Summary

- We update our ‘stock MOT’ tool with fresh data to identify the highest scorers per our 34 screening criteria.

- We review the European universe of non-financials with >€1bn market cap for potential red flags clustered around: 1. balance sheet, 2. business model, and 3. governance.

- Our criteria try to spot situations where there is an increasing gap between market expectations and underlying economics.

- We look into incentives that could push management to front-load earnings, using techniques like accelerated revenue recognition. We try to spot how this can be manifested in the financial statements (e.g. bloated working capital, expense capitalisation, slower cash conversion).

- A good short usually combines: 1. a challenged business model in a sector that faces softer margins, 2. problematic corporate governance, and 3. a debt-laden balance sheet which is difficult to service.

Following another quarter of results and new screening criteria, we update our Short Screen. This screen scores stocks based on how many red flags they hit in our categories of balance sheet, business model, and corporate governance.

This note highlights potentially interesting short ideas by showing:

- Our top 30 scorers which hit the highest number of our screening criteria out of the European non-financials universe, with market caps over €1bn and liquidity greater than $5m/day;

- Companies with relatively high retail trading volumes per Tradegate Exchange;

- Recent issuers on the Schuldschein market, a red flag highlighted in previous notes;

- Companies audited by higher risk audit partners, and;

- The most crowded and growing commercial shorts in Europe.

Please note we have no current recommendation on the stocks covered in this note, unless specifically mentioned.

The Top 30 Scorers

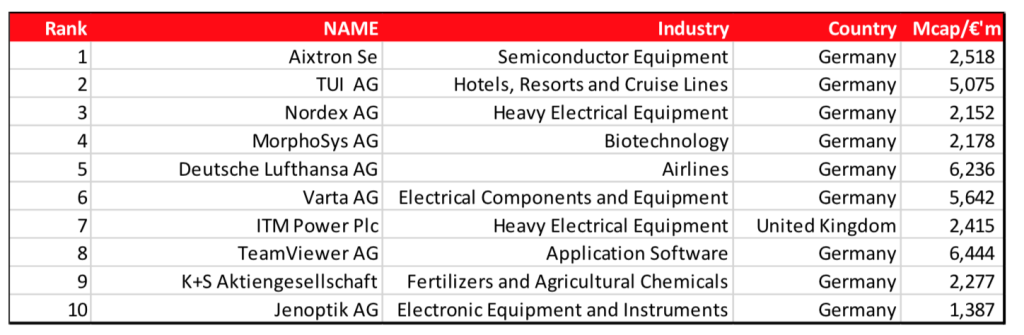

Exhibit 1 summarises the 30 companies that hit the most red flags on our updated screen, representing the highest scoring ~5% of non-financial companies in Europe with >$5m/day liquidity and >€1bn in market cap.

Exhibit 1: Top 30 Scorers

Source: The Analyst, Bloomberg

Webuild

Having rebranded from Salini Impregilo in May 2020, this €1.9bn Italian construction group resurfaces on our top 30 list as:

Business model and balance sheet: Lumpy earnings are dependent on contract accounting, and revenue has been declining since FY’16. 15% of total revenue in FY’20 derived from gains on bargain purchases and other income which may contribute to the €52m in ‘other non-monetary’ items that boosted the P&L in FY’20. Arguably, the acquisition and recent ramp up in ownership of Astaldi—which has its own difficult past having filed for bankruptcy protection in 2018—reduces comparability of the financial statements and brings with it a sizeable €832m in contract assets. We believe this is an elevated risk for a company that has been cumulatively FCF negative since FY’15.

Corporate governance/other: Given a development strategy that ‘aims to increase employment and work in Italy and other countries where [they] work’ we question whether interests are fully aligned with shareholders. Alongside mostly local brokers currently covering the name, this may be an interesting time to investigate the name further.

Swatch Group

This CHF17bn watch manufacturer hits our top 30 as:

Balance sheet: while the company enjoys a net cash position, FY’19’s inventory balance of CHF 6.9bn represented >80% of revenue, and this balance remains high at CHF6.3bn at 2020 with CHF3.3bn of this relating to finished goods.

