Recommendation: Short

€--

$250m

€--

€13.5bn

~~

WDI GY

Investment Thesis

- Fraud allegations and press reporting on Indian acquisition highlight the risk of significant loss to investors. Company’s public responses do not allay fears and the lack of detail on the internal investigation alongside the extension of police investigations in Singapore and India increases risk. Audit signing and results on the horizon for 25 April 2019, with the shorting ban scheduled to end 18 April 2019.

- Roundtripping risk is higher than previously considered due to ecosystem of undisclosed associated companies in Singapore and India — specifically, corporate relationship with Emerging India, Bijlipay, Senjo Payments, Qtail, and Goomo Orbit Travel.

- Gross debt balance of €1.3bn, €505m of risk in working capital, and concerns on €651m of historic acquisition spending. These are large items in the context of Wirecard’s current cash flows which can severely impair the equity value.

- Longer-term concerns on competitive pressures in payment processing and challenges in reconciling Wirecard’s presence in the real world with the management’s promotional commentary.

- Due diligence visit to India failed to discover evidence of meaningful business operations.

Chennai is the centre of Wirecard’s Indian operations. In light of the unrelenting negative media coverage in the Financial Times (FT), which highlights critical concerns for shareholders, we undertook some of our own investigative work. Far too much desk-based research is being pushed into the debate, whilst we wanted to challenge our negative inclinations by looking at Wirecard’s on-the-ground presence in India.

Wirecard is a highly divisive company — the company reports and sell-side supporters would have it that press reporting is unfounded, defamatory, and/or informed by unidentified ‘bogeymen’ in the form of short-sellers or hedge funds. To that end, a series of responses from the company have sought to allay investors’ concerns about potential fraud, money-laundering, roundtripping, audit quality, compliance performance, accounting, partner networks, and management complicity. We find the company’s responses broadly uninformative, resorting to general repudiation of concerns rather than providing openness and debate, engaging the opposition, and providing additional detail regarding the responses. The internal investigation performed by lawyers R&T and an unnamed forensic firm left more questions unanswered, and we await further information from Singapore law enforcement. We are unsure why the full-year results would be delayed by three weeks if there have been no material consequences. An audit process should work in parallel to other investigations, and since Wirecard believes it has answered all concerns, why are results delayed?

Much of the analysis is desk-based, both on the buy-side and amongst the extensive and bullish sell-side analyst community. Our strong suspicion is that most of those passing comment have not taken measures to independently verify allegations. We would like to have an open conversation with shareholders or analysts who have travelled to Chennai and India independently, if there are any.

We sent an investigative accountant to Chennai, India for one week to provide us with independent verification of Wirecard’s Indian-Chennai operations. This researcher speaks the local language, Tamil, and has vast business, accounting, and financial experience in several multinational organisations, including ones with interest in India. His experience also spans into exchange businesses such as MoneyGram and credit card businesses such as Vanquis Bank and other investment banks.

The Indian operations cost Wirecard shareholders at least €330m, whilst the company’s Asian operations (including the large market of India) are used to justify between half and two-thirds of the value of the company. With Wirecard’s market capitalisation at €12bn, we hoped to find operations consistent with a €5bn+ company. We briefed our investigator to have an open mind, with the mandate to seek to disprove our own negative biases. He failed to do so. At least in Chennai, Wirecard has minimal operations and no visible presence in the payment industry, other than the small head offices.

Exhibit 1: Wirecard Provides This Overview on Its Website for India

Source: Wirecard Website, Accessed on 28 March 2019

Summary Findings

- In multiple visits to shopping malls and travel agents, we found no evidence of the iCASH card; we did not find anybody that had heard of it, knew it, or accepted it in the locations we visited. We did not find any merchant that used Bijlipay terminals. We found no evidence of the existence of Goomo Orbit.

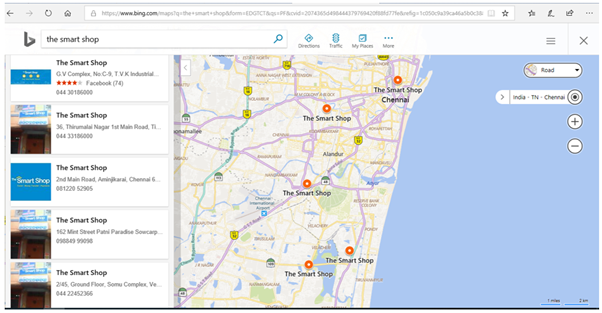

- Hermes lists five smart shops on its website in Chennai. A key feature of the product is the claimed integration of ecommerce into physical retail through top-up through local shops. No shops exist at the locations provided by Wirecard on the Hermes website and we were unable to find smart cards or top-up cards.

