Name of chemical/metalCategoryWhy is it banned or restricted in the EU?Why would it be present?

| Azo dyes | Textiles | Some can split at molecule level in processing and be carcinogenic on contact with the skin | Widely used chemical, but certain ones are banned |

| AEPOs | Textiles | Toxic to aquatic life and some suspected cases of damaging human fertility | Used illegally in some detergents, especially in low standard wet processing mills in China |

| Phthalates | Plastics/PVC | Adverse health impacts including hormone disruption and reproductive and developmental issues | There is a risk that PVC may be substituted for polyurethane. Polyurethane normally uses safe chemicals for softening |

| Lead, cadmium, arsenic, mercury | Accessories | Lead and mercury both have high acute toxicity Arsenic and cadmium are both carcinogens | Once used in pigment dyes and coatings, but now substituted by safer materials; risk that some suppliers still use them |

| Nickel | Jewellery | Skin sensitisation and allergic reaction on sensitive people due to direct and prolonged skin contact, or in piercing use, e.g. the post of an earring, hence they should not be used in jewellery of all types Effectively banned in EU and UK | Provides high level of shine in metals, but other means should be used for consumer protection |

Source: Land Registry (Accessed July 2020)

Exhibit 6: Ownership of Dunlop Business Centre

Source: Land Registry (Accessed July 2020)