Business model: lacklustre top line performance of -0.6% CAGR between 2015-19, with arguably high operational gearing that has contributed to operating margins falling ~5% to 12% in the same period. With structural mid-priced watches arguably going nowhere, the pressure on top line may persist longer term, and margins could face pressure from accelerated investment in digital watches. Combined with an equity story highly dependent on success in China, we believe the 19x FY’23e P/E multiple may be demanding.

Corporate governance/other: with the CEO and CFO holding their positions for over a decade, there is evidence of entrenched management who may be reluctant to address the structural pressures. Alongside the shares recovering since an initial COVID-19 decline, this could be an opportune moment to dig deeper.

Sacyr

This €1.4bn Spanish company has broad revenue streams across over 20 countries—from construction services and facilities management to concession operations. The latter is the largest segment, accounting for ~50% group EBITDA. It hits our top 30 as:

Balance sheet: a €5.6bn in net debt balance places the business on >7.5x EBITDA. While >80% of this relates to project financing, the business is reliant upon contract accounting for revenue recognition from construction projects largely in the higher-risk markets of southern Europe and LatAm. We also note €506m of the €2.1bn gross trade and other receivables balance, relates to ‘other receivables’, which has increased 26% on FY’19. This is alongside impairment on receivables overall, rising sharply by 78% in FY’20 to €198m, as well as a sizeable €410m provision balance.

Business model: Sacyr has been cumulatively FCF negative for the last three years and has struggled to exceed a 1.5% return on assets. We also note other operating income accounts for ~7% of revenue and non-controlling interests accounted for >65% of total consolidated net income in FY’20.

Governance/other: Manuel Cecilia is the CEO and chairman and is a founding member of the business, providing evidence of management entrenchment. Sacyr is also one of the sell side’s most loved stocks in Europe, with >90% of analysts holding a buy recommendation.

Veolia

This French €15bn liquid water, waste, and energy conglomerate reaches our screen as:

Business model: the low growth business that has struggled to deliver >1.5% return on assets over the last four years, operating in a fragmented market that dilutes pricing power and results in low operating margins of ~5%. Managing a business with >170,000 employees alone is an arduous task and there is sizeable integration risk ahead following a complex deal with Suez. We also note the company’s headline free cash flow excludes the ~€150m paid to minorities.

Balance sheet: net debt of €13.5bn represents an > 3x leverage ratio and FY’20 saw €687m in receivables derecognised as part of Veolia’s factoring programmes. This is alongside a sizeable €2.4bn total provision balance.

Corporate governance/other: with the current CEO in the position for over a decade there is evidence of management entrenchment. Combined with arguably high expectations on the Suez acquisition and associated synergies, this could be an interesting time to investigate, as the focus shifts to delivering on these acquisition promises.