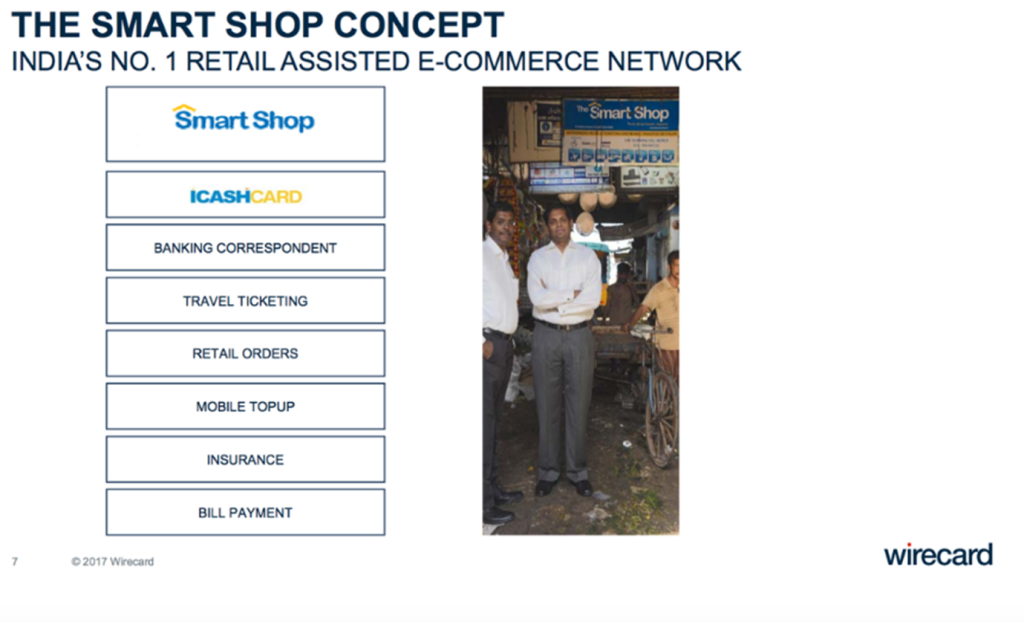

- In 2017, Wirecard claimed that iCASH and Smart Shops were ‘India’s No.1 Retail Assisted E-Commerce Network’ – we beg to differ.

- Wirecard/Hermes clearly appear to be on guard for investigative researchers. Our researcher was followed back to his hotel in an intimidating manner.

- Staff at multiple banks were unaware of Hermes iCASH card wallets and prepaid cards. Hermes suggests there are payment slips at bank partners; this does not appear to be the case. We found no options to use, or evidence of, iCASH cards at Metro stations, or any Wirecard presence.

- In contrast to Wirecard, we found that Moneygram, Western Union, Weizmann, Ingenico, and Verifone are highly visible in the area and at merchants. Most payment terminals belonged to Verifone and Ingenico in the stores we visited.

- Head offices are small, disorganised, and poorly staffed, not indicative of a significant professional payment organisation.

- Hermes and GI Technology operate at the RMZ Business Park in Chennai. They operate on the third floor of building 3B with an open plan office with space for 30-50 desks — up to half were occupied. The office was not busy and we were not provided any assistance. Our researcher was followed by two men out of the office, with one pursuing his rickshaw on a motorbike. Enquiries were later made at our hotel, which were highly suspicious.

- GI Retail still operates at Guindy, Chennai and is now a petitioner against Wirecard in the Madras High Court. This is the former parent of Hermes. No one at these offices was willing to help us in our enquiries.

- Star Global operates in Nungambakkam, Chennai. Its so-called ‘head office’ is a 60-square-foot shop with two cabins and apparently four employees. Wirecard signage was visible in the shop and on the money slip. We were made unwelcome when the manager was informed of our presence, and we left. Wirecard lists a new head office for this business in Bengaluru – perhaps a more substantial presence could be verified there.

