Summary

- We hosted a stock-picking dinner where the Analyst team made brief pitches of potential new longs and shorts.

- Our conversations were mainly focused on restructuring and turnaround situations, and the ability of ‘self-help’ to prevail.

- In this note, we publish details of these pitches as ‘food for thought’ for clients.

- We welcome client input at this stage of ideation.

Note: This note summarises an internal stock-pitching exercise. The ideas pitched do not represent active ideas under coverage and may run contrary, or complementary, to existing recommendations. The potential investment cases reflect an unproven, early-stage hypothesis on which further due diligence is required. There is no assurance that any idea in this report will lead to an initiation or recommendation from The Analyst.

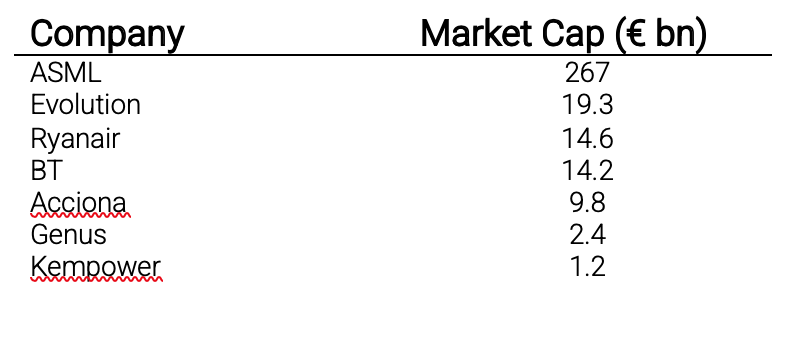

Ideas Discussed

Share prices and market data are correct as at 22 November 2022 and sourced from Sentieo. All forecast numbers in this document are Sentieo consensus and, unless otherwise stated, all reported historic figures are sourced from company filings.

ASML

- The world’s leading provider of lithography equipment for cutting-edge chip production. Operating in a growing semiconductor market, that could double by 2030 to $1.3tn. ASML has had a revenue growth from 2016 to 2021 of 22% CAGR, a PE of 30x FY23E. Average PE of the last 5 years is 38x.

- Semi industry sales growing faster than previous decade with semi end market expected to grow at 9% through 2030.

- The stock has been down 30% YTD.

- The company has guided to grow at around 13 to 21% CAGR growth, upgrading its 2025 guidance at the recent CMD from €24bn-30bn to €30-40bn.

- A new share buyback program to be executed by December 1, 2025. Intention to repurchase shares up to €12 billion.

- ASML is considering M&A to meet strong demand for its machines as countries battle to build domestic chip plants.

- Consensus sitting at lower end of guidance.

Potential Investment Case

Growth – potential entry opportunity in one of Europe’s highest quality franchises.

Evolution Gaming

- We closed our Short recommendation on Evolution on 21 October 2022. Our investment case combined what was, at the point of initiation, a premium valuation with concern over the majority of earnings coming from unregulated markets. At the point of our drop, the valuation had normalised while news of regulatory action was absent. The risk to the short was always the track record and prospective growth profile of the business.

- Revenue growing ~+35% in a structural growth global business. Online gaming appears to be an entrenched trend and live is an arguably superior product.

- Evolution dominates the industry, potentially a winner-takes-most industry due to quality and range of game offers, uptime/streaming reliability, and positive economics for customers to share costs with others.

- 62% operating margins can rise, business is doing €1bn annualised free cash to equity and has net cash.

- Stock trades on 14x FY’24e PE with 30% CAGR in EPS growth.

Potential Investment Case

Structural growth story now on a reasonable price versus regulatory/ethical risk due to their exposure to unregulated markets?

Ryanair

- Upshift in pricing. 25-50% upside in pricing is still easily affordable – €40 to €50-60 average price per ticket is a signal to low cost airline industry.

- Competition in disarray on balance sheets, limiting operating flexibility.

- Ryanair’s fuel-efficient aircraft widen structural advantage and increase ESG angle relative to peers.

- Aviation recovery from Covid continues with RPKs in Europe remaining below 2019 levels, and showing resilience against consumer weakness, however this remains a risk.

- Stock is valued 9x March 2025 PE

Potential Investment Case

Cyclical opportunity?

BT

- Deep value – Trades on 6x 2023E P/E, 10x EV/EBIT FY2023. A significant discount to other mainstream European telcos.

- Highly levered with net debt twice market cap, but potentially manageable at 2.5x EBITDA.

- Stock has sold off heavily on the back of the shift in the yield curve, but no imminent maturities and shift in interest costs essentially in the price.

- Two thirds of revenue is index linked or better, allowing for passthrough. Revenue and debt are approximately of the same magnitude.

- Q2 2022 may have reflected a turning point, with growth in revenue and EBITDA, and management signalling a return to growth and FCF generation, with further gains after 2026 when the FTPP rollout completes. Investors may be sceptical of management’s optimism against a track record of essentially stagnating revenue and EBITDA, together with heavy ongoing capex needs.

- Having cut the dividend in 2021 due to COVID-19 concerns and a need to invest, a resumption of a progressive dividend may also provide a positive catalyst.

Potential Investment Case

Deep value with a catalyst?

Acciona

- Complex Spanish conglomerate with a mix of long-term asset operation, construction, and other operations. Management repositioning investor perceptions that the company is an ESG specialist.

- €5bn net debt normalised relative to FCF €200m.

- Cost of debt increasing dramatically. 50% of gross debt is floating on the gross, with a sensitivity that 100bps on increase in rates eliminates 10% of net income.

- Potential for over-earning having benefitted significantly from energy prices on renewable generation with profits +~50% from normalised levels. On these earnings, the stock is on 20x 2023 P/E and EV/EBIT of 14.3x, but with risk of looking very expensive if energy prices normalise or excess profits taxed.

Potential Investment Case

Potential accounting risks due to high leverage and contract accounting?

Genus

- Genus is a UK biotechnology company specialising in selling genetically superior semen and embryos for artificial insemination for dairy and beef cows, and also swine.

- The stock has underperformed materially due to the depressed Chinese Porcine market.

- R&D of £67.1m reflects 11.3% of sales, with the majority of the R&D going into continual improvement. The company has a unique library of IP.

- Valuation: Headline 2023E P/E of 32x is low relative to the company’s history, but also based on depressed earnings. The consensus for 2025E reflects a more normalised level of profitability and the valuation drops to just 21.7x. An earlier reversion in the Chinese market might be possible.

Potential Investment Case

Potential fallen angel?

Kempower

- EV-charging equipment industry is now completely overhyped in Europe and listed players are warning (e.g. Compleo Charging, Pod Point). We have a Short on Alfen.

- Kempower is a DC-charging business in Finland, that span out of a family-owned welding-equipment business (Kemppi Oyj).

- €1.3bn market cap for business with €33m revenue/quarter = 10x annualised revenue multiple.

- Gross margin of 46% and operating margin of 7% do not suggest business can be super profitable – company target is 10% in 4-6 years’ time.

- The market for EV-charging equipment is growing rapidly and in the short-term experiencing some component constraint, but is also heavily competed by players whose competitive technology advantage appears limited. There are low barriers to entry, and it is easy and cheap to add capacity. Kempower has just €19m PPE on balance sheet and spent €0.9m on R&D in H1.

Potential Investment Case

Potentially overhyped?