Retail Trading: Tradegate Exchange

Exhibit 2: Recent Relative Retail Volumes Per Tradegate Exchange

Source: Tradegate Exchange, Accessed May and June 2021; The Analyst

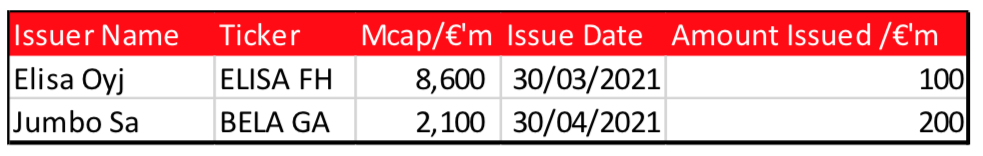

Schuldschein Market Issuers

Exhibit 3: Recent Non-German, Non-Austrian Listed Issuers on SSD

Source: Bloomberg, GlobalCapital.com, Accessed June 2021; Elisa Q1 Update

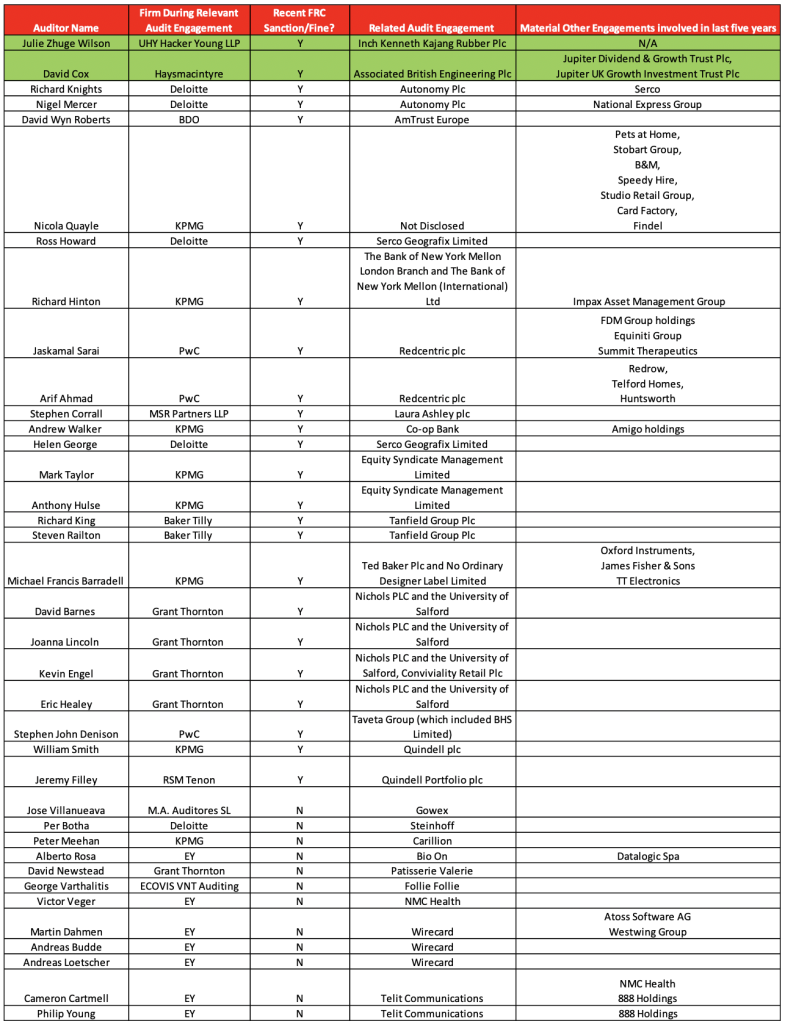

Auditor Watch List Update

Exhibit 4: Our Auditor Watch List

Source UK FRC, Sentieo, Bloomberg, Accessed June 2021

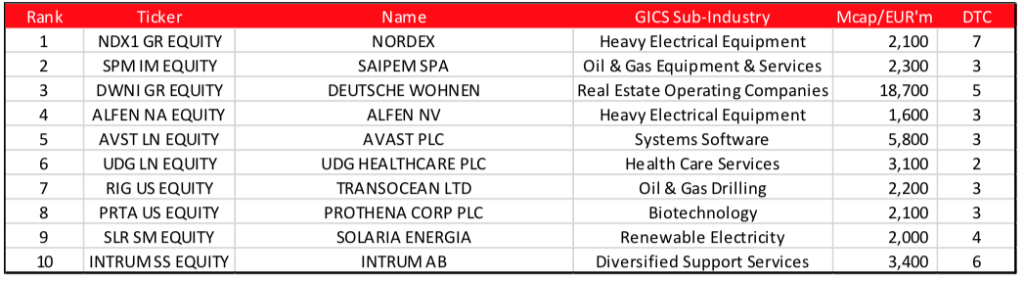

Most Popular and Growing Shorts

Exhibit 5: Most Popular Shorts in Europe

Source: S3 Partners

Exhibit 6: Fastest Growing Shorts Since May 27 2021 with Low Days to Cover

Source: S3 Partners