- Goomo is moving, or has just moved, office to a new address that is not consistent with the address listed on its website. The office was messy and incomplete. The manager we spoke to informed us that Wirecard had put capital into the business and assisted financially. There seemed to be four staff members at this location. The head office is in Mumbai, which may explain the shambolic presence in Chennai.

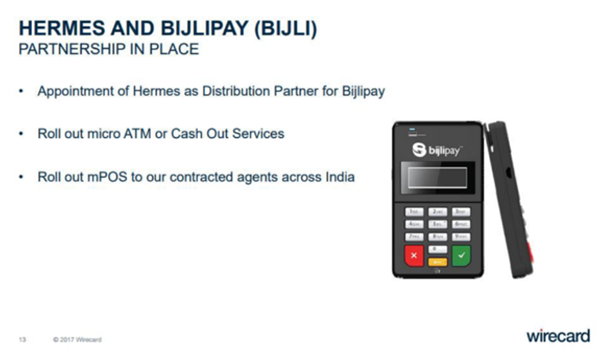

- Bijlipay/Skilworth/Qtail is described as disrupting the market and adding thousands of merchants, enabled by Wirecard. Bijlipay occupies the top floor of a building housing several small, mainly freight, businesses. The office was not busy and we were not offered any assistance.

- SR Batliboi/E&Y, CNGSN, and Kuriachan & Nova are three audit firms that have dealt with Wirecard and its predecessors. They all operate offices in Chennai. None were willing or able to assist in our enquiries, suggesting their resignation letters would provide additional insight into the changes of audit in India.

- We found no trace of Wirecard’s physical operation in Chennai other than the registered head offices, where possible internet activities could take place. A business of this size must have a more substantial physical exposure in its home city and we could not understand what, if anything, Wirecard bought in 2015/16 for ~€330m. If Wirecard is a wholly online operation in India with white labelled products, then we see a number of possible explanations:

- Wirecard has, since acquisition, removed all physical presence from Chennai, which was the original centre of the acquired business.

- Wirecard never had a physical presence in the area in the first place.

- Wirecard products and services are present elsewhere in India, but not in Chennai (same for Bijlipay).

- We should, therefore, repeat our investigation for other major Indian cities.

We let the pictures below tell the majority of the story.

Exhibit 2: Wirecard’s Claims Are Not Consistent with the Evidence in Chennai

Source: Wirecard 2017 Introduction to India Presentation

Exhibit 3: We Could Not Find the Hermes Smart Shop or the iCASH Card in Chennai

Source: The Analyst Lens

Exhibit 4: Our Researcher Went to All Addresses and Could Not Find SmartShops

Source: The Analyst Lens

Exhibit 5: Wirecard Head Offices Were Not Indicative of Sizeable Payments Companies

Source: The Analyst Lens

Exhibit 6: Wirecard and Bijlipay Have Close Relations in India According to Company Sources

Source: Wirecard Investor Presentation

Exhibit 7: The Bijlipay Solution

Source: Wirecard Website, Accessed 04 April 2019

Background to the Trip

- Most of Wirecard’s purchased companies and associates started in Chennai with registered headquarters and audit offices in the city. This was home of GI Retail, which sold assets to Wirecard via the brief ownership of Emerging Markets Fund 1A in Mauritius.

- Wirecard acquired assets of GI Retail in Hermes, GI Technology, and subsequently another entity called Star Global in late 2015. Wirecard subsequently profiled its distribution partner Bijlipay in investor presentations. The entity that sold these assets to Wirecard also invested in Goomo Orbit Travel, as outlined in our last note.

- Bijlipay has close links to Qtail and Skilworth and appears to be a recipient of loans from Wirecard as well as a key partner for technology development and mobile point of sale systems in India. Therefore, we extended our investigation into this business.

- Wirecard continues to claim it is a leading, fast-growing player in the Indian payment and ecommerce market. Investor and sell-side analyst excitement about the company’s growth in India supports a large portion of the current valuation and hope for the future.

Conclusion

We have a Sell recommendation, as the German regulator has banned short selling until 18 April 2019. On the back of these incremental findings, we advise all clients to exit Wirecard stock immediately.